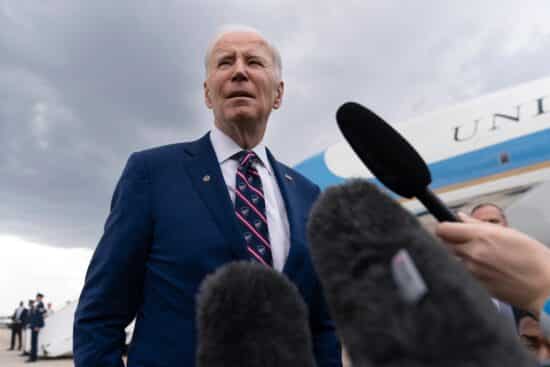

Sanctions Fail Spectacularly: Russia’s $14 Billion Oil Windfall

BRICS member Russia’s revenue in the oil and gas sector to double in April 2024 despite the US pressing economic sanctions. Russia bypassed US sanctions by selling oil at discounted prices to other trade allies since 2022. Saudi Arabia procured oil at discounted rates from Russia and laundered it all across Europe last year. The move helped the country to balance its economy and stay afloat despite sanctions from the White House.

In addition, BRICS member India was on an oil buying spree from Russia and saved $7 billion in exchange rates. China is relentlessly buying oil from Russia at cheaper prices and settling trade in the Chinese Yuan. The development indicates that the US sanctions have done little to nothing to hamper Russia’s economy. Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade.

BRICS: Russia To Pocket $14 Billion, Will Double Its Oil & Gas Revenue in April 2024

The latest report from Reuters estimates that BRICS member Russia will double its oil and gas revenue in April 2024. Russia’s oil revenue in April 2023 stood at $7 billion and will reach $14 billion this month, pocketing 100% gains. Many other developing countries are procuring Russian oil at cheaper prices using local currencies and not the US dollar.

Developing countries are making use of the sanctions by settling oil trade in local currencies to strengthen their native economies. Therefore, developing nations are mostly benefitting from the sanctions as their local currencies are being traded for oil.

“For 2024 as a whole, the government has budgeted for federal revenue of 11.5 trillion roubles from oil and gas sales, up 30% from 2023 and reversing that year’s 24% decline owing to weaker oil prices and sanctions-hit gas exports,” read the report.

This article originally appeared on Watcher.Guru

sign up for the newsletter

By signing up, you agree to our Privacy Policy and Terms of Use, and agree to receive content that may sometimes include advertisements. You may opt out at any time.