Zombie Banks In The US: A Ticking Time Bomb For The Broader Market

EDITOR'S NOTE: The US financial landscape is witnessing a worrying phenomenon as 'zombie banks' continue to rise in numbers. These institutions, burdened by unsustainable levels of debt and an inability to generate profits, are staggering along and posing an increasing threat to the stability of stocks and bond yields. This article delves into the factors behind the proliferation of zombie banks in the USA, exploring the risks they present to the broader market and the potential consequences of their continued existence. As global financial institutions grapple with the implications of this situation, it is crucial for Americans to remain vigilant and informed about the dangers that may lie ahead. For many people’s deposited funds are at risk.

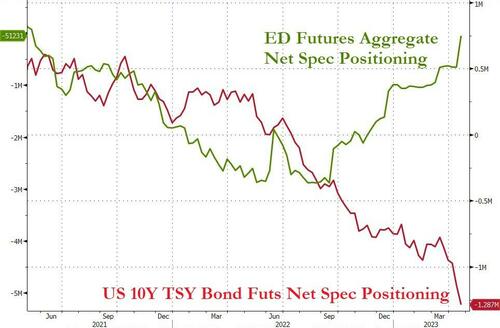

Extreme positioning (bonds record short) meets macro weakness (sentiment and soft data crashing) meets liquidity suck (M2 collapsing) meets systemic threats (debt ceiling) meets idiosyncratic problems (FRC - banking system, and UPS - consumer) - quite a day!!

Source: Youtube

The world and his pet rabbit started the day off short Treasuries...

Source: ZeroHedge

An ugly day for US macro didn't help (aside from new home sales which jumped on giant subsidies)...

Source: ZeroHedge

And liquidity is collapsing more (M2 down over 4% YoY)...

Source: ZeroHedge

FRC reported far worse than expected deposit outflows and yesterday's gains were eviscerated to take the stock down 50% back to record lows (and reignite banking crisis fears), accelerated to the downside by talk of asset sales (which if they can actually pull off would be a good thing)...

Source: ZeroHedge

For some more context, FRC was trading $120 just six weeks ago... and is now below $8...

Source: ZeroHedge

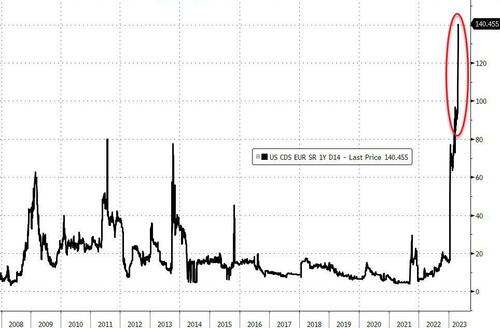

USA Sovereign risk soared once again to a new record as the X-Date looms closer amid dismal tax receipts...

Source: ZeroHedge

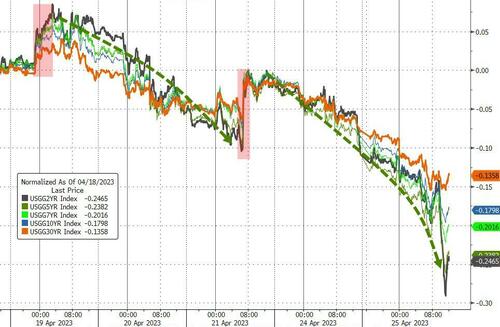

Treasury yields tumbled today with the short-end dramatically outperforming (2Y -14bps, 30Y -6bps) extending the short-squeeze from last Tuesday...

Source: ZeroHedge

2Y yields tumbled below 4.00%

Source: ZeroHedge

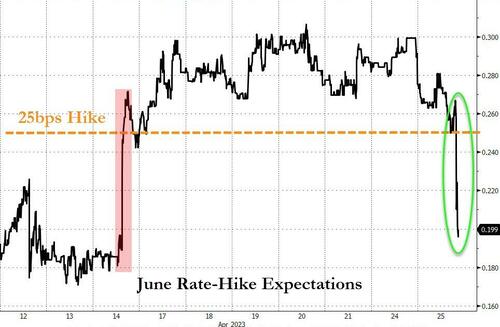

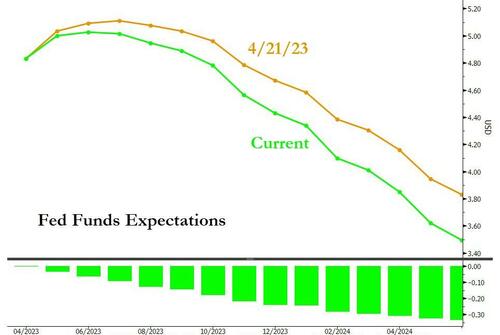

The market has now priced out a full 25bps rate-hike this year...

Source: ZeroHedge

The yield curve (3m10Y) flattened notably today (-12bps to -167bps)...

Source: ZeroHedge

The Fed Funds curve has tumbled notably this week...

Source: ZeroHedge

Small Caps were the ugliest horse in the glue factory today, followed by Nasdaq (-1.9%) and the S&P (down 1.6%). The Dow was the least bad of the majors, down 1% on the day...

Source: ZeroHedge

This is the first close down more than 1% for the S&P in over a month

The S&P held at critical support, with the next stop down to its 50DMA at around 4033...

Source: ZeroHedge

1-Day VIX exploded higher today, from an 8 handle to above 16, compressing its spread to VIX...

Source: ZeroHedge

Turns out VVIX was right after all...

Source: ZeroHedge

The dollar surged back to recent highs today (which looks like safe-haven bid as STIRs dived dovishly)...

Source: ZeroHedge

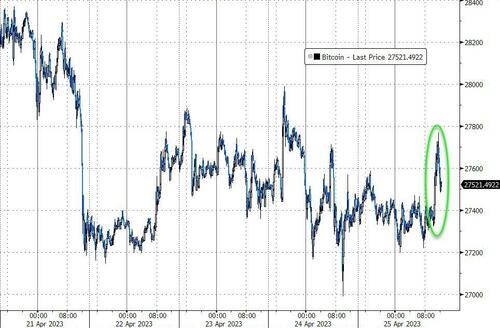

Crypto was quiet for a change with Bitcoin very modestly higher, holding around $27,500...

Source: ZeroHedge

Spot Gold rallied back above $2,000 twice today but was unable to hold it...

Source: ZeroHedge

Oil prices clipped lower with WTI briefly back to a $76 handle...

Source: ZeroHedge

Finally, worsening liquidity conditions and significant event risk coming ever closer is a decidedly negative set of circumstances. Yet despite this, there seems to be a general consensus that a) the debt ceiling will be avoided; and b) the uncertainty in the run up to X-Day is unlikely to have a notable market impact.

However, today's price action - especially in 0DTE, where there was a regime-shift from fading market trends to becoming an 'accelerant flow' - suggests fear is starting to mount that both a) and b) reflect too much complacency after all...

Source: ZeroHedge

The debt ceiling - coming in the wake of banking stress and a slowing economy - may just be the proverbial straw that breaks the camel’s back.

Can MSFT and GOOGL change that sentiment back tonight?

Originally published by: Tyler Durden on ZeroHedge