Student Loan Defaults Signal Credit Collapse: $18.6 Trillion Debt Bomb Ready to Detonate

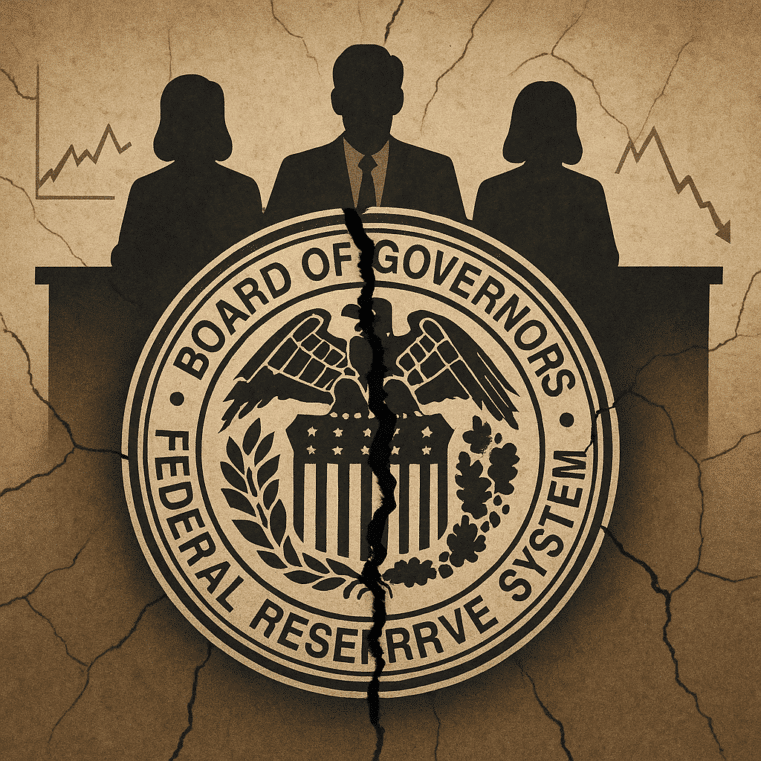

The Federal Reserve's latest Household Debt and Credit Report should strike terror into the heart of anyone still tethered to the illusion that this system is stable. Household debt has surged to $18.59 trillion—a record—and the bureaucrats are trotting out phrases like “resilient housing market” and “stable delinquency rates” to keep the sheep calm. But if you scrape away the PR gloss, the picture is unmistakable: America is defaulting, slowly, quietly, and irreversibly.

Let’s be clear: $5.1 trillion in non-housing debt—that’s student loans, credit cards, and auto loans—is where the real carnage is brewing. Credit card delinquencies just hit 12.41%, the highest since 2011, and serious student loan delinquencies are now 9.4%, with a disturbing 20% of student loans held by Americans over 50 either in default or circling the drain.

This isn’t just a financial story. It’s a human crisis, and it’s about to become a political one.

The Great Student Loan Mirage Has Shattered

Let’s start with the bombshell: Student loans that were artificially frozen and hidden from credit reports for nearly four years are now slamming back onto balance sheets like a tsunami. Anyone who thought this “pause” was debt forgiveness was badly mistaken. What it really was? A time bomb.

According to the New York Fed, missed federal student loan payments from 2020 to 2024—yes, an entire class of defaults—are now being reported. That’s not just a statistical catch-up; it’s a psychological shock. Millions of Americans are waking up to find their creditworthiness incinerated.

Default rates among borrowers over 50 have exploded. These are not fresh graduates still trying to get their footing. These are middle-aged Americans who will never pay this debt off—ever. Their earning years are behind them. Their safety net is gone. Their credit is shredded. And what happens when you default? You’re locked out of the system. No loans. No homes. No second chances.

So, let’s call it what it is: a deliberate generational trap.

The Banks Know What’s Coming

Credit card balances rose $24 billion last quarter, now sitting at $1.23 trillion—a level not seen since the eve of the last financial crisis. Auto loan balances remain frozen at $1.66 trillion, not because Americans are suddenly conservative, but because their credit lines are drying up. The system is freezing before the collapse.

And look at the real tell: Aggregate limits on credit card accounts rose by $94 billion. Translation? Banks are giving you more rope to hang yourself with—right before they cut the trapdoor. This is the same playbook from 2007. Extend credit. Collect interest. Cut the lifeline. Seize the assets.

This isn't a bug in the system. It's the design.

Mortgage “Stability”? Don’t Bet on It

The New York Fed is proudly touting low mortgage delinquency rates—0.83%—as a sign of strength. But as anyone who's lived through the 2008 collapse knows, housing markets break all at once, not gradually. When they say “ample home equity” is keeping things afloat, what they really mean is: homeowners are sitting on assets priced by fantasy, not fundamentals.

Once delinquencies climb—once job losses tick up—a liquidation cycle begins. Homes flood the market. Prices fall. Equity vanishes. Defaults spike. And banks do what they always do: tighten credit, foreclose, and leave families homeless.

New York City is already seeing property liquidation on a massive scale, and let’s not ignore the political climate: NYC is now run by a dyed-in-the-wool socialist who has no intention of protecting private property rights. What starts in cities will cascade into suburbs. The avalanche is forming.

The Endgame: A Controlled Financial Burn

Consumer bankruptcies jumped to 141,600 in Q3—the highest since the COVID crash. That’s not an anomaly. That’s a signal flare. The Fed knows the economy is being propped up by debt-fueled consumption. But as defaults and bankruptcies rise, they’ll use that as the excuse to “intervene.”

What form will that intervention take?

- More QE.

- More surveillance.

- CBDCs (Central Bank Digital Currencies) disguised as aid.

- And finally: capital controls.

This isn’t speculation. This is the trajectory we’ve been warning you about for years.

What You Can Do While the System Cannibalizes Itself

Bill Brocius saw this coming. In his book, End of Banking As You Know It, he lays out how this system is engineered to fail—and how you can get out before the net tightens.

If you’re holding wealth in fiat, if you’re trusting a banking system whose only real plan is your obedience, you are playing a rigged game. Now is the time to shift into tangible assets—gold, silver, real crypto (not ETFs and IOUs), and to divorce yourself from the banking system as much as possible.

Start with Bill’s free report: 7 Steps to Protect Your Account from Bank Failure. It will walk you through how to set up parallel systems before your bank locks you out of your own money.

And if you want cutting-edge insights that don’t make it into the mainstream? Join Bill’s Inner Circle for just $19.95/month. That gets you unfiltered access to the best mind in financial journalism, period.

You don’t fix a house that’s already burning. You get out. You find shelter. You protect your wealth.

Start here:

📘 End of Banking As You Know It by Bill Brocius

📥 Download the 7-Step Bank Protection Guide