New York Fed Reveals It Will Start Buying ETFs In "Early May"

Responding indirectly to Jeff Gunlach's late Friday tweet, in which the bond king observed something we had noted previously, namely that "the Fed has not actually bought any Corporate Bonds via the shell company set up to circumvent the restrictions of the Federal Reserve Act of 1913" adding that this "must be the most effective jawboning success in Fed history if that is true"...

If the Fed has not actually been buying Corporate Bonds, even through its shell company, the buyers of Corporate Bonds at today’s prices (maybe > the ultimate default recovery value) are simply hoping to sell to the Fed shell company at today’s or higher prices in the future.

— Jeffrey Gundlach (@TruthGundlach) May 1, 2020

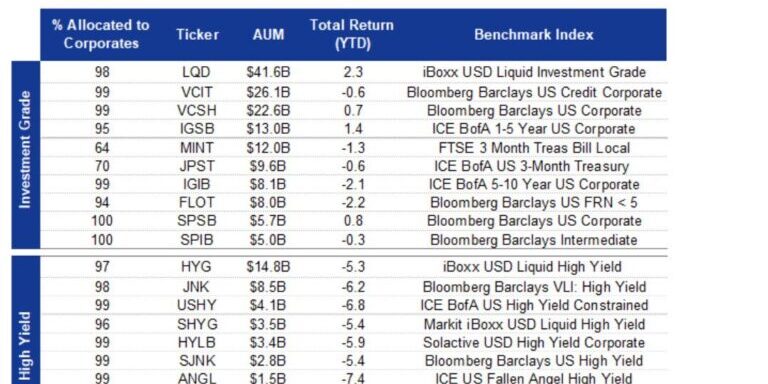

... moments ago the The New York Fed announced on its website that it expects to begin purchasing eligible ETFs, most notably the LQD and JNK, but also many others as detailed previously as part of its emergency lending programs in "early May."

The SMCCF is expected to begin purchasing eligible ETFs in early May. The PMCCF is expected to become operational and the SMCCF is expected to begin purchasing eligible corporate bonds soon thereafter. Additional details on timing will be made available as those dates approach.

In addition to Gundlach, the NY Fed was likely also addressing BofA's Friday lament, which published a "A Note To Fed" which was meant to precipitate the Fed's decision to get off the fence and to start waving it in as "a lot of investors (including non-credit ones) have bought IG corporate bonds the past two months on the expectation they can sell to you. So would be helpful if you soon began buying broadly and in size."

The problem, if the Fed does not start "buying broadly and in size" is that the bond market may soon suffer from a very painful indigestion of the record IG bond issuance that has taken place in the past two months, first profiled here.

And so the Fed responded, adding that the Fed’s "secondary market corporate credit facility" and "primary market corporate credit facility" will then begin lending via purchases of corporate bonds soon thereafter.

"Additional details on timing will be made available as those dates approach,” the Fed said, which is odd since "early May" is - well - now, so it wasn't clear just how much longer the Fed plans on waiting.

And with that any risk of a selloff following Gundlach's announcement that so far "the Fed had been all hat and no cattle", i.e., only jawboning, has been alleviated as bond investors can now look forward to the Fed buying their trash from them instead of having to just flip it among each other. As for what "early May" means, we will just have to wait and see.

Article originally posted on ZeroHedge