Opinion: China's Digital Currency DCEP Will Dominate

EDITOR NOTE: Later this year, China will be launching its Digital Currency Electronic Payment (DCEP) system. Approximately 39 million Chinese citizens living abroad will be the first adopters. The standard international payment system, what the entire world is using now, was developed by the US. DCEP is poised to compete with the current system, not only internationalizing the yuan, but threatening the dollar’s global monetary sovereignty. As China expands its influence toward shaping the international digital financial system, will the digital yuan define the future of international trade? And what might it mean for China to have such vast access to international data collection and surveillance?

Chandler Guo was a pioneer in cryptocurrency, the digital currencies that can be created and used independently of national central banks and governments.

In 2014 he set up an operation to produce one of those currencies, Bitcoin, in a secret location in western China.

"Mining" Bitcoin is a power hungry enterprise involving dozens of computers so he used power from a hydroelectric station, in partnership with a local Chinese government official.

At its peak his machines were capable of mining 30% of the world's Bitcoin. He believed Bitcoin would one day change the world and replace the dollar.

But now he sees a new force emerging - a payment system created by the Chinese state and known as Digital Currency Electronic Payment (DCEP).

It's really a digital version of China's official currency, the yuan, and Mr Guo feels DCEP will become the dominant global currency. "One day everyone in the world will be using DCEP," he says.

"DCEP will be successful because there are a lot of Chinese people living outside of China - there are 39 million Chinese living outside of the country.

"If they have a connection with China they will use the DCEP. They can make DCEP become an international currency."

But many question whether it will succeed and there are concerns that it will be used by Beijing to spy on citizens.

Like Bitcoin, DCEP utilises a blockchain technology, a type of digitised ledger used to verify transactions.

Blockchain acts as a universal record of every transaction ever made on that network, and users collaborate to verify new transactions when they occur.

In practice, that means users don't need a bank if, for example, they want to pay each other, perhaps with their phones.

China plans to launch DCEP later this year. But so far, the People's Bank of China has not given an exact date for the nationwide launch.

China began testing the digital currency earlier this year in selected cities. When rolled out it will allow users to link downloaded electronic wallets to their bank cards, make transactions and transfer money.

"It's hard to predict the timeline but the People's Bank of China is under a lot of pressure to accelerate the development because they do not want to be in a world where Libra (Facebook's digital currency) becomes the global currency, which they think is worse than the current global financial system controlled by the US," says Linghao Bao, an analyst from Beijing-based Trivium.

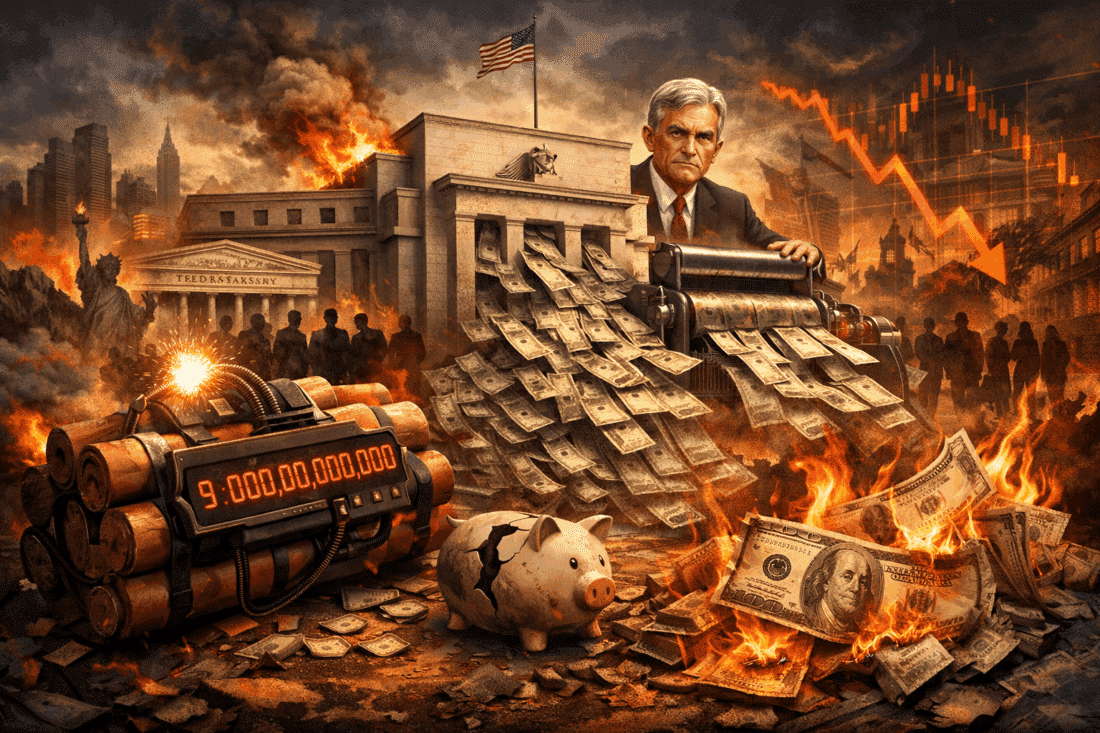

Observers say China wants to internationalise the yuan so that it can compete with the dollar.

"The Chinese government believes that if some other countries can also use the Chinese currency it can break the United States' monetary sovereignty. The United States has built the current global financial system and the instruments," says an anonymous Chinese cryptocurrency observer known as Bitfool.

The technology enthusiast worked in the venture capital sector before joining a number of Chinese internet companies. He started researching Bitcoin and believes that digital currencies represent the future of money.

Read more on BBC