When King Dollar Falls: The Perils of a Cashless Society

Digital Chains: How the Death of Cash Threatens Freedom

The world is at a crossroads, staring down the barrel of a cashless future. If physical cash disappears, it won’t just take the familiar feel of paper bills with it—it’ll strip away the last vestiges of individual liberty in the financial system. A cashless society isn’t a convenience; it’s a control mechanism.

Once governments own the money supply in an entirely digital form, they won’t just regulate the economy; they’ll regulate you. A digital dollar is programmable money, and the program isn’t for your benefit. They can dictate where you spend, how you spend, and if you spend at all. The system's operators, those shadowy "controllers of currency," will be pulling your strings.

The Mirage of Modern Wealth

The concept of money has drifted into the abstract, divorced from tangible assets and real value. These days, wealth isn’t in gold bars, productive land, or physical cash—it’s a phantom, hovering in the digital ether. Credit scores, debt ratios, and financial derivatives are the new metrics of power.

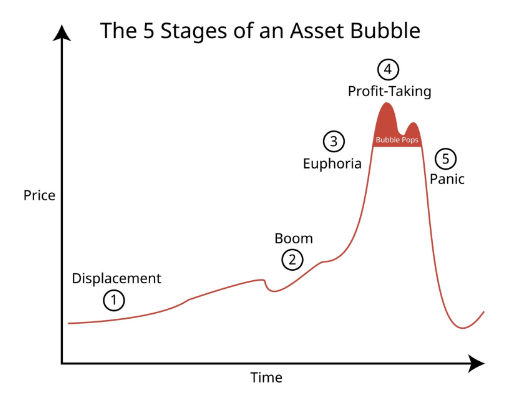

Governments and central banks love this abstraction. It lets them play fast and loose with “value,” endlessly printing digital dollars or euros while telling you everything’s fine. But here’s the hard truth: if money isn’t real, neither is your wealth. And when public trust falters—when people realize their digital “dollars” can evaporate with the flick of a switch—the system collapses.

Currency relies on confidence. And confidence, like a bridge, collapses when it’s built on lies.

The Central Bank Power Grab

Inflation, that quiet thief, is eroding what little value remains in your cash. Governments have weaponized it, diluting your purchasing power with every new dollar they conjure out of thin air. At the same time, they’re gearing up to replace cash with Central Bank Digital Currencies (CBDCs)—the ultimate tool for authoritarian control.

CBDCs aren’t just another way to pay—they’re a Trojan horse. With a digital currency, governments can track every transaction, freeze your funds at will, and even expire your money to force spending. They can tie your wallet to your behavior, rewarding compliance and punishing dissent. It’s the Panopticon, but for your bank account.

If you think this sounds like dystopian sci-fi, look no further than China. Their digital yuan is already a tool for social control, integrated with their social credit system. Don’t toe the party line? No problem—just don’t expect to buy a plane ticket or access your savings.

Why Gold and Cash Still Matter

In this age of economic sleight-of-hand, physical money retains a symbolic power. A coin in your pocket or a bill in your wallet is more than a means of exchange—it’s proof of sovereignty, a relic of a time when money wasn’t just a data point on someone else’s server.

Gold, too, has resurged as a hedge against the madness of fiat currency. While it’s not perfect—gold can’t feed you or keep you warm—it’s real. You can hold it. Its value isn’t dependent on government decree or the continuous hum of the electrical grid.

The nostalgia for physical currency isn’t misplaced. Coins and cash symbolize stability, anchoring a society to something tangible. Even the smallest denominations—the penny, the nickel—serve as a psychological check against runaway inflation. Their slow death marks a societal shift from tangible value to ephemeral, invisible wealth.

The Illusion of Progress

The push toward a cashless world is sold as innovation, but let’s call it what it is: a way to dismantle autonomy under the guise of convenience. When your ability to buy, sell, or save is entirely dependent on a digital ledger controlled by unaccountable institutions, you’re not free—you’re enslaved.

Consider the precariousness of it all: a world where power outages, cyberattacks, or bureaucratic whims can render your wealth inaccessible. A world where a simple glitch can erase your financial existence. That’s not progress; it’s a disaster waiting to happen.

A Warning and a Call to Action

As the era of physical cash fades, so does our freedom. A silver coin in your hand—a relic like the Maria Theresa thaler—might someday feed you when digital wallets fail. The face of a long-dead ruler on a minted coin carries more reliability than any central bank governor with a Twitter account.

But the clock is ticking. Prepare now. Diversify your assets into things you can hold, trade, and rely on when the digital system falters. Gold, silver, and yes, even cash, still have their place in a world teetering on the brink of financial feudalism.

Download Bill Brocius’s Seven Steps to Protect Yourself from Bank Failure. It’s a roadmap to securing your wealth in an age of digital dependency. Click here to get it now.

Freedom isn’t free, and neither is financial independence. The death of cash is a death knell for liberty. Don’t let it be yours.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.