Who’s Really Driving Business Cycles? Banks, the Fed, or Both?

Written by Derek Wolfe

Who Starts the Fire? The Fed and Banks are Playing the Same Game

Here’s the question at the heart of the debate: Do banks make loans out of deposits, or do they conjure money from thin air by making loans, which then become deposits? Shedlock insists it’s the latter and claims the Austrian economists are clinging to outdated ideas of fractional reserve banking. He pulls quotes from Playing with Fire to paint Joseph Salerno and Jonathan Newman as relics who don’t understand how banks operate today.

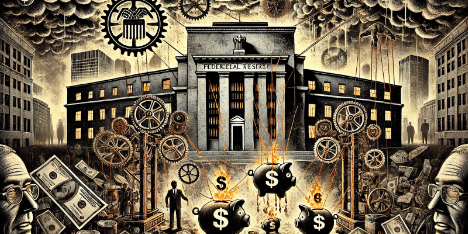

But here’s the kicker: both sides are right—and both are missing the forest for the trees. Banks may no longer rely on old-school reserve requirements to create credit, but they’re still expanding credit recklessly. And who keeps the system propped up when the whole thing goes belly up? You guessed it—our friendly neighborhood central bank: the Fed. They didn’t build the system to serve you. They built it to control you.

From Fractional Reserves to Interest on Reserves: A Shell Game

Shedlock argues that banks don’t lend out deposits and that reserves are irrelevant to lending decisions. Instead, banks decide to lend based on profitability and risk, not on how much cash they have stashed away. He’s not wrong—since 2008, the Fed has been paying banks to sit on reserves, effectively bribing them with Interest on Reserves (IOR) to prevent a flood of loans that could destabilize the system.

This isn’t some harmless technical change; it’s a power play. By paying banks to hoard reserves, the Fed has bottlenecked credit expansion—not to protect the public, but to control interest rates and manipulate the money supply without you noticing. They even scrapped minimum reserve requirements entirely in 2020, handing banks even more freedom to play fast and loose with credit while keeping the financial fire hose tightly controlled from Washington.

The narrative that "banks are just lending according to demand" masks the deeper truth: the Fed is engineering the economy from the shadows, making sure banks play their part in an endless cycle of boom and bust. When the bubble pops, they swoop in with emergency measures that bail out banks and screw everyone else. Sound familiar?

Endogenous vs. Exogenous Money: Who Cares?

The debate about whether money is created inside the banking system (endogenous) or dictated by central bank policy (exogenous) is a smokescreen. Austrian economists argue that banks—whether by design or neglect—expand credit beyond what the economy can sustain, setting the stage for inevitable crashes. Shedlock thinks this criticism only applies if money creation is exogenous (i.e., controlled directly by the Fed). But here’s the truth: it doesn’t matter if the banks or the Fed light the match. Both are throwing gasoline on the fire.

Even if money creation is driven by banks seeking profits, the Fed is still the enabler. Without the Fed backstopping the system and manipulating rates, the banks wouldn’t be able to engage in these reckless lending practices in the first place. It’s a cozy partnership. Banks push the limits, knowing the Fed will be there with bailouts and "liquidity injections" when the party’s over. This unholy alliance ensures the cycles of inflation, recession, and crisis continue—and you’re the one left cleaning up the mess.

Modern Banks Aren’t Safer—They’re Just Better at Hiding the Risks

Shedlock wants you to believe that Austrian economists are stuck in the past, clinging to theories about fractional reserves and outdated monetary practices. But Austrian economists have been warning for decades that no matter how the money is created, the system is rigged. Whether it’s a traditional fractional reserve system or today’s loan-first, reserve-second model, the end result is the same: credit expansion beyond what the economy can sustain, followed by a crash that wipes out the wealth of ordinary people.

The Fed, through its policies, has only made things worse. By paying banks to hoard reserves and removing reserve requirements, they’ve created the illusion of stability while setting the stage for the next crisis. And when that crisis comes, you can bet the Fed will print trillions more to bail out the banks while your savings lose value and prices skyrocket.

The System Won’t Save You—Only You Can Save Yourself

Here’s the bottom line: It doesn’t matter whether banks or the Fed are pulling the strings—the game is rigged, and the stakes are your financial freedom. Every boom-and-bust cycle siphons more wealth from the public and concentrates it in the hands of the elites who run the banking system.

This isn’t just about understanding the technical mechanics of loan creation or reserves. It’s about waking up to the fact that the entire financial system is a trap, designed to benefit banks and central planners at your expense. The only way to win is to stop playing their game.

Start taking steps to protect yourself now—because the next crash isn’t a matter of if, but when. Download Seven Steps to Protect Yourself from Bank Failure by Bill Brocius. Click below to grab your copy. Your money, your freedom, and your future depend on it.

👉 Download your free ebook here: 7 Steps to Protect Your Account from Bank Failure

👉 Join the Inner Circle today: Exclusive Membership Access