If AI Comes for Your Job, the Fed Will Make It Much Worse

The Fed's Playbook: Print, Pretend, and Prolong the Pain

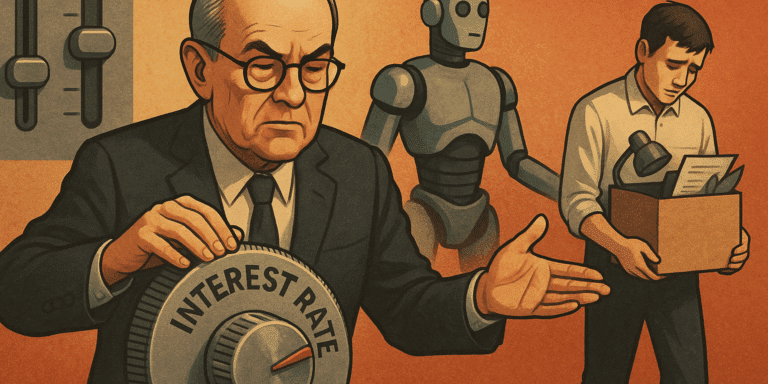

Let’s get something straight: when AI starts gutting the workforce, the Fed’s answer will be to cut interest rates and inject liquidity—just like they did in every previous crisis they helped manufacture. Axios frames this as compassionate central banking. In reality, it's a script written in blood by Keynesian witch doctors who think they can micromanage 330 million lives with a few dials and a press conference.

Austrian economics, however, teaches us something crucial: you can’t fix structural problems with monetary policy. When the Fed intervenes in labor markets by manipulating rates, they distort the very signals entrepreneurs rely on to allocate capital and labor efficiently. This isn’t “easing the pain”—this is morphine before the guillotine.

Jobless Recoveries: A Feature, Not a Bug

The article references the 2001 recession and the so-called “jobless recovery” of the early 2000s. Productivity rose, but employment lagged. Sound familiar? That’s because the Fed had already blown up the dot-com bubble with easy credit in the '90s. Then, when the bust came, they doubled down—slashing rates to 1% in 2003. The result? Artificial growth, misallocated capital, and yet another bubble—this time in housing.

Austrians call this malinvestment—and it’s what happens when interest rates are set not by the free market, but by central planners in marble buildings. These manipulated rates signal to businesses and consumers that saving is unnecessary and risk is cheap. That’s how we end up with boom-and-bust cycles and hollowed-out job markets where AI is just the latest scapegoat.

AI Isn’t the Enemy—Central Planning Is

Let’s not demonize artificial intelligence. Innovation is not the problem—it’s the lifeblood of progress. But when AI collides with a centrally planned economy and a rigged financial system, it becomes a wrecking ball. Why? Because the Fed has already distorted capital structures to the point of fragility.

If the market were allowed to function without interference, capital and labor would reallocate organically. People would retrain, entrepreneurs would spot new opportunities, and prices would guide behavior. But the Fed short-circuits this process. It props up zombie companies, rewards speculation, and punishes savers. That’s not a free market—it’s monetary fascism dressed in technocratic jargon.

The Fed’s Real Mandate: Control, Not Stability

Axios parrots the idea that the Fed’s dual mandate—maximum employment and price stability—justifies intervention. That’s a lie. The real mandate is control. And in a world where AI displaces millions, the Fed’s toolkit will expand from interest rates to full-blown digital surveillance via central bank digital currencies (CBDCs), despite President Trump’s ban.

Don’t believe it? FedNow is already laying the groundwork. Once millions are out of work and dependent on universal basic income, the Fed will deliver it via programmable money. They’ll tell you when, where, and how you can spend it. Welcome to the AI dystopia—brought to you by central planners and cheered on by corporate media lapdogs.

Conclusion: Fight the Future—Don’t Fund It

The AI-pocalypse won’t be a natural disaster—it’ll be a policy-induced collapse, exacerbated by the same institutions that caused the 2008 crisis, the dot-com bubble, and the stagflation we’re in today. The solution isn’t more central banking—it’s decentralization, sound money, and individual sovereignty.

Don’t wait for the Fed to fix what it’s breaking. Prepare now. Download Seven Steps to Protect Yourself from Bank Failure by Bill Brocius. Learn how to exit the system before it traps you.

Stay free,

Derek Wolfe