China’s ETF Chaos Underscores the Power of Physical Gold

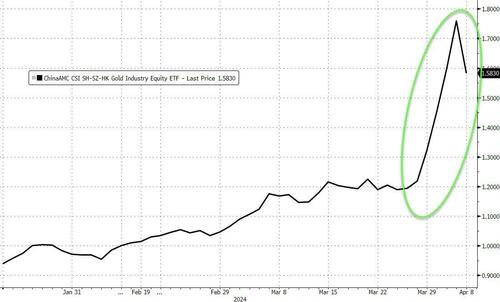

For the second time in a week, trading in an ETF that owns gold companies was halted in China overnight.

The ETF’s price had gained over 40% in the past four sessions before falling 10% after trading resumed Monday.

“The lack of alternatives, and the fact that it’s become a lot more difficult than it was a few years ago to get your money out of China and invest elsewhere – I think that’s definitely helping gold,” said Nikos Kavalis, managing director at consultancy Metals Focus Ltd.

“Demand is pretty decent, considering where the price is.”

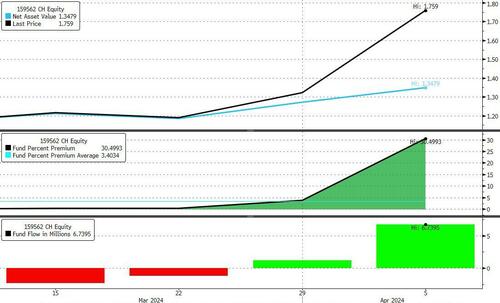

China Asset Management Co. – who run the ChinaAMC CSI SH-SZ-HK Gold Industry Equity ETF – halted the investment vehicle “to protect investors’ interests” as the fund’s premium over its underlying assets increased to more than 30%…

As Bloomberg’s Eric Balchunas highlighted: “Investors [in China] are so desperate to buy things that are not linked to their own economy/stock mkt, which has been in the gutter.”

For context, that surge in the ETF correlated with a spot gold price near $2700…

Source: Bloomberg

As Bloomberg reports, the enthusiasm about products tied to gold, which has staged a record-setting rally in recent weeks, shows a desire to park money in a sector seen relatively immune to a struggling economy.

“Gold is trading at an all time high and gold ETF demand has surged in the past week with almost $600 million of net inflows into gold ETFs globally,” said Rebecca Sin, a Bloomberg Intelligence analyst.

“Demand in Mainland China could continue as investors look to diversify their holdings with commodities and foreign ETFs.”

The ETF fervor is a fresh example of yield-hungry Chinese investors flocking to pockets of market strength as deepening property woes, volatile stocks and falling deposit rates reduce their options.

For those wondering why buying bitcoin ETFs is not allowed there, Bloomberg’s Eric Balchunas notes that “if it were, they’d be going gaga for them given how much FOMO they have been showing for gold and US stocks (btc easily outperforming both).”

This article originally appeared on Zero Hedge

sign up for the newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.