Silver Crash Exposes the Calm Before the Financial Surveillance Storm

The Silver Smash: What Just Happened?

Silver plunged a staggering 27% in a single day, falling to $83. Gold followed with an 11% drop. For many, this felt catastrophic. But let’s be brutally honest: this kind of correction was overdue.

Metals surged rapidly over the past 18 months. When assets run too hot, they pull back—and hard. But context matters. Even after this correction, precious metals remain significantly elevated from their prior lows. That’s not a crisis. That’s a discount in an ongoing bull market.

Don’t Let Recency Bias Blind You

We’ve all been there: your portfolio hits a high-water mark and anything less feels like failure. But today’s dip is tomorrow’s opportunity. If someone had told you last year that silver would be trading at $83, would you have believed them? Would you have called that a disaster?

This is the psychology of investing, and it’s weaponized daily by Wall Street and Washington to keep retail investors in a fog of fear and reaction. But not here. We’re grounded in macro reality, and the fundamentals haven’t changed.

The Real Story Behind the Correction

The financial media is blaming the drop on President Trump’s new pick for Fed Chair, Kevin Warsh, a supposed hawk replacing the anticipated dove Rick Rieder. That’s a convenient narrative. But it’s irrelevant noise.

Here’s the truth: no matter who runs the Fed, money will be printed in the next crisis. Stimulus checks. Infrastructure boondoggles. Massive deficits. All backstopped by Fed debt monetization—digital dollars created out of thin air to prop up a failing system.

This isn’t about leadership style. It’s about monetary addiction—and they’re not getting clean.

JPMorgan’s $8,000 Gold Forecast: Why It Matters

This week, JPMorgan stunned Wall Street by putting an $8,000 price target on gold by the end of the 2020s. Their math? If private investors increase their gold allocation from 3% to just 4.6%, gold explodes.

Let that sink in: a minor portfolio shift triggers a 40%+ upside in gold.

This aligns with what we’ve been saying for years. The global economy is bloated with debt and overflowing with fiat capital. That wealth is now looking for real stores of value—and precious metals remain the last bastion of untraceable, uninflatable financial security.

Global Wealth Is Fueling the Fire

U.S. household wealth has more than doubled since 2010. China’s households, with a 40% savings rate, are rapidly accumulating gold and silver. These are not fringe speculators—these are savers looking for safety in a world gone mad.

In previous bull markets, Western central banks controlled the narrative. Not anymore. The East is awake. The West is broke. And hard assets are once again king.

This Isn’t Over. It’s Just the Eye of the Storm.

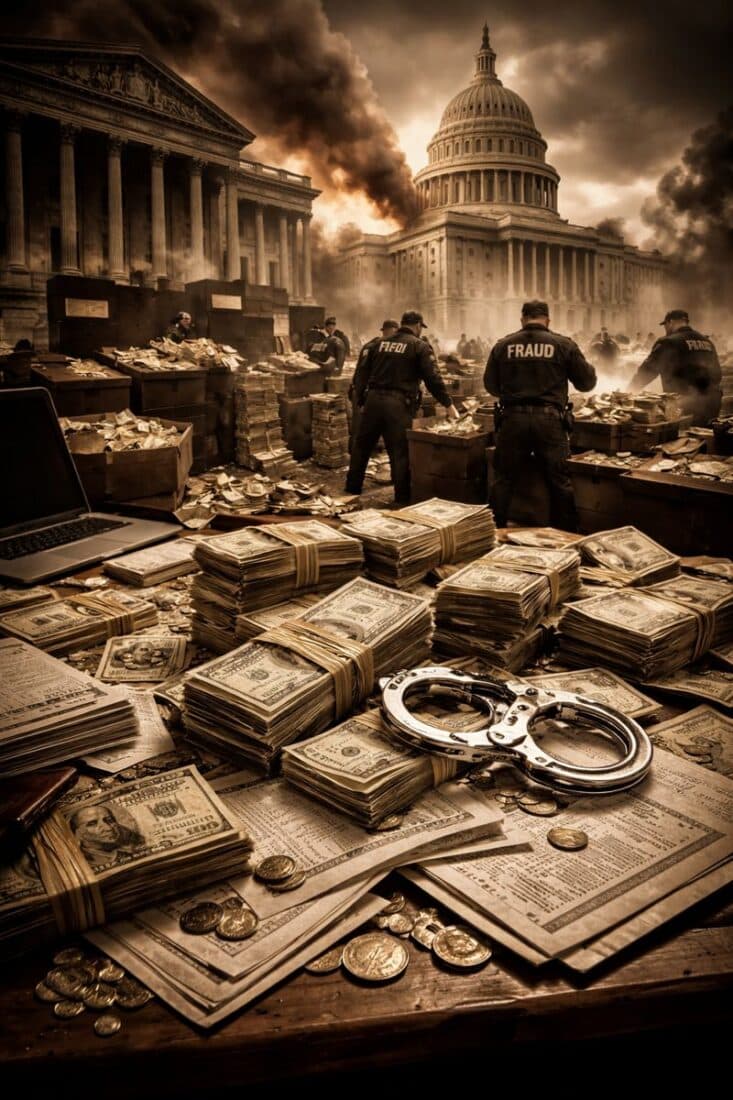

We’re not just watching a correction—we’re watching the recalibration of global finance. Every policy out of the Fed, every line of new debt from Congress, every move toward digital IDs and CBDCs is part of a wider strategy: consolidate control and eliminate privacy.

The crash in metals is temporary. The rise of programmable currency, FedNow transaction monitoring, and state-sanctioned financial surveillance is not.

Which is why I tell readers again and again: own gold, own silver, hold it outside the system.

Final Thoughts: Buy the Dip, Before They Lock the Door

This dip is your warning. The dollar is being digitized. The surveillance state is expanding. And the financial elite are already repositioning. You should be too.

I’ll leave you with this: in the coming digital dollar regime, your transactions will be programmable, taxable, and censorable. That’s not paranoia. That’s policy.

So don’t just watch the metals markets. Act.

Your Next Move: Download the Digital Dollar Reset Guide

If you see the writing on the wall—central bank digital currencies, financial surveillance, and capital controls—then you need a survival plan.

Bill Brocius has laid it all out in his Digital Dollar Reset Guide—the blueprint for defending your wealth before the next wave of monetary tyranny hits.

Download it now: Digital Dollar Reset Guide by Bill Brocius

Because when they flip the switch, you won’t get a second chance.