No Easy Pivot: Powell Conditions March Rate Cuts on Employment Slump

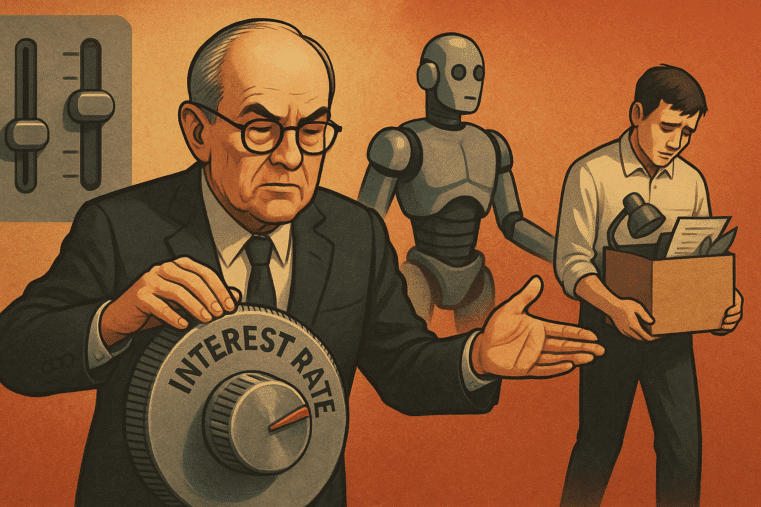

(Kitco News) - After the Federal Reserve left interest rates unchanged on Wednesday, Chair Jerome Powell used his press conference to push back against market expectations for rate cuts as early as the March meeting.

“Based on the meeting today, I would tell you that I don't think it's likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that,” Powell said. “That's probably not the most likely case, or what we would call the base case.”

“There was no proposal to cut rates” among FOMC members, the Fed Chair added, though “some people did talk about their view of the rate path.”

Powell reiterated throughout the press conference that the FOMC “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” though he acknowledged that “inflation has eased over the past year.”

The central bank did drop their oft-repeated reference to the potential for further rate hikes in Wednesday’s statement. Powell said the Fed's interest rate target is “likely at its peak for this tightening cycle” and they expect to cut rates “at some point this year,” but said the committee will take the necessary time to confirm that the data supports monetary policy easing.

In response to a question about whether the U.S. economy has already achieved a ‘soft landing’, Powell said “we are not declaring victory, we think we still have a ways to go.”

Powell told journalists that “almost every participant on the committee does believe that it would be appropriate to reduce rates” in 2024, but what the FOMC is trying to do is “identify a place where we are really confident about inflation getting back down to 2% so that we can then begin the process of dialing back the restricted level.” He pointed out that the median committee participant “wrote down three rate cuts this year,” but they need further confirmation that inflation is on track for the long term.

Powell also took care to separate growth from employment in terms of priority indicators, emphasizing that a sudden downturn in the labor market would significantly alter the timeframe for rate cuts. “If we saw an unexpected weakening in the labor market, that would certainly weigh on cutting sooner, absolutely,” he said. “If we saw inflation being stickier or higher, those sorts of things would argue for moving later.”

In response to a question about the balance of risks, Powell said that while there remains a risk “that inflation would re-accelerate, I think the greater risk is that it would stabilize at a level meaningfully above 2%,” and said that he sees the latter as more likely. “That's why we keep our options open here, and why we're not rushing,” he said.

Gold prices saw a brief runup to $2,050 per ounce during the Fed chair’s press conference, but shortly after he finished speaking they had fallen to session lows just below $2,031. At the time of writing, spot gold last traded at $2,038.33, virtually flat on the day.

This article originally appeared on Kitco News