China Controls the Lifeblood of Modern Tech—Trump's Rare Earth Move Is a Step, But Is It Too Little, Too Late?

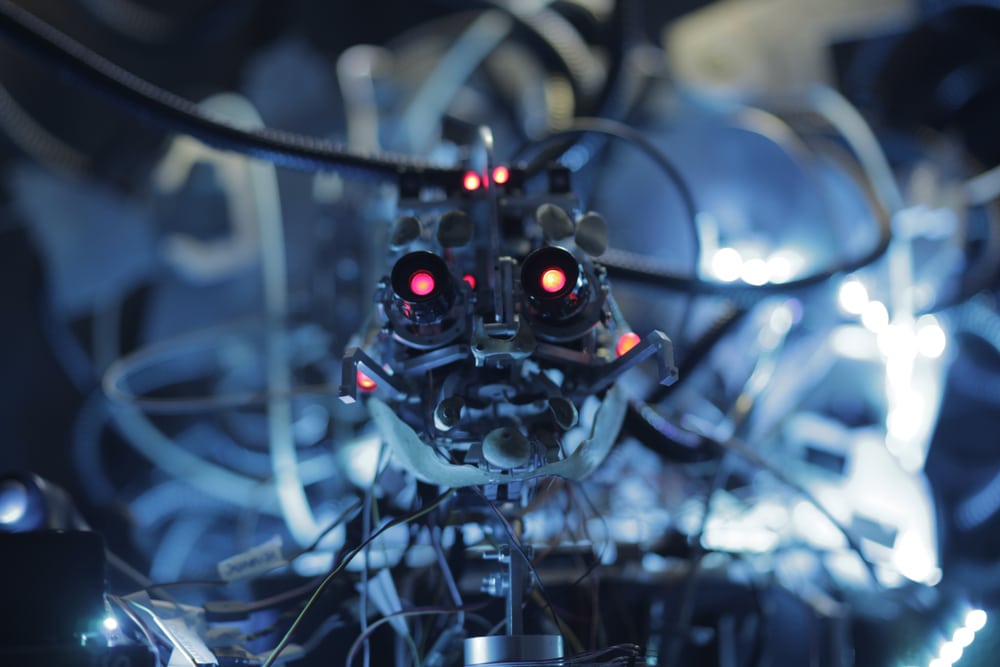

If the collapse of trust in our financial institutions hasn’t alarmed you yet, perhaps this will: China controls over 80% of global rare earths refining capacity, and they’re not interested in playing fair. These minerals—dozens of obscure-sounding elements like neodymium, dysprosium, and terbium—aren’t just academic trivia. They're essential to everything from F-35 fighter jets and electric vehicles to smartphones and wind turbines.

So when Trump signed an executive order to reverse Biden’s roadblock on Alaska’s Ambler mining district—and the U.S. took a 10% stake in Trilogy Metals—it wasn’t just political theater. It was a rare moment of economic pragmatism aimed at clawing back some degree of self-sufficiency in the face of an increasingly adversarial Beijing.

We Are Dangerously Dependent on a Geopolitical Rival

Let’s call this what it is: an urgent national security risk. Our grid, our weapons systems, even the very gadgets we use to criticize or praise government policy—all are powered by rare earths. And right now, China holds the spigot.

It didn’t get this way overnight. Decades of offshoring and short-term profiteering gutted the U.S. domestic mining sector. Environmentalist policies—some valid, some absurdly overreaching—further strangled mining permits. The result? The U.S. now mines just a fraction of its own critical materials and refines almost none. We're not just dependent—we're hostage.

Even the Pentagon is waking up. Earlier this year, they injected $400 million into MP Materials to secure a domestic supply chain for rare-earth magnets. That's promising, but the fact remains: one mine in Mountain Pass, California, cannot compete with a vertically integrated Chinese monopoly that has had a 20-year head start and state-backed subsidies.

Biden’s Blockade Was a Gift to China

Last year’s decision by the Biden administration to block the 211-mile access road to Alaska’s Ambler mining district—over caribou migration concerns—was a perfect example of environmental ideology overriding economic survival. Dozens of communities, the military, and the entire industrial base are held hostage by Chinese policy, yet we’re told a few animal crossings are reason enough to kill a project that could tap into billions in untapped resources?

It’s hard not to ask: Whose interests are being protected here?

Thankfully, Trump reversed the block and greenlit both the road and federal investment. It’s a small but essential move toward building a parallel supply chain outside Beijing’s grip.

But We Need More Than Symbolic Stakes

The U.S. taking minority stakes—10% here, 9.9% there—in resource companies is better than doing nothing, but it's not nearly enough. This is economic triage, and it requires decisive, long-term planning. That means fast-tracking domestic permits, streamlining EPA hurdles, and investing in refining capacity onshore.

It also means insulating your own wealth from the fallout of a global supply chain disruption. Because if China ever decides to turn off the tap—say, in response to a Taiwan conflict or U.S. sanctions—the effects won’t be limited to government projects. You’ll feel it at the gas pump, in the cost of your groceries, in energy bills, and in massive inflationary waves as entire industries get disrupted.

And let me remind you: this disruption won’t be solved by printing more money. You can’t paper over a supply shock with digital dollars. When the minerals stop flowing, so does everything else.

Actionable Protection Starts With Self-Reliance

This story is just one more data point in a larger, darker trend: the slow unraveling of American economic autonomy. Whether it's currency debasement, overreliance on hostile suppliers, or increasing federal overreach, the systems we’ve come to depend on are cracking.

That’s why now—not later—is the time to move a portion of your assets out of the fiat-based, bank-controlled economy and into tangible stores of value: physical gold, silver, and decentralized cryptocurrencies that you control. Because the moment the global chessboard shifts—and it’s already happening—you’ll wish you weren’t stuck holding paper.

To help you take the first steps toward protecting yourself and your family, I recommend downloading Bill Brocius’ essential guide:

👉 7 Steps to Protect Yourself from Bank Failure

For deeper insights on the rare earth scramble, fiat collapse, and how to outmaneuver the system before it turns on you, join the Inner Circle newsletter for just $19.95/month. You’ll get direct access to Bill’s private research, unfiltered market calls, and practical asset allocation strategies the mainstream media doesn’t want you to see.

📘 And if you haven’t yet read Bill’s eye-opening book, End of Banking As You Know It, it’s not just a title—it’s a warning. One that’s becoming more prescient by the day.

The time for blind trust is over. The time for preparation is now.