Why CBDCs Are Foundering in the Five Eyes—And Why We Shouldn’t Trust the “Alternative”

The Global Push for a Digital Currency Trap

It’s no coincidence that by 2022, 90 nations are well on their way to developing a CBDC. Today, 98% of the world’s GDP lives in a nation actively exploring or deploying CBDCs, with the advanced stage creeping closer in dozens of those countries. But curiously, America, self-proclaimed leader of the financial world, is slowing down. While other countries race to control citizen transactions in real time, the U.S. is taking a step back. Is this really because they care about our privacy? Or are they simply laying the groundwork for something more covert and more powerful—synthetic control wrapped in the cloak of “private” enterprise?

The U.S. House’s passing of the “CBDC Anti-Surveillance State Act” may look like a heroic stand for privacy, but this legislation is far from a total victory. If anything, it’s cover. This Act claims to prohibit the Federal Reserve from issuing a CBDC directly to Americans. But don’t forget the other side of the coin: private corporations. These private interests aren’t exactly new to cozying up with the government—and they’re hardly privacy-friendly.

Private Stablecoins: The New Face of Financial Control

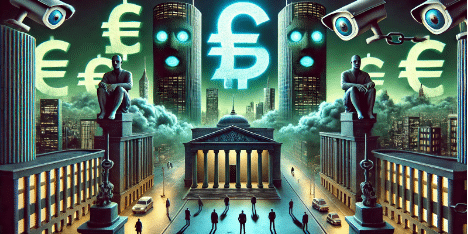

While CBDCs are sold as government overreach, stablecoins have been presented as “free market” alternatives, helping the dollar maintain its global dominance in a digital age. Trump himself touted these stablecoins as the way forward, giving his endorsement at the Bitcoin Conference 2024. But here’s the rub: private stablecoins can be surveilled and manipulated just as much as any CBDC, if not more so. For those who think they’re immune to prying eyes, think again. These stablecoins are programmed to track every transaction, freeze wallets on command, and blacklist anyone who steps out of line. Sound familiar?

When you take a closer look at stablecoins, it’s clear they’re just CBDCs in a different wrapper. Dollar-backed stablecoins by Tether, Circle, and others work hand-in-glove with government agencies. They routinely freeze and seize assets on demand, all in the name of “compliance.” These companies might boast independence, but they’re beholden to U.S. authorities who dictate which assets to freeze, blacklist, or monitor. The stablecoin network is no friend to the average user, but a willing collaborator in surveillance schemes that would make a central banker blush.

The Synthetic CBDC—Just Another Trap

What the government can’t do directly, it will do indirectly. By leveraging private companies as intermediaries, the U.S. can claim it “doesn’t directly control” currency while pulling strings through private-public partnerships. The IMF has been on this track for years, pushing “synthetic CBDCs” that enlist private companies to handle the “customer management” side, leaving the government to orchestrate control quietly in the background. If synthetic CBDCs take root, say goodbye to cash and your financial autonomy, because every transaction will run through systems that report directly to the government.

It’s the ultimate loophole. By putting a synthetic CBDC in place, the Fed can dodge public outrage while still reaping the surveillance benefits. The IMF loves it, the U.S. Treasury loves it, and stablecoin operators are happy to profit while collecting and storing all your data. And they’ll continue selling this under the guise of “national security.”

Don’t Take Their “Retreat” as Defeat

Canada and Australia’s withdrawal from retail CBDCs isn’t a concession; it’s a strategic pivot. Behind the scenes, they’re cozying up to private operators who will do the same job without sparking as much public backlash. Wholesale CBDCs may be all they need to establish the tracking systems they want in place, allowing central banks to exert indirect control over global transactions through private channels.

You’re not “free” from the digital dollar just because a couple of central banks are delaying their launches. When the private sector builds synthetic versions of the CBDC that achieve the same ends, central banks don’t need to play the “bad guy” anymore.

The Bottom Line: The battle against CBDCs is far from over. What we’re seeing is simply a rebranding of control and surveillance, disguised as a private-sector solution. Now more than ever, we need to stay vigilant and skeptical. Central banks and governments may not “own” these private digital currencies, but make no mistake—they control them just the same.

Stay informed and get prepared for what’s coming next. Download “Seven Steps to Protect Yourself from Bank Failure” by Bill Brocius here. It’s time to take real action before they lock us out of our own money.