Gold Scams on the Rise: Montgomery County Officials Warn Investors to Stay Vigilant

Montgomery County, Maryland, law enforcement officials are urging the public to be vigilant about an ongoing scam in which a growing number of seniors have already lost millions of dollars.

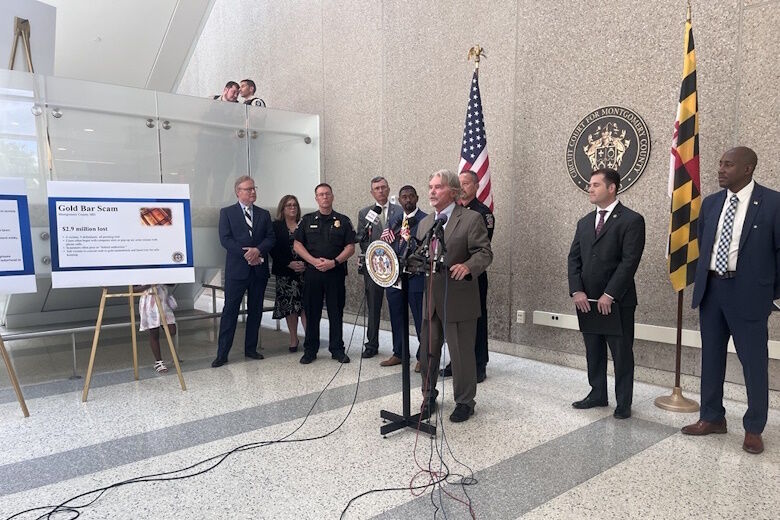

So far at least five people have been arrested and charged in these schemes, Montgomery County State’s Attorney John McCarthy said.

Around 20 victims have come forward since July 2023, and McCarthy said he believes there are more victims who may not even know they have been swindled.

“Make no mistake about it, this is organized crime at the highest level,” McCarthy said at a news conference Monday, alongside officials from the FBI and Homeland Security.

He said the scams often originate in India or China: “The reality is that once you are a victim of one of these scams, the chances of getting your money back — not high.”

The state’s attorney’s office said the scams usually begin with a computer alert, a pop-up ad or a phone call. Scammers often pose as federal agents or tech support, trying to convince targets that their accounts have been compromised. Then panicked targets are instructed to convert savings to gold immediately, and hand it over for safekeeping.

In July, a 74-year-old Bethesda man told police he had been defrauded out of more than $1 million that he had converted to gold bars. Montgomery County police said the alleged scammer, Vipul Thakkar, 52, of Owing Mills, was arrested July 17 after picking up the last payment of bullion from the victim’s home.

In recent weeks, a 19-year-old New York resident was arrested after police said the suspect targeted an 82-year-old Montgomery County woman. Another suspect was arrested at O’Hare airport trying to board a flight to Dublin, Ireland.

Detective Sean Petty of the Montgomery County Police Department’s Financial Crimes Section, who is leading the investigations, said victims often hesitate to come forward because they feel ashamed.

“It’s important for people to understand if you think that you could not fall victim to this because you have a degree in psychology or science or astrophysics — you’re wrong,” Petty said. “The individuals who we have seen have all been intelligent individuals, they have degrees, they have very respectable jobs that they have retired from.”

He said the department has launched a public service announcement with area pawnshops, alerting them to signs that a senior who is requesting to buy gold bars might be a victim.

Residents are being urged to talk with elder loved ones and warn them that they may be vulnerable to this type of fraud. People are also advised not to pick up the phone if they don’t recognize the number and to never click on pop-up ads.

If a call seems suspect, police said hang up and call a friend or family member and talk it through with them.

Internet scams should also be reported to the FBI’s Internet Crime Complaint Center online or by calling 1-800-CALL-FBI.

This article originally appeared on WTOP News.