Zelle Scandal Exposes Rotten Core of Big Banks—Americans Left Holding the Bag

The Banks Knew. The Banks Didn’t Care.

JPMorgan Chase, Bank of America, and Wells Fargo dominate the Zelle payment network. They sold Zelle as a fast, easy way to send money. But what they didn’t advertise was the goldmine they handed to fraudsters.

The CFPB’s lawsuit lays it out plainly: these banks ignored the glaring flaws in Zelle’s security, allowing scammers to siphon money directly from customers’ accounts. Worse still, when customers reported fraud, banks reimbursed a measly 38% of claims. That means nearly two-thirds of victims were left with empty pockets and zero support.

The system is rotten to the core. Banks knowingly used weak identity verification methods that opened the floodgates for criminals. They didn’t share fraud data among themselves, creating a haven for thieves to hop from one bank to another. And why should they fix the problem? The customers, not the banks, were footing the bill.

Fraud or Scam? Banks Split Hairs While You Suffer

Banks are playing a semantic game, claiming most losses weren’t “fraud” but “authorized scams” where customers were tricked into sending money. Here’s the dirty truth: this legalese allows banks to avoid taking responsibility. It’s a masterclass in corporate greed.

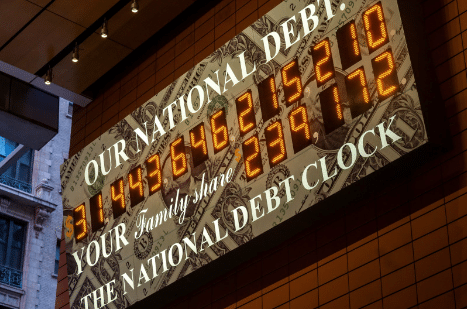

While $806 billion flowed through Zelle last year, $166 million was flagged as fraud. Yet, the banks shrugged and reimbursed only a fraction. For the elites running these institutions, your hard-earned money is collateral damage in their pursuit of profits.

A Tool for Thieves, A Nightmare for Americans

Zelle has become the go-to platform for cybercriminals because it’s fast, poorly monitored, and allows scammers to drain accounts in seconds. Yet, when the CFPB pointed out these flaws, the banks accused the regulator of “misguided attacks.”

Misguided? Try telling that to the Americans who lost $870 million.

The CFPB’s lawsuit isn’t about penalizing banks unfairly—it’s about holding them accountable for their role in this fiasco. But don’t be fooled: the banking lobby will fight this tooth and nail in courtrooms friendly to corporate interests. It’s all part of the game, and they’ve rigged the rules in their favor.

A Pattern of Exploitation

This isn’t an isolated incident. From overdraft fees to credit card late charges, the big banks have a long history of exploiting their customers. Zelle is just the latest weapon in their arsenal. And while they distract you with fancy apps and promises of convenience, the truth is clear: the system is designed to bleed you dry.

The Call to Action

Enough is enough. The Zelle scandal is a wake-up call for every American who still believes the big banks have their best interests at heart. They don’t.

Protect yourself before it’s too late. Download “Seven Steps to Protect Yourself from Bank Failure” today. Learn how to safeguard your money from the corruption and greed of the banking elite.

For the insiders who want real-time strategies to outsmart the system, join the DeDollarize Inner Circle for only $19.95/month through my exclusive offer: Subscribe here.

Let’s fight back against the banking cartel. The time for action is now.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.