A Soft Default May Be the Only Way to Solve the Debt Crisis

The national debt has risen to stratospheric levels, and its rate of ascent doesn’t appear to be slowing.

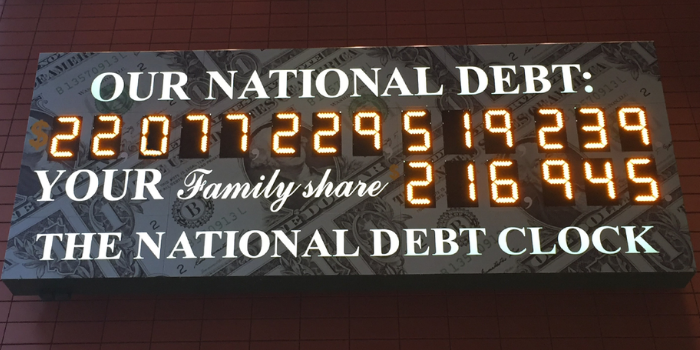

Last month, the national debt surpassed $22 Trillion, amounting to roughly $180,000 per taxpayer.

This is equivalent to adding another mortgage on top of each household’s already existing debts and expenses.

And this figure is projected to double within just three decades as the American population ages, their need for Social Security, Medicare, and Medicaid benefits ballooning to record levels.

What about tax revenue? It’ll hardly make a dent, as most of it will be used to pay down interest.

With the US debt-to-GDP already at astronomical levels, worldwide confidence in the Almighty Dollar can sink even further, from all-time lows down to a complete loss.

As you can see, the national debt’s current trajectory is untenable.

But more importantly, and this is what many Americans would consider “unthinkable,” it’s likely that the government may not even be capable of paying its debts.

Sooner or later, something’s gotta give. The US national debt will reach a breaking point.

When, exactly? Nobody can predict this.

But when it does, our nation’s leaders may be facing a critical choice between one of two possible solutions: both entailing the prospect of a default.

Other alternative solutions--such as raising taxes to levels unforeseen, cutting Social Security or Medicare benefits; such draconic austerity would send the economy spiraling toward depression.

Taking the opposite approach--printing more money--as most advocates of “Modern Monetary Theory” propose, would only plunge the economy into a state of hyperinflation.

The only seemingly workable solution would be for the US to default on its debts.

And there are ways to do this: a hard default and a soft default.

If the US Decides Opts for a Hard Default...

Suppose the government simply refuses to pay its debts. This would cause nothing short of a total global economic meltdown, as US Treasuries and federal reserve notes virtually power the entire global financial system.

With such drastic consequences, it seems highly unlikely that our elected leaders would ever go down this path. But neither would they go down the road of draconic austerity.

This leaves the nation with the only other option, a soft default.

If the US Decides Opts for a Soft Default...

This solution would be a one-off measure, devaluing the dollar once to allow the government to pay back its debts at a lower value.

It would also have the least catastrophic effect of all other solutions considered.

The US Treasury would likely peg the dollar to a commodity, such as gold or silver.

In the case of gold, perhaps they’ll devalue the dollar so that an ounce of gold will cost roughly $10,000 rather than the current price of $1,291 per ounce, making it easier for government to pay off a good portion of its debt.

This may not be the most moral solution. After all, Americans stashing their money away in cash, debt securities, and money markets will be financially devastated.

But a soft default would work.

And if the government were to choose between printing more money (leading to hyperinflation), drastically raising taxes and cutting out social programs, or opting for a hard or soft default, they’ll likely choose the softer route.

Pegging the dollar to gold and silver would cause short-term instability, for sure.

But in the long run, it would also strengthen the nation’s financial situation.

Besides, America’s Founding Fathers supported a commodity-backed currency, fearing that fiat would only encourage reckless borrowing and monetary manipulation...as what’s happening today.

Another reason why a soft default would be a likely scenario is that the US holds the world’s largest gold reserves. Plus, the US is also one of the world’s top silver producers.

A painful solution for Americans holding dollar-based assets, those who happen to be holding gold and silver naturally would benefit the most.

But those holding gold and silver would benefit regardless of the scenario--hyperinflation (if the government continues to print money), draconic austerity and taxation, or a hard default in which the government refuses to pay its debts.

There’s a reason why gold and silver have traditionally been considered a safe haven. It’s for times like these when financial conditions strain the limitations of fiat.

And has history has shown time and again, gold and silver always prevail.