Inflation's Grip: Retirees Forced Back to Work as Savings Shrink

A wave of America's retirees are dusting off their résumés and stepping back into the workforce, seeking financial stability as inflation changes the trajectory of their golden years.

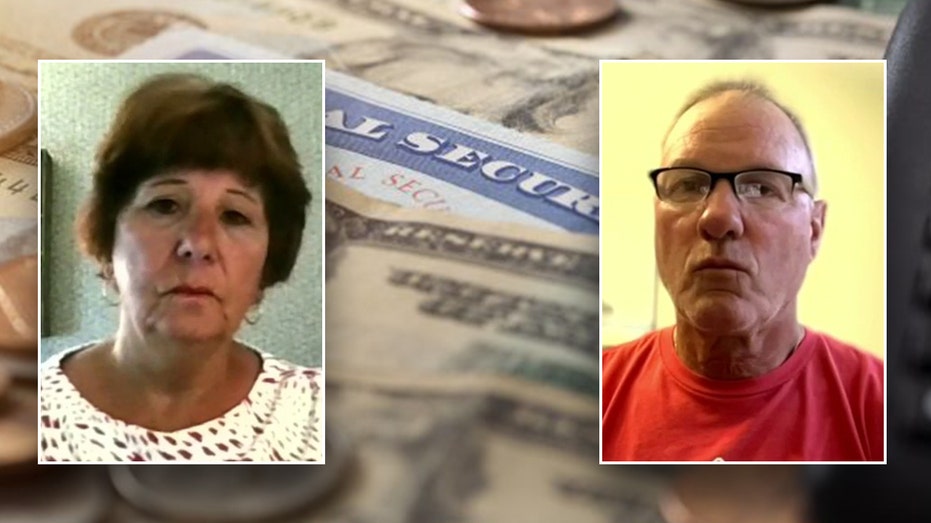

"I've been back to work twice already, but now with watching the grandchildren, trying to help out the younger generation, I've had to look for work that can work with my schedule and work with the schedule that I do with the kids," Joyce Fleming, a retired nurse who was pushed back into employment, told "FOX & Friends" on Wednesday.

Fleming has considered opening a daycare in her own home so she could make money while watching her grandchildren, but that would more than likely require full-time status.

"I guess I'll find a way," she said when asked about balancing family and work. "But the economy right now, with the cost of things, it almost mandates that you [go back to work]. I have made a budget plan prior to my retirement, but I'm still struggling to keep that budget on target."

Retired police officer Greg Piazza went back to work as a full-time groundskeeper to help mitigate the pressures of inflation. His wife, a retired teacher, is now tutoring.

"Law enforcement has a very good pension. I feel very blessed, and I appreciate that very much," he told Fox News' Ainsley Earhardt. "But it just goes to show you that, even for us so-called retired folks, it's just not enough under today's current economy, and I went back to work full-time to assist us."

Piazza needed health insurance for his wife and daughter in addition to additional funds to cover staggering living expenses, including rising costs for gas, groceries, utilities and car insurance.

He blamed the Biden economy for the hardship.

"When they say that the average American has [experienced] a [cost of living] increase of about $10,000 to $12,000 a year under Joe Biden, that is absolutely factual. I did the math myself," he said.

"My car insurance has gone up $300 a month since I moved [to Florida]," he continued. "The gasoline went from $2 a gallon to $3.50 a gallon right now. You talk about utilities… electric and all the other stuff, it absolutely has increased ten to twelve thousand dollars a year."

The Consumer Price Index rose 3.4% last month, slightly down from March's 3.5% reading, but the report also showed prices are 19.4% higher today than when President Biden took office in 2021.

Grocery prices are up more than 21% from the start of 2021, while shelter costs are up 18.37%, according to FOX Business calculations. Energy prices, meanwhile, are up 38.4.%.

"The inflation costs are just unbelievable," Fleming said. "Even when you own a home and you go to do repairs, those kinds of things, every cost [has increased]. It's not just food and cost of living types of things. It's trying to keep your home going. If you try to get even a plumber, an electrician to come in, the costs have doubled."

The Fed's Economic Well-Being of U.S. Households report for 2023 showed that inflation made financial lives "worse" for approximately 65% of U.S. adults. Nineteen percent of those respondents described their financial situation as "much worse" due to higher prices.

This article originally appeared on Fox Business