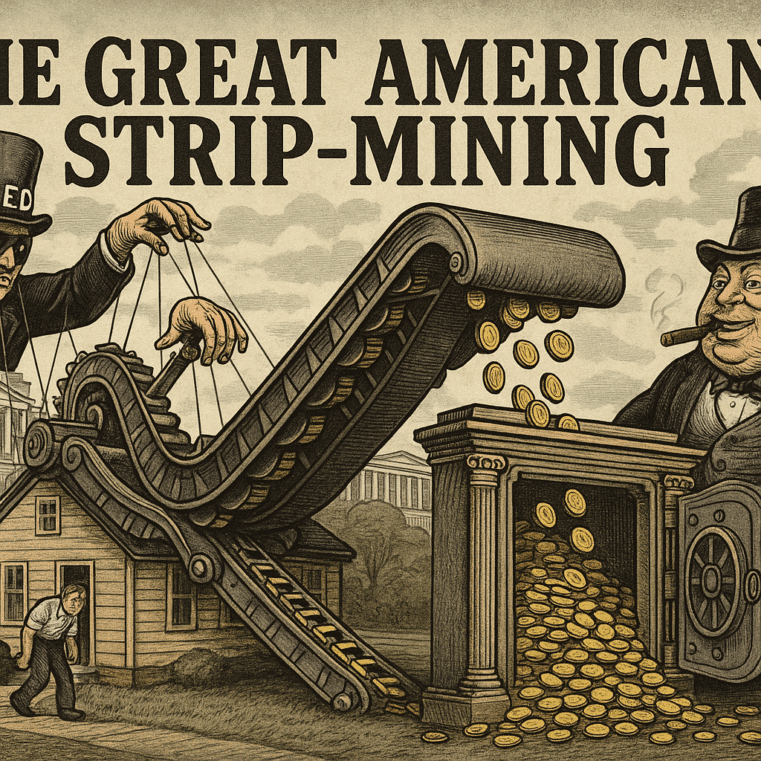

Gold at $10,000? The Monetary Reset Has Already Begun — And You're Not Supposed to Know

The COMEX Just Coughed Up $21 Billion in Gold… And That’s No Fluke

Let me lay it out for you: this April, over 64,000 gold contracts were delivered from COMEX. That’s not just some technical trading event — that’s 6.45 million ounces of physical gold, worth over $21 billion. And it’s the second-largest gold delivery on record.

In the past, most futures contracts would just quietly settle in cash. Traders didn’t really want the gold — they were just making paper bets. But this time? Not only did a boatload of contracts stick around right up to the bitter end… but people actually wanted the metal. That's the key shift here.

More than 10,000 new contracts opened up in the middle of delivery. That’s wild. It’s like everyone suddenly realized: "I don’t want the cash. I want the real thing."

Something is breaking down behind the curtain.

A Quiet Panic Is Brewing

Even while gold’s flying off the shelves, inventories are shrinking fast. COMEX stockpiles have been diving since early April, which tells me this isn’t just noise — this is systemic stress.

We’re seeing all the hallmarks of a market under pressure:

- Strange surges in open interest

- Sudden cash settlements in place of delivery

- Withdrawals happening at a historic pace

What’s happening here isn’t just about market mechanics. It’s about nations, banks, and power players preparing for what comes next. They’re repositioning. And they’re not telling you why.

The World Is Done With the Dollar — And They're Saying It With Gold

Folks, I’ve been shouting this from the rooftops since 2008: de-dollarization is real, and it's picking up steam like a runaway freight train. You’ve got Russia and China leading the charge, but now even Saudi Arabia is making oil deals in other currencies. That’s not just a slap in the face to the petrodollar — that’s the end of the system we’ve all been living under since the ‘70s.

And what are they turning to? Gold.

The ultimate neutral asset.

No counterparty risk.

No central bank printing press.

Just pure value.

Luke Gromen, a guy I respect deeply, made this crystal clear in a recent interview: The U.S. system — debt-loaded, deficit-driven, and utterly dependent on foreign buyers — can’t hold forever. Eventually, the music stops.

$10,000 Gold Isn’t a Dream — It’s a Backdoor Bailout

Let me throw you a scenario. What if the U.S. Treasury — sitting on over 8,000 tons of gold — suddenly revalued it?

At $10,000 an ounce, the U.S. could conjure up $3 trillion out of thin air without borrowing another dime.

That’s right. A gold revaluation would let Washington refill its coffers without a single vote in Congress. And those deliveries we saw in April? They may very well be part of that chess game — quiet movements from sovereign players prepping for a gold-backed financial reset.

It would be the biggest shift in monetary architecture since Nixon took us off the gold standard.

And you and I? We're not invited to the table.

We’re just left holding the bag… unless we act now.

The Playbook Has Changed — Are You Ready?

This isn’t some vague warning about the distant future. This is now. If COMEX is running low, and central banks are stockpiling gold like it's wartime, you should be doing the same.

Don’t wait for the headlines to catch up. Don’t wait for gold to hit $10,000 to realize you should’ve moved at $2,300.

It’s time to go old-school.

🔒 Protect Yourself Before the System Fails

👉 Download Bill Brocius’ FREE eBook — “Seven Steps to Protect Yourself from Bank Failure”

Learn the exact moves to protect your savings before the next wave hits. Click here to get your free copy

👉 Subscribe to Dedollarize’s full suite of financial sovereignty tools.

Gold, silver, private wallets, and survival strategies — we’ve got your back. Get started now

The reset is no longer coming.

It’s already started.

Don’t get caught flat-footed.