Positive Unemployment Report Historically Signals Dark Days Ahead

Last week’s unemployment report came as a surprise, flying hard against the face of negative sentiment.

Up until the report’s release, a large majority of investors were anticipating numbers confirming their suspicions--that a recession was forthcoming.

Economists forecasted 176,000 jobs to be created in December. Instead, the report gave us 312,000 jobs.

It was a blowout...the largest monthly increase since February 2018.

It’s no surprise that the markets that day reacted the way they did: Dow Jones, up 747 points! S&P, up 84! Nasdaq, up 275!

As in the words of Stu Hoffman at PNC Financial, “what recession”?

Yet in contrast to this newfound market optimism, the International Monetary Fund (IMF) gave the world its starkest warning to date: the next recession is just over the horizon, and the world is “dangerously unprepared” for it.

We can understand that after decades of Quantitative Easing, central banks may not have enough ammo to counter a recession should one come anytime soon. Hence, the US Federal Reserve is aggressively slashing its balance sheet.

But why are the IMF and a small minority of financial institutions still forecasting a global recession to hit sometime between 2019 and 2020?

It doesn’t seem to make sense given the most recent unemployment report and the evident strength of the US economy.

Simply put, you can’t see what’s on the horizon if your view is myopic. It doesn’t matter how long or hard you stare.

The December unemployment report provides critical data on recent history, but a deeper view of history shows us many things that the December unemployment report cannot.

History has shown that when the unemployment rate falls below 4%, GDP takes a dive and recessions follow shortly thereafter.

An unemployment rate below 4% might be a current sign of a relatively healthy economy, but even the healthiest of economies undergo business cycles--meaning ups...and downs.

Therefore, it’s no reason for celebration; rather, it’s a signal to exercise prudence.

|

Year |

Unemployment Rate |

Following Cycle |

|

1929 |

3.2% |

Great Depression 1930 |

|

1943-1944 |

1.9% and 1.2% |

Recession in 1945 |

|

1947 |

3.9% |

Recession in 1949 |

|

1952 |

2.7% |

Recession in 1954 |

|

1966-1969 |

3.62% average |

Recession in 1970 |

|

2000 |

3.9% |

Recession in 2001 |

|

2018 |

3.9% |

??? |

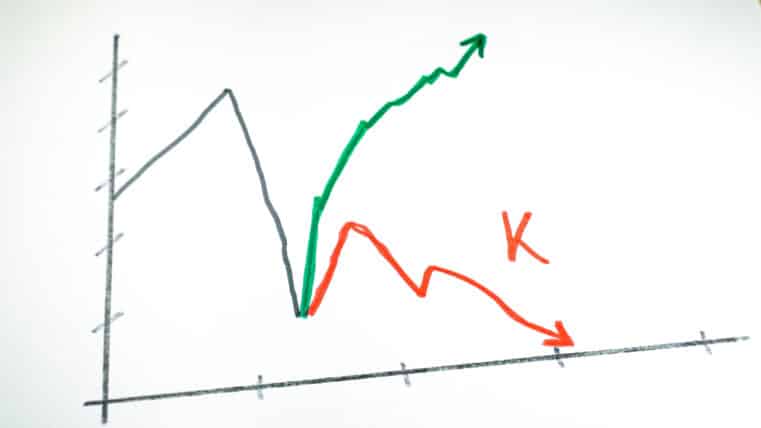

Historically, declines in the unemployment rate below 4% often correlate with the highest expansion phase of a market cycle...an expansion that typically ends in a recession.

If you’re not convinced, check out the data yourself. We can’t say for sure whether this correlation has anything to do with causality, but it is an indication of a pattern that has always repeated itself.

Not all recessions are preceded by a -4% drop in the unemployment rate. But when the unemployment rate drops below 4%, a recession tends to follow within the next year or two.

Bear in mind that extremely low unemployment is often associated with an overheating economy.

And right now, the official US unemployment rate stands at 3.9%.

How does the Fed cool down an overheating economy? It raises interest rates.

Hardly had there ever been a “soft landing” when the Fed slammed the brakes.

We know that Powell is taking a more flexible, “accommodative” or gradualist approach to hiking rates, but the fact remains that the Fed aims to unload their balance sheet to the tune of $50 Billion a month.

That’s more than an accommodative series of rate hikes. It’s enough to choke off the market’s expansionary momentum.

And this balance sheet shrinkage, according to Powell, is on “autopilot,” a comment that set the markets tumbling on the day of the announcement.

A few days later, if you remember, Powell changed his tone, stating that the Fed is “listening carefully” to the markets, implying a potential halt to rate hikes, “if needed.”

The Dow Jones then rallied 400 points after Powell’s remarks (markets are fickle).

So will the Fed ever truly “normalize” their balance sheet? Either way, it doesn’t matter.

If the Fed does, interest rates will rise and equities will fall.

If the Fed doesn’t, there still may not be enough momentum going, and when the recession finally hits, the Fed will not have enough ammo to prop up the markets.

What might this mean for the average investor?

It’s time to hedge a portion of your assets with sound money. It’s your best insurance against the uncertainties that befall the markets and the economy.