As Unemployment Nears Great Depression Levels - Learn How The Eras Are Similar

EDITOR NOTES: Take your eyes off the market for a moment and let’s think about one fundamental factor that’s indicative of the state of the American economy: jobs. Half of the entire US workforce is currently unemployed. The unemployment rate stands at 14.7%. A breach beyond 20% would put the country at Depression-like levels. Economists are divided with this figure, the more optimistic ones saying that these levels are going to bounce back once the economy reopens. But are these jobs coming back? There are a lot of moving parts to the current turmoil. For companies who are surviving now but in financial distress, will they be able to maintain their current workforce? And what might happen if coronavirus cases continue to surge? The recovery of these jobs spell the difference between recovery and another great depression. Right now, we’re teetering on the edge, and we have no clue as to what the outcome might be.

The unemployment drama playing out in the U.S. has drawn comparisons to the Great Depression, the worst economic downturn in the history of the industrialized world.

But is the comparison fair?

Yes and no, according to labor economists.

On one hand, the country may soon achieve Depression-era levels of joblessness due to the coronavirus pandemic. By some metrics, we may already be close.

But the downturn will likely fall short of “depression” standards relative to overall duration, economists said.

That’s because the causes of the current meltdown are much different and the government has more policy tools at its disposal to buoy the economy than it did in the early 20th century.

Definition of ‘depression’

The Great Depression is the only “depression” the U.S. has ever experienced in industrial times.

It spanned a decade, from the stock market crash of 1929 until 1939, when the U.S. began mobilizing for World War II.

There is no exact definition of a depression — just as there’s no precise definition for a recession. The latter label is determined by the National Bureau of Economic Research, often months after a recession occurs.

Simply put, both are periods of significant declines in economic activity.

A depression is a “totally different order of magnitude,” said Susan Houseman, research director at the W.E. Upjohn Institute for Employment Research. “We haven’t seen anything like it for 80 to 90 years,” she said.

Unemployment rate

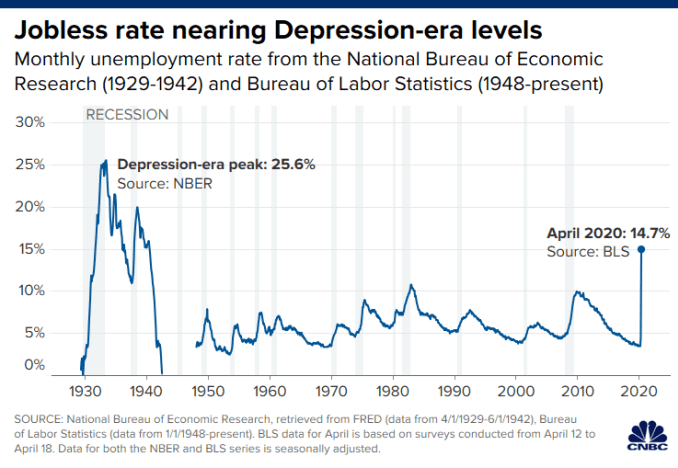

The unemployment rate is perhaps the best measurement by which to judge if we’re in a depression, according to Stephen Woodbury, an economics professor at Michigan State University.

The rate peaked at 25.6% during the Great Depression, in May 1933, according to NBER data.

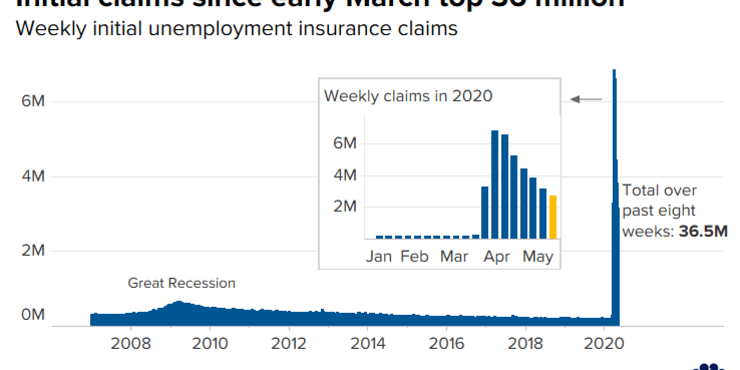

This year, more than 23 million Americans were unemployed as of mid-April as the coronavirus pandemic caused broad shutdowns of economic activity, according to the Bureau of Labor Statistics.

That translates to an unemployment rate of 14.7% — its highest level since the Great Depression. (The statistic includes furloughed workers, or those on temporary layoff.)

The unemployment rate has breached 10% only two other times in history — in December 1982 and October 2009, both during recessions.

The speed with which the unemployment rate increased is unparalleled in modern history — rising from a half-century low of around 3.5% to its current level in just two months.

By comparison, it took more than a year for Depression-era unemployment to witness an equivalent rise, Woodbury said.

Depression-era ‘rival’

“We’re experiencing something that’s starting to rival what we saw in the Depression,” Houseman said of unemployment.

A rate that breaches 20% and persists for several months would likely meet the definition of a “depression,” economists said.

That would mean 1 in 5 Americans who want a job (and are available to work) can’t find employment.

“We’re already way past [prior] recessions,” said Jay Shambaugh, an economist and director of the Hamilton Project at the Brookings Institution, a left-leaning think tank. “Do we push this to 20% and stay there for a few quarters?

“If the unemployment rate is 20% in December, I think it’s very fair to say we’re in a depression.”

Unemployment near 20%

In fact, we might have already breached that level.

For one, the Bureau of Labor Statistics hinted that the true unemployment rate is actually around 19.7%.

he agency determines the rate based on a household survey. Many Americans who should have been classified as furloughed appear to have been misclassified — thereby depressing the official figure, BLS said.

Plus, the 14.7% official rate is the government’s tally as of April 18 — which, at a time when millions of Americans are filing new claims for unemployment benefits each week, seems like eons ago.

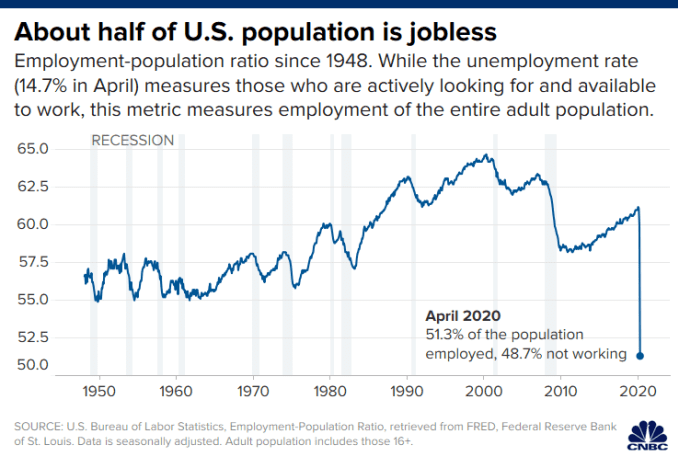

Another useful metric to judge unemployment is the “employment-population” ratio. The ratio was 51.3% in April, by far its lowest level since modern record-keeping began in 1948.

‘Superficial’?

However, the similarity between the unemployment rate today and during the Great Depression is somewhat “superficial,” Woodbury said.

That’s because nearly 80% of currently unemployed Americans are temporary layoffs, or furloughs.

That means about 18 million of the 23.1 million unemployed Americans are still technically attached to an employer and expect to return to their job once states and companies reopen for business.

(The number of unemployed Americans, from which the unemployment rate is derived, differs from the number of people who file for unemployment insurance. Not all those who are unemployed apply for unemployment insurance, for example.)

This level of temporary layoffs relative to the total unemployed population far exceeds any other time in modern history. The next-closest during the post-war era was 24.4% in June 1975.

“When I saw that, my jaw dropped,” he said of the furlough statistic. “I’ve never been so stunned by data.”

Of course, many of those job losses could ultimately be permanent depending on the scope of business failures and the speed with which economic activity restarts.

Self-inflicted

Some economists also don’t believe the unemployment rate — if it officially breaches 20% — will hover at that level for an extended time, as it did during the Great Depression.

The Congressional Budget Office projects an 11.7% unemployment rate in the fourth quarter this year and a 10.1% rate in 2021.

“If the unemployment rate drops down to 10% by end of the year, I think people would say this was a really horrendous recession, but not a full-fledged depression, unless it persists for a number of years,” Shambaugh said.

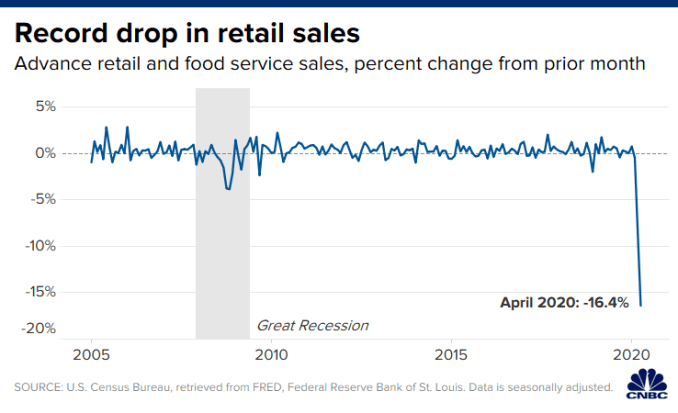

The current economic situation is different from the Depression era because it’s largely self-inflicted, economists said. Federal and state officials decided to shut down broad sectors of the economy to stem the spread of the coronavirus, and the economy could rebound as states and businesses begin reopening.

The Great Depression, by contrast, wasn’t self-inflicted but the result of many factors, such as a stock-market crash, use of the gold standard, deflation and the lack of any real fiscal or monetary policy from the Hoover administration to combat the crisis, Shambaugh said.

Unemployment insurance, for example, wasn’t created until 1935, in response to the Great Depression.

Doing enough?

The U.S. government was caught flat-footed in the early years of the Great Depression, since it didn’t yet have many of the economic tools currently at its disposal, economists said.

This time, federal officials have implemented relatively aggressive measures, such as various lending programs for small businesses, enhanced unemployment benefits and direct payments to Americans, to try to stave off a further catastrophe from the coronavirus, economists said.

“We can still debate whether we’re doing enough,” Houseman said. “It’s hard to tell when you’re in the middle of it.”

Originally posted on CNBC