BRICS Dumps Dollar for Gold: $4 Trillion Bet Exposes the U.S. Treasury’s Fragility Before the Digital Dollar Reset

Foreign Central Banks Choose Gold Over U.S. Treasuries for the First Time Since 1996

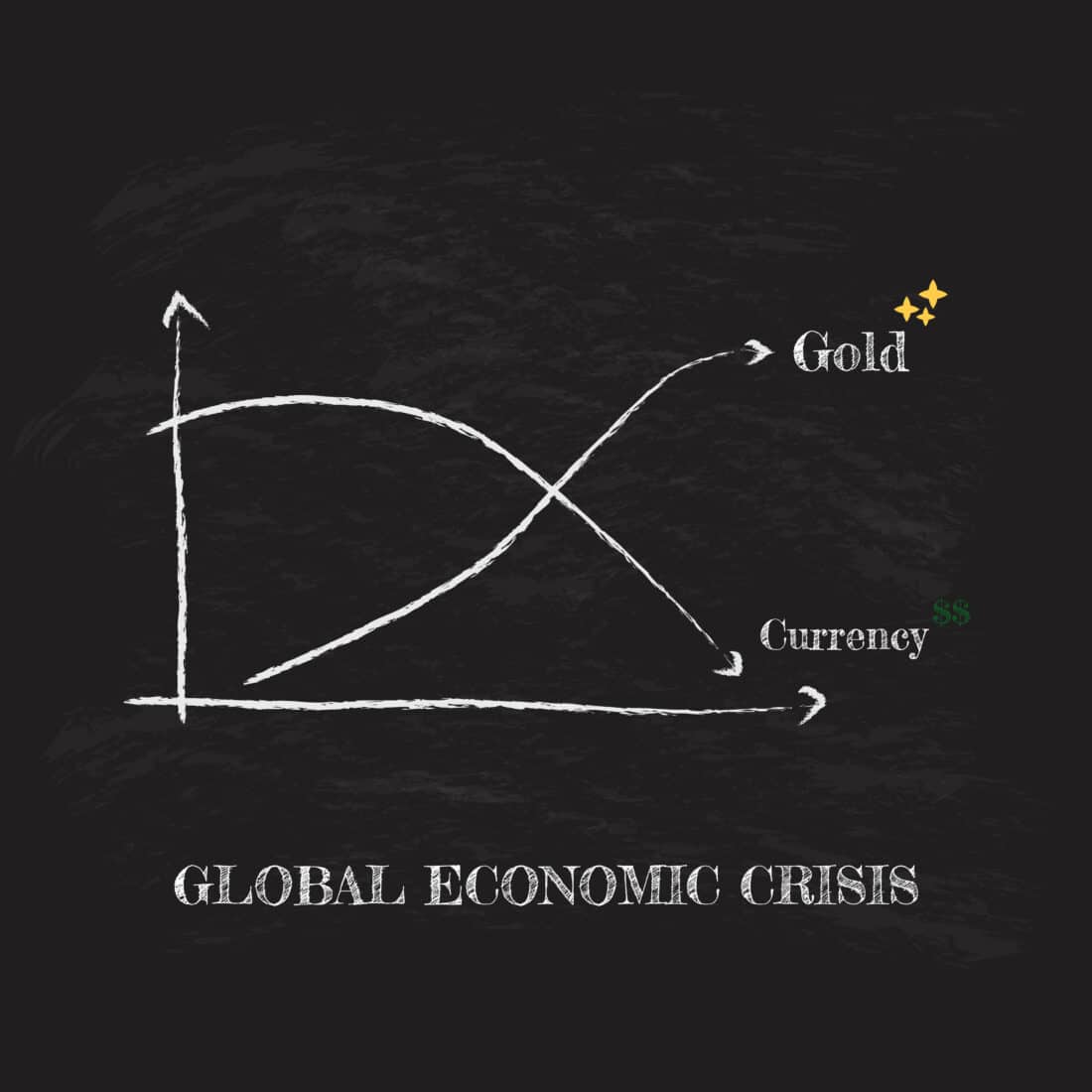

In a move of seismic importance, BRICS nations have officially pivoted from U.S. Treasury holdings to gold, marking the first time in 30 years that foreign central banks hold more gold ($4 trillion) than Treasuries ($3.9 trillion). This signals a decisive loss of faith in dollar-denominated assets. BRICS choose gold over U.S. Treasuries as a deliberate rejection of mounting debt risk, monetary expansion, and geopolitical leverage embedded in the dollar system.

What triggered the shift?

- Over 1,000 tonnes of gold bought by BRICS since 2022

- BRICS central bank reserves now hold 6,000+ tonnes of gold

- Gold has soared to $4,837, up 76% year-over-year

This isn’t a trend. It’s a strategy—and it’s working.

Why BRICS Made the Move—and Why It Matters Now

While gold has always been a safe-haven asset, the timing and scale of BRICS' accumulation is what sets this apart. They’re not just protecting wealth—they’re preparing for a post-dollar financial architecture.

This is a direct response to:

- U.S. debt saturation and rising Treasury risk

- Geopolitical tensions and trade wars (e.g., Trump-era tariffs)

- The encroaching rise of central bank digital currencies (CBDCs)

- Concerns over dollar-based financial surveillance and control mechanisms

The message is clear: sovereign wealth is being moved off-grid, away from the control of U.S. monetary policy and surveillance infrastructure.

What U.S. Savers Are Not Being Told

Mainstream coverage downplays this pivot as a technicality. But the truth is stark:

- The same governments launching programmable digital currencies are buying real, untraceable assets.

- While retail investors are nudged toward cashless systems and digital wallets, central banks are securing hard assets with zero counterparty risk.

This double standard should concern anyone who values financial autonomy.

The BRICS Gold Move Is a Direct Rejection of the Fed’s Trajectory

Let’s be clear: BRICS dumping Treasuries for gold isn’t just about returns. It’s a political and strategic decoupling from the U.S.-led financial system.

And as the FedNow payment system rolls out and CBDC pilots accelerate, this exodus from dollar assets is a flashing red warning for American savers.

Consider:

- CBDCs allow for programmable money, enabling governments to restrict spending, enforce fines, or freeze accounts.

- Combined with real-time transaction monitoring, a cashless society paves the way for total control over how you access and use your money.

BRICS knows this. That’s why they’re buying gold. The question is: What are you doing about it?

The Blueprint to Preserve Financial Freedom in a Controlled Currency Future

If gold is the safe haven for sovereign nations, it must also become the safety net for individuals. But even more important is understanding how to navigate the transition to digital currency control.

That’s why I’ve created The Digital Dollar Reset Guide—a concise, actionable roadmap to safeguard your assets before the reset hits full speed.

Inside, you'll learn:

- How FedNow, CBDCs, and programmable money will reshape your daily financial life

- The real consequences of government financial surveillance

- What practical steps to take now to protect your privacy, autonomy, and savings

Take Action Before the Trap Springs Shut

Central banks aren’t waiting. They’re already making moves.

You must too.

Download The Digital Dollar Reset Guide Now

This isn’t just information—it’s a strategic defense plan for anyone who sees where this is heading and refuses to be financially disarmed.