Kiyosaki's Stark Warning: CBDCs And The Erosion Of Financial Freedom

EDITOR'S NOTE: Financial guru and best-selling author Robert Kiyosaki delivers a clear-cut warning against the insidious rise of Central Bank Digital Currencies (CBDCs), cautioning that they may spell the demise of financial privacy and individual liberty. This no-holds-barred article exposes the chilling rationale behind Kiyosaki's claims, delving into the problematic implications of CBDC adoption. For those just now hearing about CBDCs, it’s a jarring revelation; one that can lead to the irrevocable dismantling of our economic freedoms.

Soon the dollar will be destroyed, and every cent you have will be tracked.

Robert Kiyosaki is worth an eye-watering $100 Million.

He’s a proponent of using debt to avoid paying taxes.

He despises the traditional schooling system.

And he says getting a job is a scam.

Kiyosaki has credited martial arts for significantly impacting his life and career. He says it teaches essential skills like discipline, focus, and overcoming challenges and believes these qualities have been crucial to his personal and business successes.

Kiyosaki’s earnings mainly come from his international best-selling book and aggressive upselling of his high-priced seminars, sometimes north of $45,000 to attend. He’s used the income as a cash cow to filter into his property, Gold, Silver and Bitcoin investments.

It’s hard not to notice that his marketing tactics often rely on fear which is apparent in many of his online videos.

Fear of being poor.

Fear of losing all your money to the government.

Or fear a weakening dollar is robbing you of your pension.

He speaks about poor people as if they’re a different bread of human beings. But despite all the talk, according to Forbes, there is no documented evidence of any wealth Kiyosaki had generated before the influx of income from Rich Dad Poor Dad.

It made some people wonder whether the book’s anecdotes about his previous success were true.

Full disclosure I enjoyed his book when I read it as a teenager. But I often ask myself — How can someone give solid business and wealth creation advice when most of his companies have gone bankrupt?

He’s yet to have a company maintain financial health and avoid controversy.

Today, “Rich Dad Poor Dad” has sold millions of copies worldwide and is considered a classic book in personal finance. The part that stuck with me over all these years is the difference between assets and liabilities.

Rich people buy assets.

Poor people buy liabilities.

While the book was a smash hit, it’s faced negative feedback for the high-risk advice, including taking on debt to avoid taxes and investing in real estate with little or no money.

Kiyosaki also came under fire for his take on traditional methods of making money, like openly criticising the path of getting a safe job, paying off your mortgage and investing in a pension.

You have to give credit where it’s due. Kiyosaki has a world-class ability to break down complex financial topics and make them easy to understand. And he has a way of stirring emotions in you to want more for yourself and challenge your conventional thinking.

Robert Kiyosaki — Source

“The problem with school is that it takes your creativity and turns it into memory.

It teaches you to memorise and regurgitate information rather than think critically and solve problems.

That’s why so many people are stuck in jobs they hate because they were never taught how to think for themselves and create their own opportunities.

To succeed, you must learn to think differently than the masses.

You need to take risks, be willing to fail, and never stop learning. That’s how you create your path and achieve financial freedom.”

Whoever Controls Your Money Rules the World.

Kiyosaki usually makes an enemy of someone, and this time he says the Fed is trying to end your money and remove your privacy.

They’ve destroyed the dollar by lending it into existence with fractional reserve banking. It’s a system used by most modern banks worldwide. Banks are only required to hold a fraction of the deposits they receive from customers in reserve, while the rest is for lending and investing.

For example, if a bank has $100 in deposits and is required to maintain a reserve ratio of 10%, it would need to keep $10 in reserve and could use the remaining $90 for loans and investments.

Kiyosaki says we have a skewed view of how banks hold our money, and the entire monetary system creates money out of nothing, which shows how “fake the whole system is”.

When America starts paying its bills by making money from nothing, he says the American Empire is going down, and the dollar will collapse.

Robert Kiyosaki —Source

“Throughout history, who controls the money, rules the world.

Since 1944, America’s held the capital, with the U.S. dollar being the world’s reserve currency, which caused America to boom but also caused many problems.

95% of the dollars in the world were created by lending them into existence.

So most people have this idea that dollars are just kind of a green piece of paper, and you take your green pieces of paper that you digitally get with your paycheck and deposit it at the bank, and then the bank puts that in a vault and stores it for you until you need it.”

Central Bank Digital Currencies

By now, you’d have heard of central bank digital currencies or CBDCs.

They’re like digital versions of traditional money, issued and backed by central banks, which control them directly.

It differs from cryptocurrencies, which operate independently of governments and central banks.

CBDCs are becoming more popular due to the increasing digitisation of the global economy and the need for faster, more secure payment systems.

They have the potential to make payments quicker and cheaper, reduce fraud and counterfeiting, and provide banking services to those who currently lack access.

There are concerns about privacy and security with CBDCs and the possibility of central banks having too much control over financial transactions, and Kiyosaki believes they will eliminate our privacy.

Robert Kiyosaki — Source

“The Fed’s ending our money is just part of it. They’re also ending our privacy.

They want to know everything about us. They want to track every single dollar, every cent we make, and where it goes.

They’re trying to create a digital currency, and they’re doing that because they want to eliminate cash.

They want to eliminate privacy.

They want to eliminate our ability to make transactions without them knowing.

So, it’s a control mechanism. And that concerns me the most about what’s happening with the Fed and our monetary system.”

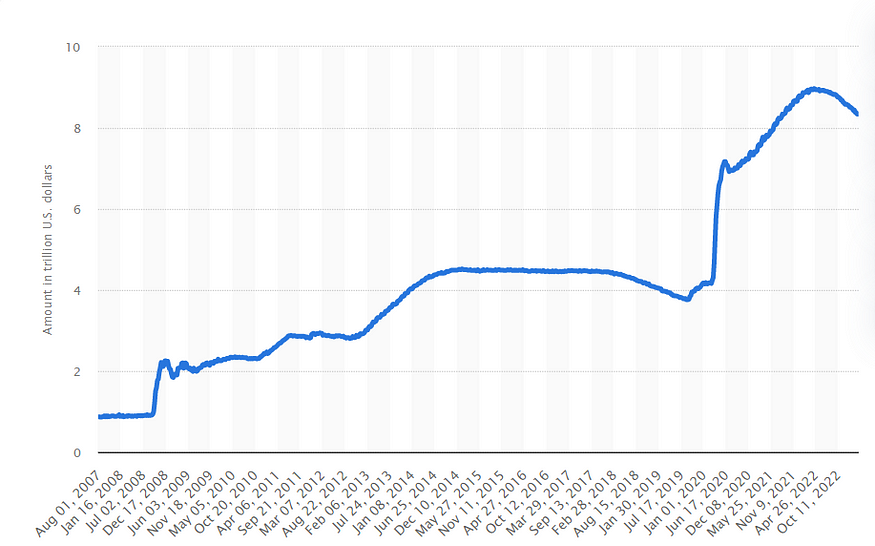

The value of the Federal Reserve’s balance sheet has increased significantly since 2007 when it stood at roughly 0.9 trillion U.S. dollars.

As of March 8, 2023, the Federal Reserve had 8.34 trillion U.S. dollars of assets on its balance sheet. The most dramatic increases occurred in 2008 and during the first half of 2020.

These were the 2008 financial crisis and the COVID-19 pandemic.

The Federal Reserve reacted to these difficult times by using methods that increased the money supply and encouraged spending to create more jobs and help the economy grow.

Central banks can use different ways to increase the amount of money circulating in the economy, known as “expansionary monetary policies”.

One of these ways is to reduce interest rates, making it cheaper for people and businesses to borrow money. However, increasing the money supply can and has led to inflation, causing economic problems and making it more difficult for people to buy things.

Following the Federal Reserve’s quantitative easing (Q.E.) in 2020, the inflation rate in the United States reached 4.7 per cent in 2021, the most significant value since 1991 after doubling their balance sheet.

Assets on the balance sheet denominated in Trillions of US Dollars

Source: Medium

If You Play in the Grey and Spend Your Money in Cash, You Risk Going to Jail (ECB President)

If you’re worried about CBDCs, and the potential censorship controls, you’ll be shocked by the European Central Bank Presidents’ recent comments.

Christine Lagarde, the European Central Bank president, says that there are systems she will put in place to ensure the central bank can monitor your funds through CBDCs.

No joke. She said that.

A visual of Europe’s balance sheet is almost a copy-and-paste version of America’s, just denominated in Euros.

Christine Lagarde — Source

“I don’t want a foreign currency to be something other than the currency of trading within Europe, so we have to be ready.

Now the problem is people don’t want to be controlled.

You know what? Now we have this threshold above 1,000 Euros in Europe. You cannot pay cash.

If you do, you are on the grey market and take your risk. If you get caught, you’ll get fined or go to jail.

But you know the digital Euro will have a limited amount of control. There will be control.

We are considering whether we could have a mechanism with zero control for very small amounts, anything around 300–400 Euros, but that could still be dangerous.”

Final Thoughts.

For all my cynicism towards Kiyosaki, I agree with his sentiment around the government’s stance on trying to gain control, which will significantly impact our privacy.

You’ll spend money, and the Central Bank will know what you buy and when.

It will happen everywhere in the world, not just in the U.S.

It’ll also, as a consequence, accelerate the adoption of genuinely decentralised cryptocurrencies like Bitcoin as people lose trust in the traditional system.

Because it already has.

According to data from the on-chain analytics firm Santiment, BTC now has 45.14 million addresses, which grew by 3.95% (1.71 million wallets) during the last two months.

This trend indicates that new users are joining the network, and more people are starting to use Bitcoin.

Source: Medium

While I try and avoid Kiyosaki’s lead tactic of fear, he’s right about the flawed financial system and the government’s monetary policies.

When CBDCs launch, we’ll be in a world with increased surveillance, zero privacy and worse, a system that can control our assets.

He believes governments could use the information to track your spending habits and control your access to money.

And worse, freeze or seize everything you own.

Yuck.

Originally published by: Jayden Levitt on Medium