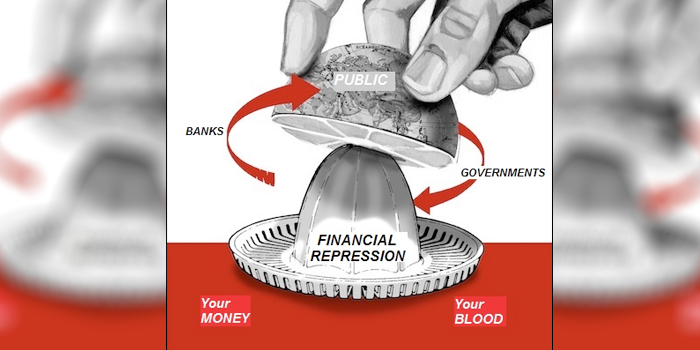

What is The ‘Great Repression’?

EDITOR'S NOTE: We will most likely look back from the vantage point of history and judge these people very harshly for financial crimes against humanity. We are just now starting to think about feeling the pain... but the real pain hasn't even been fathomed yet.

It is here and it will make past downturns look tame, economist says.

The economic aftermath of the 2008 financial crisis was so tepid it was referred to as the “Great Recession.” In the wake of the coronavirus catastrophe, investors need to brace for the “Great Repression,” which may be even uglier than the downturn of a decade ago.

That’s the takeaway from an analysis out Monday from economist David Rosenberg. Rosenberg is often considered a “perma-bear,” but that’s not entirely fair. He’s had his optimistic spurts.

This just isn’t one of them.

In the “base case” for the U.S. economy, published by his firm, Rosenberg Research, the economy “reopens” in May, in a staggered approach across industries and regions. There are “periodic setbacks in terms of COVID-19 case counts…sufficient to make people less comfortable and confident about spending then they did prior to the crisis. A vaccine is not developed in this forecast, but treatment that alleviates the worst respiratory symptoms” is developed within the next six months, he writes.

What does that mean for the economy and financial markets?

A 30% contraction in real gross domestic product in the second quarter, negative year-over-year consumer price growth for 5 quarters, and an unemployment rate of 14.2% by the end of 2020, averaging 13% throughout 2021.

The 10-year Treasury yield TMUBMUSD10Y, 0.629% sinks lower and lower each quarter, to 31 basis points by the fourth quarter, and averages 18 basis points throughout 2021. Yields fall as bond prices rise.

Investors in high-yield debt run for the doors, leaving those bonds more than 700 basis points more expensive than Treasurys at the end of this year.

Stocks hit bottom in the second quarter, with the S&P 500 SPX, 0.91% at 2,000, then start a “slow recovery.” But it’s meager: the index averages only 2,600 throughout 2021. Put another way, Rosenberg assumes stocks sink 30% in the coming months, then spend most of the next 18 months grinding higher to valuations about 10% lower than today’s levels.

Read Original Article at marketwatch.com

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.