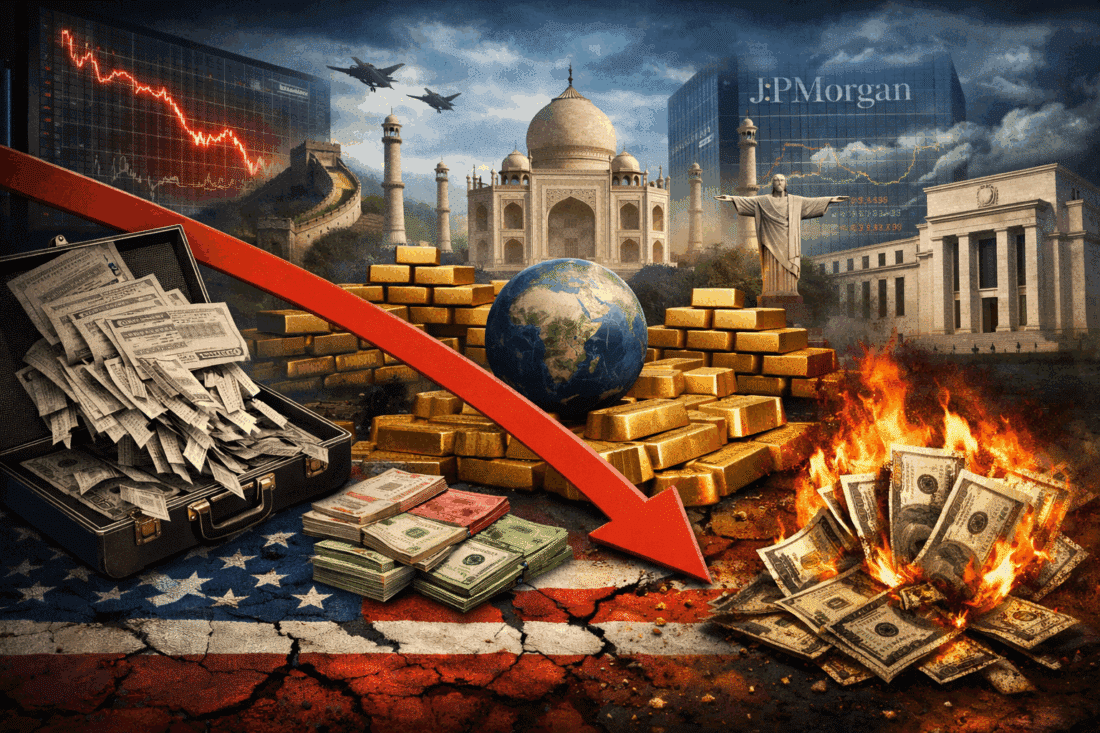

What Might Happen if BRICS+ Accelerates the Dumping of US Treasuries?

De-dollarization: A Quick Recap

De-dollarization is all about cutting back on using the U.S. dollar in global trade and finance. Here’s why countries are doing it:

- Economic Independence: Countries are looking to gain more control over their own economies. By relying less on the U.S. dollar, they can avoid getting caught up in U.S. economic policies and sanctions, giving them more freedom to do their own thing.

- Diversification: Think of it like a financial safety net. By holding reserves in gold and other currencies, countries can protect themselves against the rollercoaster ride of the dollar's value. It's all about spreading the risk.

- Geopolitical Tensions: With tensions heating up between the U.S. and China, among others, countries are fast-tracking their plans to ditch dollar-based assets. It's a way to avoid getting burned by the fallout of these big power struggles.

What’s the Scale of BRICS’ US Treasury Dumping?

BRICS nations have been busy offloading U.S. Treasuries in a big way. In 2023, they collectively ditched $123 billion in U.S. government debt. China led the charge, unloading $117.4 billion last year and an extra $53.3 billion just in the first quarter of 2024. Other BRICS members like Brazil, India, and the UAE are also cutting back on their Treasury holdings.

What’s Behind the Treasury Sell-Off?

There are different approaches to de-dollarization. Why specifically offload treasuries? There are several main reasons for this:

- Propping Up Local Currencies: Countries like China have been offloading U.S. debt to support their own currencies. China, for example, has been using its dollar reserves to stabilize the yuan amid its depreciation against the dollar.

- Investing in Alternatives: BRICS nations are turning to gold and other commodities. China's gold reserves have surged, now making up nearly 5% of its total reserves.

- Strategic Diversification: By moving away from dollar-denominated assets, these nations are shielding their economies from U.S. economic and monetary policy shifts that might not suit their interests.

Potential Negative Impacts on the U.S. Dollar

The continued reduction of U.S. Treasury holdings by BRICS nations can have several negative impacts on the U.S. dollar and the broader U.S. economy:

Rising Treasury Yields: When BRICS nations sell off U.S. Treasuries, the increased supply can push their prices down and yields up. Higher yields mean higher borrowing costs for the U.S. government, businesses, and consumers, potentially slowing economic growth.

Dollar Depreciation: Large-scale Treasury sales can decrease demand for the dollar, leading to its depreciation. A weaker dollar can cause higher import prices, contributing to inflation and reducing the purchasing power of U.S. consumers. It also raises the cost of servicing foreign debt.

Reduced Foreign Investment: Continued de-dollarization could signal declining confidence in the U.S. dollar and economy, deterring foreign investors from holding U.S. assets. This could reduce foreign capital inflows, impacting financial markets and investment in U.S. businesses and infrastructure.

Impact on Global Reserve Currency Status: The U.S. dollar's position as the world's primary reserve currency could be weakened if major economies continue to cut back on dollar reliance. This shift might lead to increased exchange rate volatility and reduce the global influence of U.S. monetary policy.

Economic Uncertainty and Instability: The move away from a dollar-dominated system to a more multipolar currency system by BRICS could introduce uncertainty and instability in the global financial system, potentially leading to significant adjustments and disruptions.

Hyperinflation (Worst-Case Scenario): If the U.S. dollar significantly depreciates and confidence in its value continues to erode, the worst-case scenario could be hyperinflation. This is where the price of goods and services skyrockets uncontrollably, eroding purchasing power rapidly and causing severe economic disruption. Hyperinflation can lead to a severe and perpetual collapse in the value of the currency, making it extremely difficult for consumers to afford basic necessities and destabilizing the broader economy.

The Takeaway

BRICS nations are strategically reducing their U.S. Treasury holdings to de-dollarize their economies. This move signals a shift towards economic independence and diversification. The shift poses significant risks for the U.S. dollar and the broader economy. As the global financial landscape evolves, policymakers and investors must closely monitor these developments. To hedge against potential dollar troubles, buying gold could be a prudent strategy.