Yuan Strength Amid Dual Circulation And US-China Decoupling

EDITOR NOTE: Read this article closely, for it outlines a clever dual strategy on China’s part to secure an advantage in an event of a US-China decoupling. China’s “dual circulation” strategy has two components--internal and external circulation. Whether a US-China decoupling takes place, either component can give China a superior advantage with regard to its domestic economy and international competitiveness. Not quite a “checkmate” move against US’ economic dominance, but it comes close. As the White House aims to play a quick and direct “finite” game against China, China is playing a more “infinite” game of long-term sustainability. At the least, it’s starting to appear that way.

The times they are a-changin’ – as the Bob Dylan song goes. The foreign exchange market would do well to heed that lyric. Beijing is moving towards a “dual circulation” economic model, while in Washington, President Donald Trump is talking again about decoupling the US economy from China.

The renminbi should strengthen. President Xi Jinping’s vision for the Chinese economy relies more on “internal circulation”, encompassing domestic production, distribution and consumption. This more self-sustaining approach is to be complemented by China’s continuing exporting prowess, the “external” component of the “dual circulation” strategy.

On its own, “dual circulation” could have major implications for the currency market, and that is before any attempt to factor in Washington’s intentions to reset the US-China relationship. It would appear that Washington wishes to make the US economy less reliant on China and to bring back the manufacturing jobs now seen as having been lost to China in recent decades.

With China’s trade surplus with the United States having surged by 27 per cent year-on-year in August, according to the Post’s calculations, clearly Washington still has quite a way to go before achieving its goal. But that doesn’t mean some degree of decoupling won’t happen, regardless of who wins the White House in November.

From a currency market perspective, the prospect of such decoupling has implications for the renminbi.

Economies that rest heavily on exports often favour some degree of local currency weakness in an attempt to bolster exporters’ competitive advantage on the international stage. Indeed, Washington – Trump himself, that is – has often, if not always justifiably, accused Beijing of keeping the renminbi weaker than market forces would otherwise have set it.

But under a “dual circulation” economic model, especially if there is a Washington-initiated decoupling of the US and Chinese economies at the same time, then the currency equation changes.

If, and admittedly it’s a big if, the United States is able to wean consumers off a diet of well-made and competitively priced Chinese goods, a level of yuan weakness versus the US dollar becomes less of an issue for China’s exporters. If the US decides it is not in the market for Chinese goods, then it’s not in the market. The exchange rate becomes far less relevant.

In such a decoupling, the “external circulation” component of the Chinese economy would surely fare better if the renminbi were to strengthen against the dollar at a slower pace than other major currencies. The renminbi would then remain competitive versus the likes of the euro and the Japanese yen.

But whether this is the outcome or not, if there is to be a decoupling of the US and Chinese economies, it undermines the argument for keeping the renminbi as competitively priced as possible versus the greenback.

Then there are the currency implications arising from China’s own “dual circulation” economic strategy.

If domestic production, distribution and consumption are to be the foundation stones of China’s economy, then the conditions in which such “internal circulation” dominates must be favourable.

One thing is for certain: China’s domestic economic plan will require a lot of raw materials which cannot be sourced locally and which China will have to continue importing. Such raw materials are generally priced in US dollars.

It doesn’t matter whether those raw materials are energy in the form of oil, liquefied natural gas and thermal coal or base metals such as copper and iron ore, they all have to be imported and paid for. And these imports are cheaper in yuan terms if the renminbi is stronger against the US dollar in which those materials are priced.

Markets should also take into account that while the Belt and Road Initiative has seen China export capital to other countries, the scale of ambition inherent in the “dual circulation” strategy will require international capital to flow into China as part of the process.

Beijing will want to create an environment that further encourages overseas capital inflows into China, inflows that will necessarily underpin demand for the renminbi.

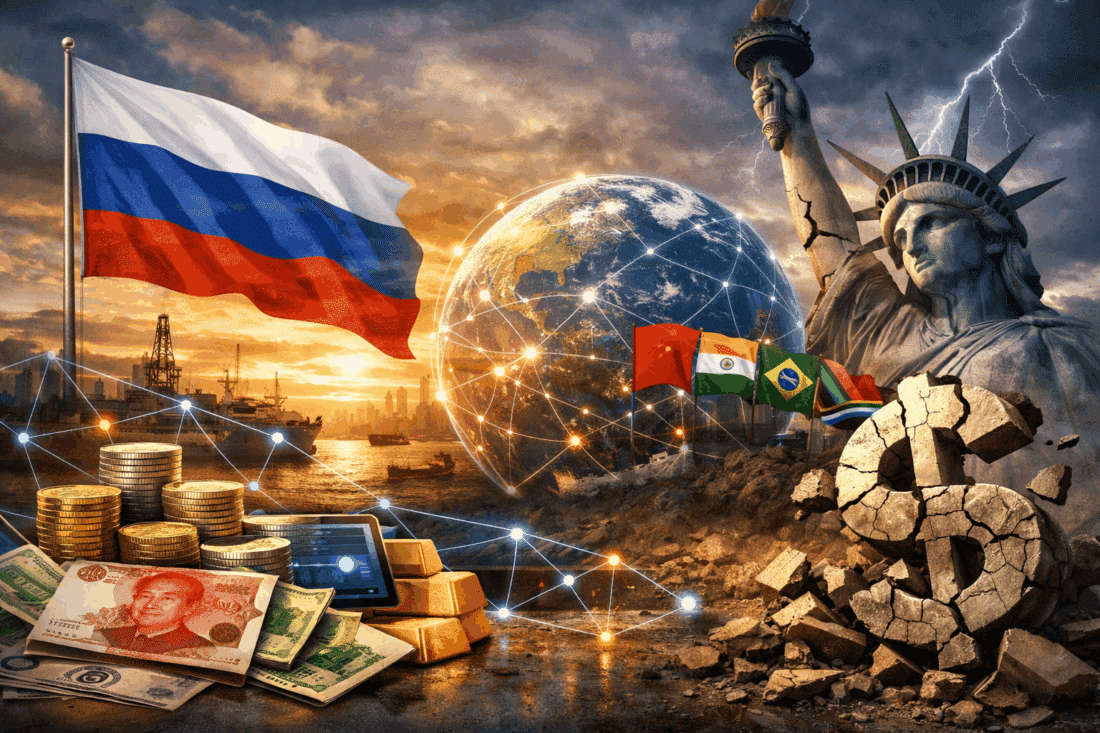

Nor can markets ignore the fact that Beijing needs to foster greater international use of the yuan, not only to reflect China’s current economic heft but also its growing geopolitical footprint. Additionally, in a world where the US has decoupled from China economically, the internationalisation of the yuan reduces Beijing’s reliance on the dollar, which remains the hegemonic currency in the global financial system.

“Dual circulation” and “decoupling” are not just slogans. The times they are a-changing and as they do, the yuan should strengthen.

Originally posted on SCMP