America’s Debt Bomb Is Detonating — And Even Wall Street Is Running Out of Excuses

The Debt Surge No One Can Spin Away

The numbers are no longer debatable.

In just one month, the U.S. added $132,987,000,000 to the national debt, pushing the total past $38.5 trillion. That’s not a typo. That’s nearly $133 billion in new obligations layered onto a system already drowning in red ink.

At this pace, debt is not merely growing—it’s compounding, and it’s doing so faster than the real economy can absorb. This is no longer a future problem. It’s an active process unfolding in real time.

When Jamie Dimon Sounds the Alarm, Pay Attention

JPMorgan Chase CEO Jamie Dimon recently described the U.S. debt and geopolitical situation as “tectonic plates”—slow-moving, unpredictable, and capable of catastrophic collision.

His conclusion was blunt:

U.S. borrowing is not sustainable.

That admission matters. Dimon isn’t a fringe commentator or a doomsday blogger. He represents the very heart of the global banking system. When someone in his position publicly concedes that the debt trajectory “will not work eventually,” what he’s really saying is that the current system has no credible exit strategy.

“Not a 2026 Issue” — The Most Dangerous Phrase in Finance

Dimon carefully noted that this may not be a 2026 crisis. That framing is intentional. It buys time. It calms markets. It preserves confidence.

But debt crises don’t announce their arrival. They compound quietly, then break suddenly.

History is clear on this point: sovereign debt failures don’t happen when policymakers expect them to. They happen when confidence evaporates—often after years of assurances that “there’s still time.”

The $2 Trillion Annual Deficit Reality

The U.S. is now running nearly $2 trillion in annual deficits during what is supposed to be a stable economic period.

This is critical.

Deficits of this magnitude were once reserved for wars, recessions, or emergencies. Now they’re the baseline. That tells you everything you need to know about the structural integrity of U.S. finances.

Interest expense alone is becoming one of the largest federal budget items. And as rates remain elevated, the math gets uglier by the quarter.

The Growth Myth: A Convenient Escape Hatch

Dimon argues that economic growth is the solution—that if the U.S. can grow fast enough, the debt becomes manageable.

This is the standard elite fallback argument, and it sounds reasonable until you examine the constraints:

- Growth must outpace debt expansion, not merely match it

- Growth must be real, not inflation-adjusted or debt-fueled

- Growth must occur while demographics worsen, productivity stagnates, and capital is misallocated

That’s a tall order.

Growth doesn’t erase debt created through decades of financial repression and monetary distortion. At best, it delays the reckoning. At worst, it encourages policymakers to borrow even more aggressively, assuming growth will always bail them out.

What Comes Next: Printing, Digitization, and Control

When governments reach debt saturation, they don’t default openly. They redefine the system.

That means:

- More monetary creation

- Expanded use of digital payment rails

- Increased transaction monitoring

- Reduced reliance on cash

- Subtle forms of capital control

Debt this large cannot be serviced honestly. It can only be managed through currency debasement and financial surveillance.

This is the real context behind the rush toward digital money systems and centralized payment infrastructure. Debt isn’t just an accounting problem—it’s a control problem.

Why This Matters to You, Not Just Economists

This isn’t about spreadsheets in Washington. It’s about:

- The purchasing power of your savings

- Your ability to move and store money freely

- Whether your financial life remains private or programmable

When debt becomes unpayable, governments look inward—toward their own citizens’ capital.

That’s why those paying attention are reducing exposure to purely digital, permission-based financial systems and increasing exposure to tangible, self-custodied assets.

Hard Lessons From History

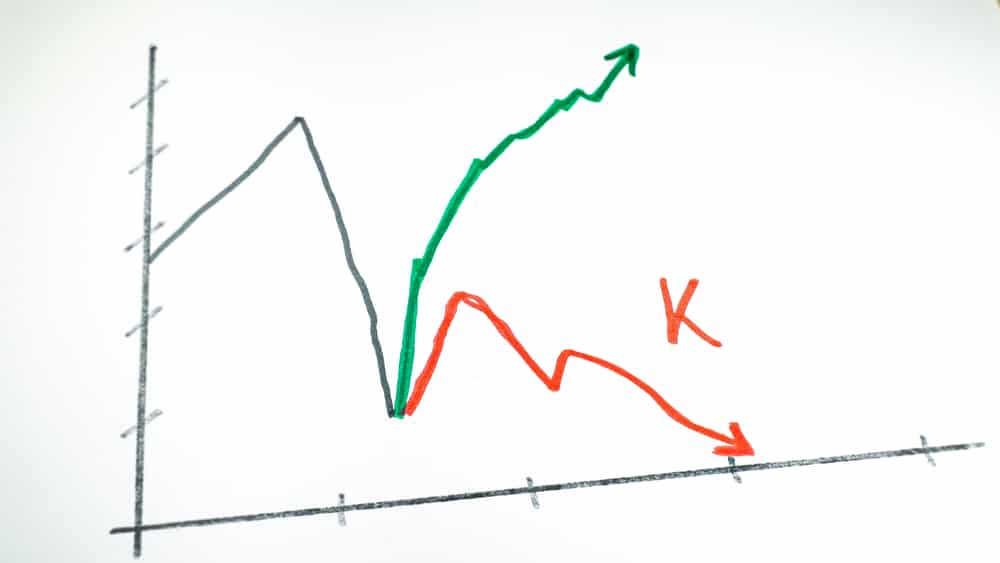

Every major debt crisis follows a familiar arc:

- Denial

- Rationalization

- Financial engineering

- Currency debasement

- Loss of public trust

The U.S. is well past step three.

The only variable left is timing, not outcome.

Final Thoughts: Believe the Actions, Not the Reassurances

Jamie Dimon is right about one thing: this won’t work forever. Where he’s wrong is in assuming policymakers will choose restraint over control.

They won’t.

Debt at this scale forces radical solutions, and those solutions always come at the expense of financial autonomy.

That’s why preparation isn’t optional anymore. It’s rational.

A Critical Next Step: Understand the Digital Dollar Endgame

If you recognize where this debt trajectory leads—toward digitized money, transaction monitoring, and reduced financial freedom—then you need clarity, not comfort.

Bill Brocius lays out exactly what’s coming and how to prepare in the Digital Dollar Reset Guide. It’s not theory. It’s a practical framework for defending your wealth before the rules change.

Download it here:

Digital Dollar Reset Guide by Bill Brocius

Because once the debt forces the reset, the window to act will already be closing.