The Bull Market is Dead and Roaring Kitty May Have Killed It

My intuition is telling me this is it. This is the end of the bull market.

Before I get into my reasoning, I want to remind my readers that this is not financial advice, and I have been wrong about the market being overdue for a pullback over the last 2 1/2 years since interest rates have started to rise.

About a year ago, I corrected myself and began a series of mea culpas, explaining that it was my timing that was off, but also that I still believed the mathematics of 5.5% interest rates were all but a guarantee that the market and other financial assets, including things like real estate and commodities, at some point would have to deflate.

I didn’t set out this past weekend with premeditated intentions of writing an article about why I think the market has peaked for the time being. Rather, it was a string of events that took place over the last 48 to 72 hours that have my spider senses tingling.

I think the shark has been jumped, the tab has come due, and the American consumer, as well as the retail investor, are completely exasperated, out of options, and out of ideas. Here’s my reasoning.

It was just a day or two ago that I wrote about Nvidia and why I thought it had become a disproportionately large risk to the overall market. The stock now represents 6.5% of the S&P 500, an astronomical amount for one name to make up a 500-name index, and appears to be hitting peak levels of hysteria, as evidenced by CEO Jensen Huang signing autographs on the breasts of women at computer shows.

On top of Nvidia's mind-numbing S&P concentration, single-handedly driving broader market moves, I raised the question of whether or not the growth that the market expects from the company could be far overshooting the company's actual trajectory in years to come, despite the fact that artificial intelligence will likely remain in a secular bull market for years to come.

No sooner did I publish that article than all eyes turned to “Roaring Kitty” on Friday.

For those unfamiliar with Roaring Kitty, also known as Keith Gill, he is the man that stoked the flames of excitement with GameStop’s astronomical short squeeze higher some years back, and the man who profited the most handsomely — about $40 million to $50 million in the first run up — as a result.

He has become somewhat of a legend among retail investors and saw his fellowship increase exponentially in the days, weeks, months, and years after the initial GameStop squeeze higher. They even made a movie out of his story, called Dumb Money, with Paul Dano in the starring role.

At this blog and at QTR central, we have no beef with Gill. I though the movie Dumb Money was great and I generally find any type of anomaly in the system that temporarily shifts the power back to the people interesting (hence my curiosity around bitcoin). And I generally root for any story that takes away from Cathie Wood’s CNBC airtime.

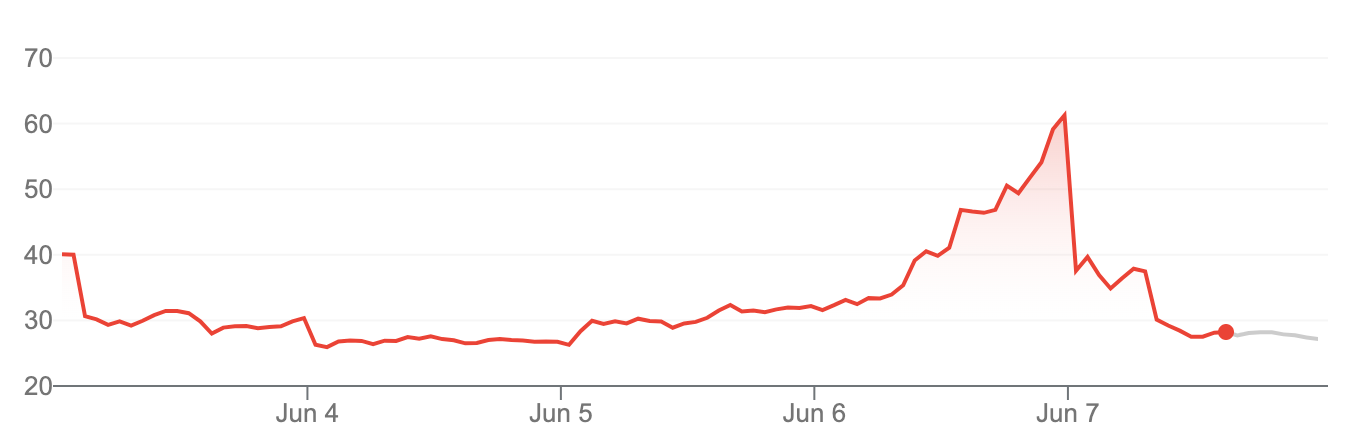

GameStop stock has been bubbling higher over the last couple of weeks, making retail investors wonder whether a repeat of history—and subsequently their chance of getting rich—is possible again. Hell, on Thursday night last week, GameStop shares had reached all the way into the $60 range before it was announced Friday morning that the company would be selling stock to raise cash at the company’s inflated prices.

As usual, price becomes a rationing mechanism, and GameStop is getting the deal of the century by selling into this retail euphoria. The company added more supply to the market and GameStop wound up finishing the day on Friday at $28.

But the last few runs up in GameStop haven’t stopped roaring Kitty from taking what used to be around a $50 million bankroll and parlaying it into what appears to be a nearly quarter-of-a-billion-dollar bankroll.

It’s difficult to try and figure out how he could have amassed such wealth without trading in the name after recently reactivating himself on his Twitter account and posting this Tweet-gone-round-the-world.

One thing driving the euphoria in GameStop shares heading into Friday was the expectation that Gill might do something crazy on his live stream. Would he come out and buy another couple million shares live? Would he introduce some grand plan that would help shares skyrocket even higher and punish shorts even further? Is it possible he would exercise his options live on the air, leading to the entire stock market breaking? People were waiting with bated breath to see what his plan was.

But while everybody was waiting for Gill to answer this question, reality was already setting in with GameStop shares. The company’s issuance of new stock was diluting existing investors and making it more difficult for the stock to move higher.

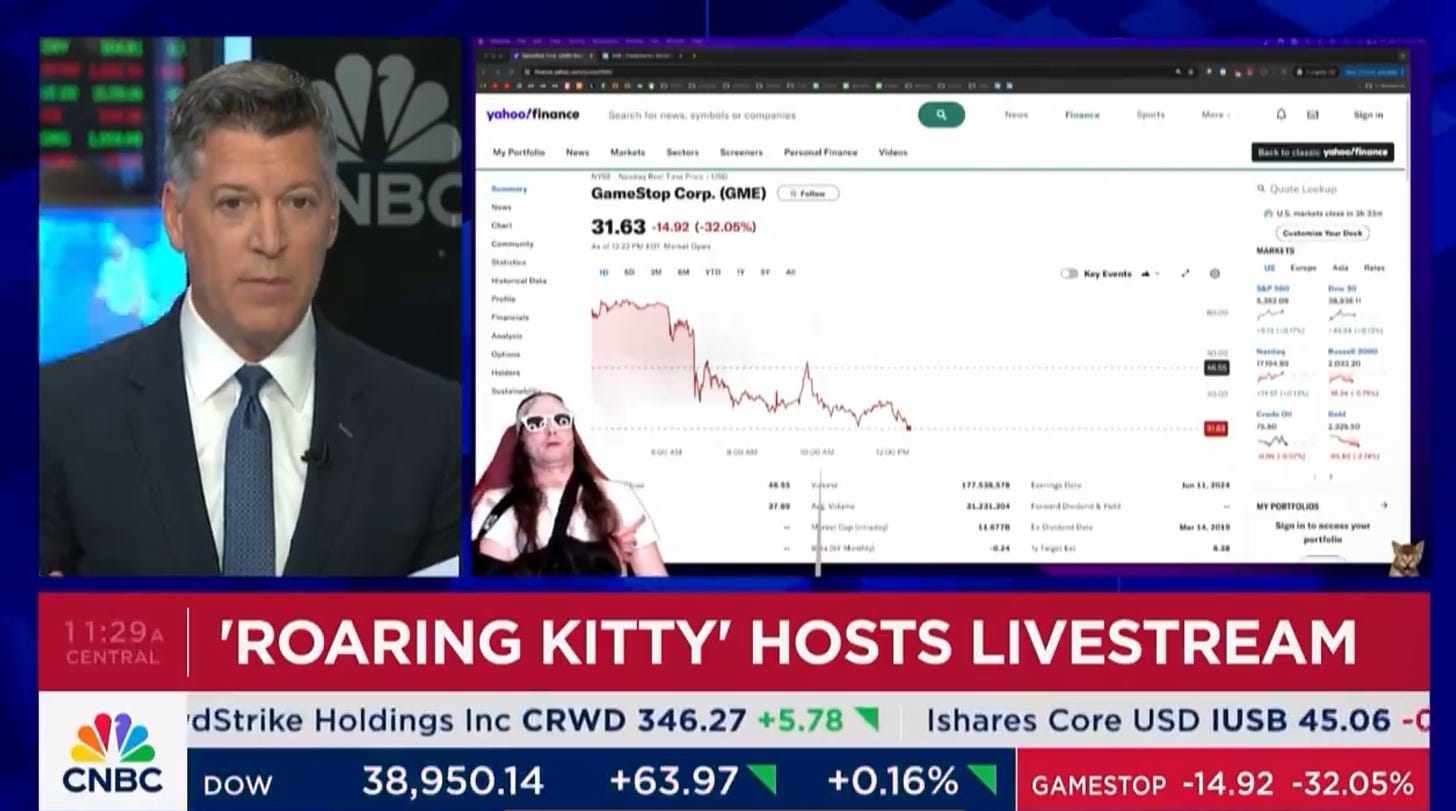

As the stock percolated around the $30 to $35 level before the live stream began, a queue of interested investors, analysts, and market participants lined up to see what Gill had to say. By the time he went live at about 12:20 Eastern time on Friday, there were over 600,000 people watching his live stream.

The format was reminiscent of the original live stream Gill used to do before the first GameStop run-up: the screen was structured in the same way, he poured himself a beer, he gave everybody a look at his portfolio holdings, and he ran back a half-assed thesis on why he thinks GameStop could turn around its business for the long term.

It was what he didn’t do that made his appearance a "sell the news" event. He didn’t say anything unexpected, he didn’t offer up a war cry or a price target, nor did he reveal some intricate trickery to try to further stick it to “the man” in the hedge fund industry. The appearance was devoid of hype, devoid of actual analysis, and uninteresting enough that the number of live viewers started to dwindle as quickly as 10 or 20 minutes into it.

I’m not saying there won’t be an audience for Gill in the future, because there will be. And chances are, it’ll always be a multiple of my outreach. His stream sits at the intersection of the stock market, the roulette table, a late night Mountain Dew fueled Dungeons and Dragons game and the underdog plots of the movies Rudy and Rocky combined. And there’s always going to be an audience for that.

But there was something about watching the number of viewers on his stream dwindle in real-time that caused a thought to wash over me with a calm resolve as though I had been a Buddhist monk in seclusion, meditating about it for years:

“If this isn’t the absolute peak of this market cycle, I don’t know what is.”

Leading into the stream, I was taken back by how 600,000 people could be watching.

The enormity of the number of people tuning in to watch somebody host their own version of stock-market-ComicCon was fascinating to me.

On one hand, I loved it because it was probably 10 times the amount of viewership CNBC got at any point during the day Friday, which furthers my long-held belief that the mainstream financial media is generally useless and can be easily replaced, but on the other, I started to wonder if this could be the biggest "sell the news" event in retail investor history.

If one wanted to generalize and put a bow on the retail investor base from this most recent market cycle, there would be no better way to do it than the people that hang out on r/WallStreetBets.

The Reddit crowd and the people who started the meme stock frenzy are the quintessential examples of the everyday investor for this particular market cycle. And, frankly, they’re outright amusing: they have a gripe with “the man”, they love a good underdog story, they’re slightly less informed than they probably should be but are doing their damndest to learn, they ridicule the industry’s norms and they’re self-deprecating — all of which, the last two especially, make them tough for me to hate.

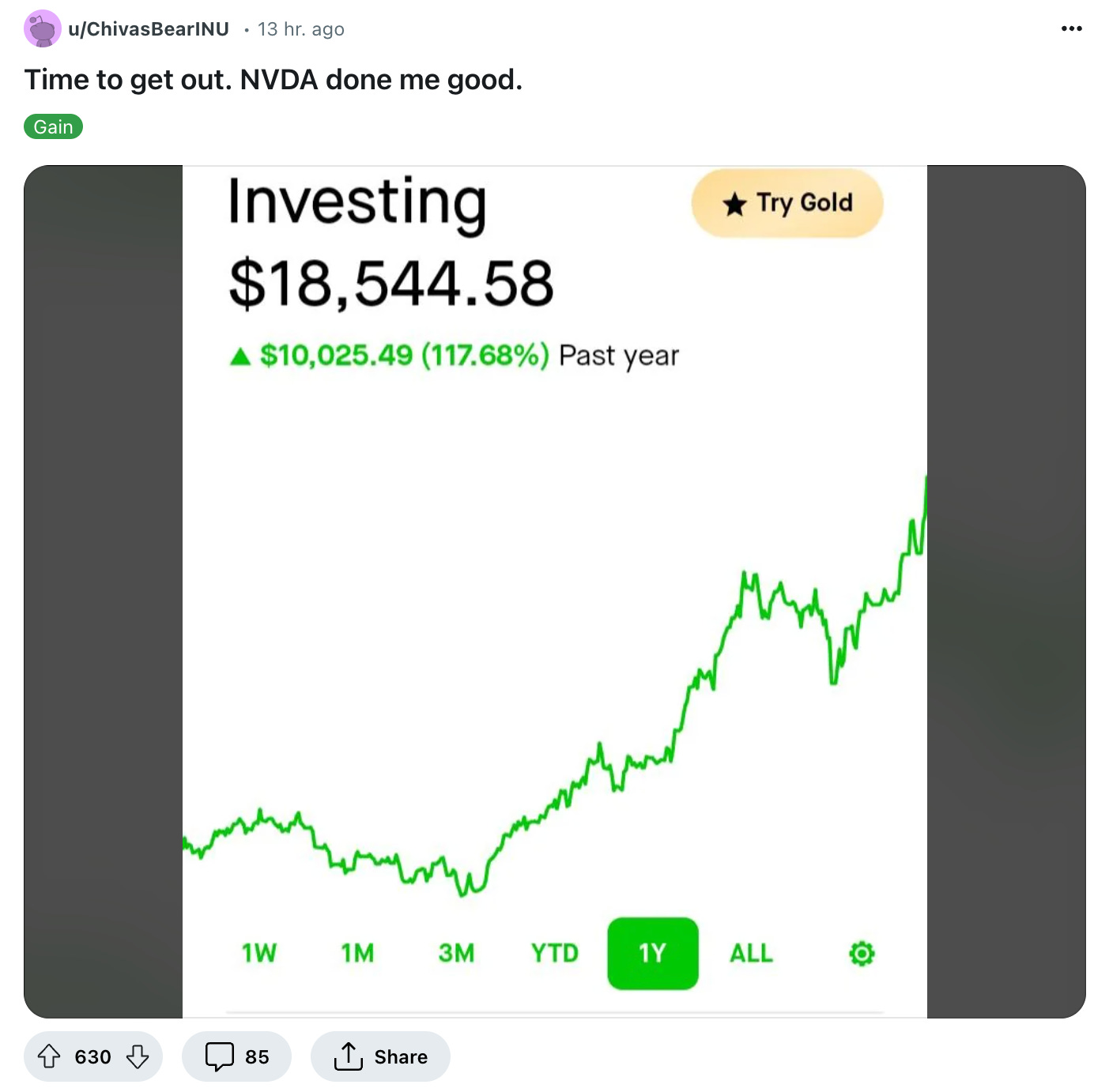

But they’re still arguably the lowest rung of retail money on the Wall Street totem pole — a designation I’m sure they’d embrace.

I’m not trying to poke fun at them in the slightest, but only to make the objective point that its fair to think that once they have fired their last bullets or have psychologically capitulated, we could be seeing this lowest rung of market investors lead the charge of others out of the market. Once the necessity of raising cash and de-leveraging starts, it has a tendency to snowball as price pressure comes in. First it’s the meme stocks — and then its very easy to see how it can move to more serious names like Nvidia, which, again, I’ve said is basically the entire S&P 500. Here’s a post from r/WallStreetBets this weekend:

Now, multiply that by a couple million investors who just got trounced by GameStop to end last week.

I couldn’t quite put my finger on what felt different about this last GameStop run-up, but now I know.

While the first squeeze higher in the name was fueled by a tidal wave of excess liquidity and downtime as a result of the Covid pandemic, the latest run-up felt like one last desperate attempt to chase losses.

While the first run-up felt like it may have been motivated to make some type of statement against Wall Street, however misguided, this second run-up feels like the sole purpose is to try for everybody to repeat the rare success that Gill himself had during the first run-up.

This time around, it feels as though hundreds of thousands, or millions, of retail investors are simply hoping that history will repeat itself and they will be positioned at the right place at the right time for one last bite of the apple.

Put simply, as is the case when trying to relive any great moments of days past, it simply isn’t the same the second time around.

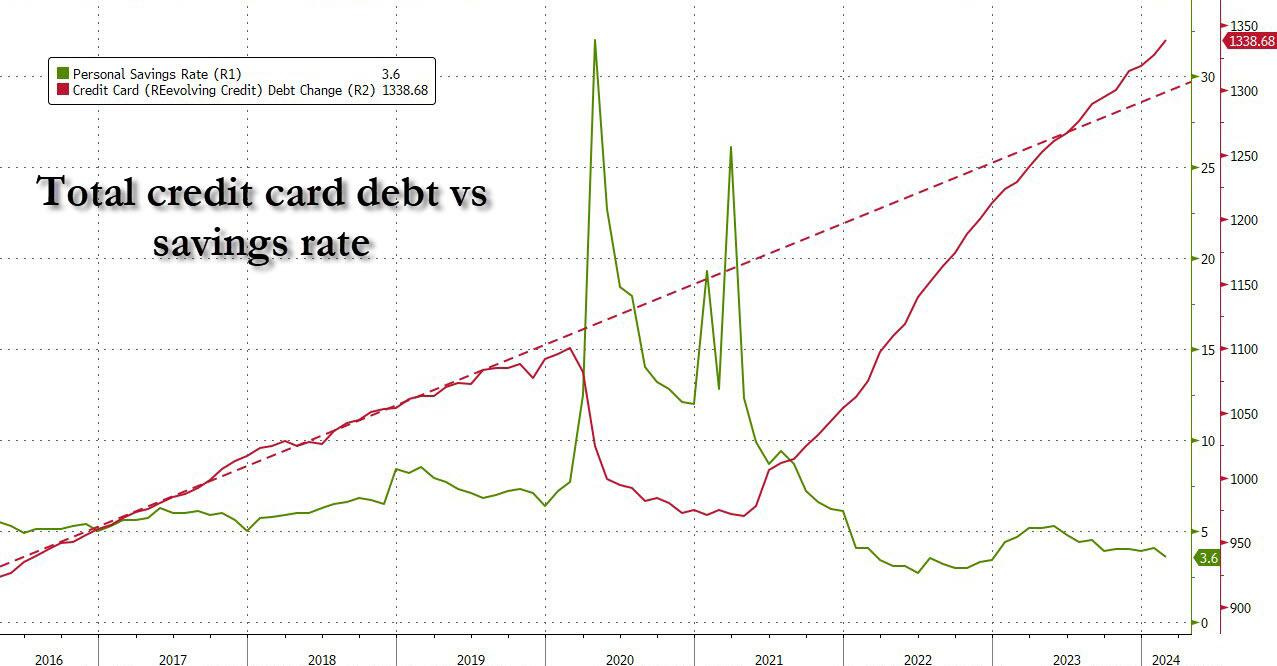

And in the wreckage of the failed experiment this time around, people are not going to be replete and flush with cash like they were at the end of Covid. As I have consistently pointed out on this blog, consumer credit and personal savings metrics look nothing short of atrocious, with consumer credit ballooning to all-time highs and personal savings hitting lows.

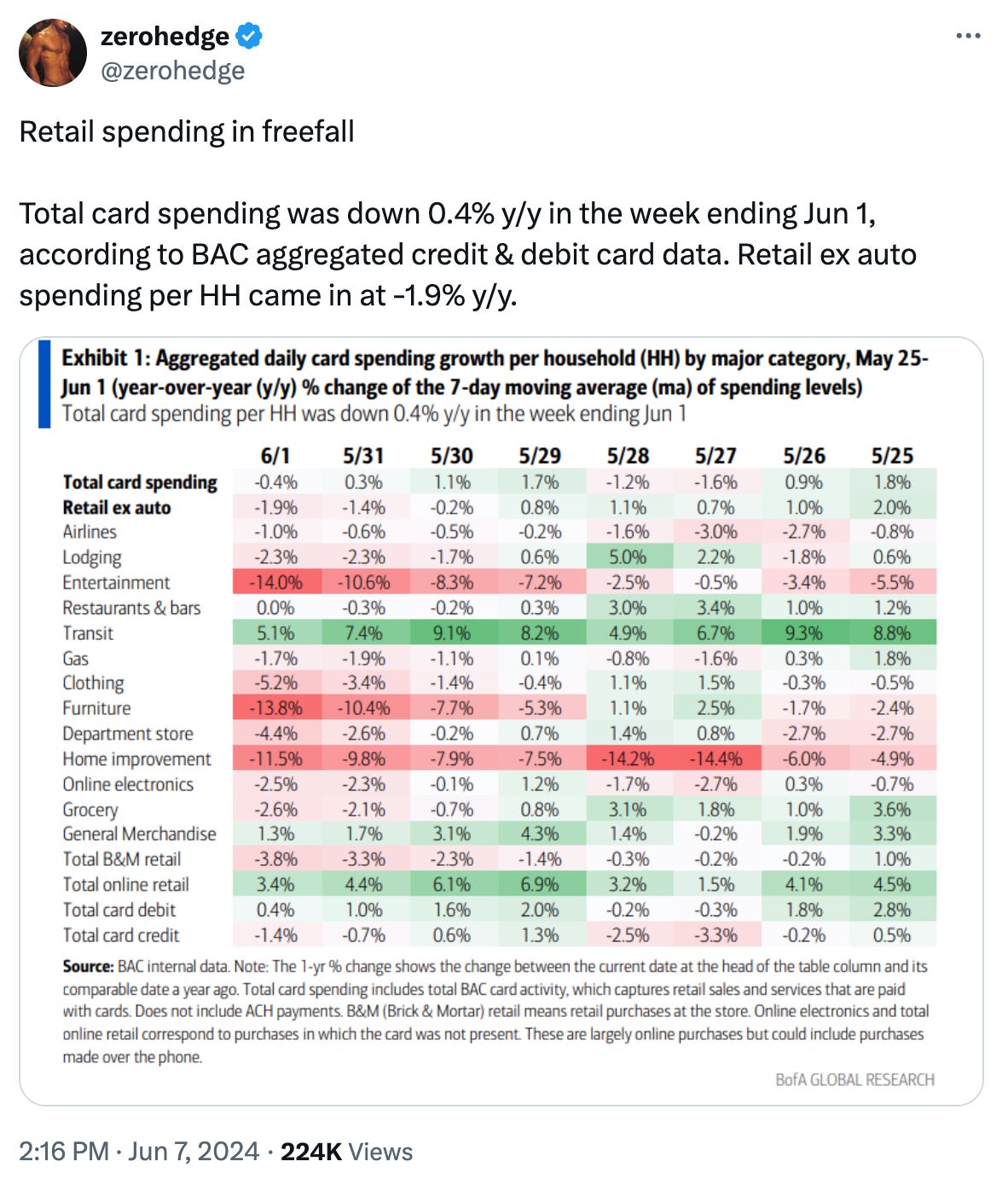

Source: Zero Hedge

And as this below chart about retail sales indicates, the American consumer is simply tapped out.

There is a huge difference between taking a wildcard shot on GameStop and still having a job or savings to fall back on and firing your last bullets of desperation with literally no other plan and no other option for replacing the capital destroyed as a result.

The entire idea that short sellers were repressing the company to begin with and that manipulating GameStop stock higher was somehow going to save the company was partially misguided to begin with. Now, in order for GameStop to save itself as a result of its ballooning stock price, it has to issue shares and dilute holders.

The more shares it issues, the tougher the squeeze becomes, and it soon becomes very clear that “investors” following Roaring Kitty now are one half of a Chinese finger trap that, at some point, they’re not going to be able to get out of.

I can’t predict what’s going to happen to GameStop over the next few weeks: maybe we do some type of repeat of history, maybe Roaring Kitty becomes a billionaire. But extrapolated over a longer period of time than a couple weeks, reality, mathematics, and the macroeconomic environment are going to take hold and eventual gains for those who hold will, in my opinion, be limited.

There’s always ways out of bear markets. It used to just be recession and then eventual growth in productivity. Nowadays it’s excessive money printing. I’m not saying we’re heading into a Great Depression that will last decades. But its foolish to think there won’t be any rough road ahead for markets. And Friday’s fiasco was a warning sign, in my opinion.

In fact, Friday was a shining beacon at the very peak of the mountaintop for the market if you ask me. What better way to justify attempting to call a short-term market top than watching those who can least afford it shell out what little cash they have left? When you combine this with the backdrop of pure euphoria in Nvidia, the one stock that is seemingly driving the market by itself, combined with lackluster retail sales data, rising delinquencies, defaults, supply and demand in the housing market starting to rebalance, and the fact that any cuts to rates to “save” a crash will likely take 18 to 24 months to work their way through the system – you have, in my opinion, the best case yet for arguing the worst is yet to come.

This article originally appeared on Zero Hedge