Corporate Buybacks to Explode the Markets in 2019

There’s a difference between a company and its stock. Every smart investor knows this.

A company’s value and the value of its stock price don’t always go hand-in-hand.

That’s what makes “value stocks” a great buy, and overvalued stocks a great sell.

Ultimately, it’s about the true value of the company.

If the stock price doesn’t match the company value, it will eventually rise or fall to meet it, so the theory goes.

Corporate buybacks tend to obscure the true value of a company and its stock.

Investors may think that a company is returning value to its shareholders by purchasing its own stock (thus, raising its value), but if the company itself is not doing well, then buybacks are nothing more than a sleight-of-hand trick to make a stock look more valuable than it really is.

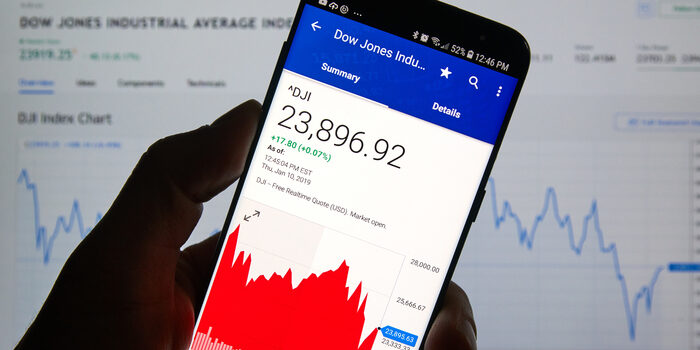

According to a Bloomberg report, corporate buybacks in 2018 for S&P 500 companies alone reached a record-breaking $800 Billion.

This should have encouraged the public to invest more into these companies. Instead, negative geopolitical and economic factors injected doubt into the markets, and the S%P plunged 6% toward the end of 2018.

But the investing public also has a short-term memory when it comes to investing, coupled with myopic foresight. Most investors are limited to seeing only what’s in front of them.

Companies are aware of this well-known characteristic, and so many choose to take advantage of it. Stock buybacks provide a perfect solution.

Among these “Buyback Monsters” is Apple. In 2018, upon announcing $210 billion worth of buybacks, they increased their market cap by $118 billion.

Another company performing this sleight-of-hand is Home Depot.

Having bought back nearly 35% of their outstanding shares, it means that Home Depot’s earnings look 35% better, yet their revenues and costs have not changed a bit.

Apple and Home Depot are just two among 80 S&P 500 companies that have reduced their outstanding shares by more than 25% since 2010.

Though a smart tactic for the companies involved, for investors seeking true value, such tactics are shady, questionable, and unethical.

When the market’s largest players have obscured the true valuation of their stocks, doesn’t it follow that the stock market’s true valuation is also in question?

Corporate Buybacks to Explode (and explode the market) in 2019

In a CNBC article, JPM’s US equity strategist, Dubravko Lakos-Bujas, stated that there are “some $800 billion in buybacks scheduled for 2019.”

Fed Chief Jerome Powell’s sudden dovishness paved the way for the continuation of this deceptive Wall Street practice.

Among those scheduled to engage in buyback activity are numerous corporate giants including Boeing, Facebook and Johnson and Johnson.

The current game is not about fundamentals, not about increasing revenues, not about providing real value to customers, shareholders, and the economy at large.

It’s about propping up their stock prices.

Collectively, buybacks may intensify the stock market rally. But it’s a house of cards.

How to Invest Under High-Risk Market Conditions

No matter how much of an astute investor you might consider yourself, the allure of raging bull can be overwhelming, despite the risks that it might pose.

You seek as much growth and appreciation as possible, yet you don’t want to lose it all when everything comes tumbling down.

In that case, pursue those returns. But hedge your portfolio while you’re at it.

Keep your stocks, hold on to your bonds, stash away some cash, and seriously consider holding safe haven assets such as gold and silver.

Central banks across the world have begun converting their treasury and currency reserves to gold. In fact, 2018 marked the largest gold buying spree among central banks in over 50 years.

It’s a smart move. You might want to do the same.

What matters most is how you apportion your assets within your total portfolio. If you want a perfectly balanced all-weather portfolio--one that can pursue capital growth, income, and safety in rising or declining markets--allocate your portfolio evenly across stocks, bonds, cash, and precious metals (a 25% allocation to each).

We don’t know exactly when this house of cards will come crashing down. We just know that it will happen sooner rather than later.