Inflation Wipes Out Wealth Gains Under Biden: A Sobering Analysis

Gains in American households' net worth have flattened during President Biden's administration because of inflation, a new analysis finds.

A report by the Wall Street Journal analyzed changes in household net worth from the start of Biden's presidency in comparison to those seen during the tenure of his predecessor and presumptive opponent in the 2024 election, former President Donald Trump. It found that in nominal terms, total household net worth rose by 19% through Biden's first three years in office – a comparable figure to the 23% increase seen in Trump's first three years.

However, when factoring inflation's impact on household net worth, the data is less favorable for Biden. After adjusting for inflation, household net worth is up by just 0.7% through Biden's first three years in office, whereas it was up 16% in Trump's first three years.

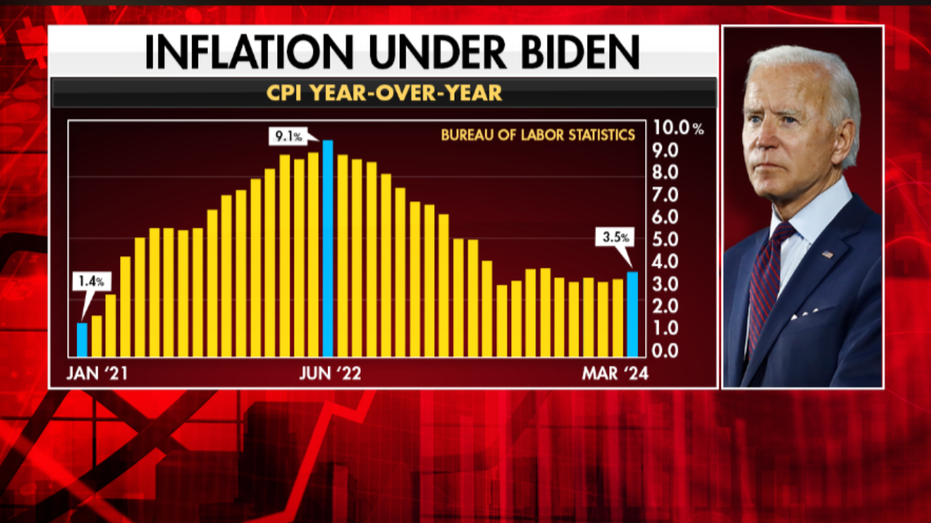

At the time of Biden's inauguration in January 2021, year-over-year inflation in the U.S. economy was about 1.4%. However, inflation surged due to global supply chain disruptions related to the COVID pandemic as well as elevated levels of government spending, peaking at a 40-year high of 9.1% in June 2022.

The U.S. spent trillions of dollars to stimulate the economy amid the pandemic at the end of Trump's administration and at the outset of Biden's term.

Among those measures were the $1.9 trillion American Rescue Plan Act that was enacted in March 2021 and the Inflation Reduction Act, an $891 billion package enacted in August 2022. The two measures were approved by congressional Democrats on party-line votes using the budget reconciliation process.

The Biden administration has blamed global supply chain disruptions as the main factor causing inflation and has defended those pieces of legislation as providing critical financial support to American households as the economy dealt with the pandemic's impact and addressing other pressing policy needs.

The White House has also pointed to other actions, like releasing oil from the Strategic Petroleum Reserve to give energy markets a boost, as ways it has looked to ease the sting of inflation.

The U.S. economy continues to experience elevated inflation, which came in at 3.4% in April. That's well above the Federal Reserve's target rate of 2%.

To tamp down inflation, the Fed raised the benchmark federal funds rate, which influences interest rates across the economy, to a more than 20-year high target range of 5.25% to 5.50%.

With inflation remaining elevated, the central bank's policymakers have signaled that interest rates are likely to remain higher for longer than originally anticipated to allow more time for inflation to subside.

This article originally appeared on Fox Business