The Global Elite Misread Trumponomics — And It’s Exposing Their Economic House of Cards

The Real Market Isn’t Fragile — It’s Adaptive

Let’s be clear about one thing — this isn’t a defense of Trump the man. This is about Trump the phenomenon. A spanner thrown into the gears of global economic orthodoxy. And what happened when he did it? Nothing collapsed. Despite the IMF’s whining and the Fed’s hand-wringing, the U.S. didn’t spiral into a recession when tariffs were slapped on. The global economy didn't detonate. Why?

Because markets — real markets, not the ones cooked up by economists in DC boardrooms — don’t behave like fragile ecosystems. They adapt. People adjust. Prices move over time, not overnight. Producers find workarounds. Consumers shift their habits. Margins flex. And the sky doesn’t fall just because a Goldman Sachs analyst thinks it should.

Elites Cling to Control While the Market Moves On

The so-called “experts” overestimated their models and underestimated the resilience of people navigating commerce in the real world. They assumed tariffs would instantly ignite inflation and stifle trade. Instead, what we got was a staggered, seasonal recalibration. Why? Because most companies don’t — and can’t — just jack up prices on a whim. There are pricing cycles. Contracts. Competition. Market pressure. You know, capitalism.

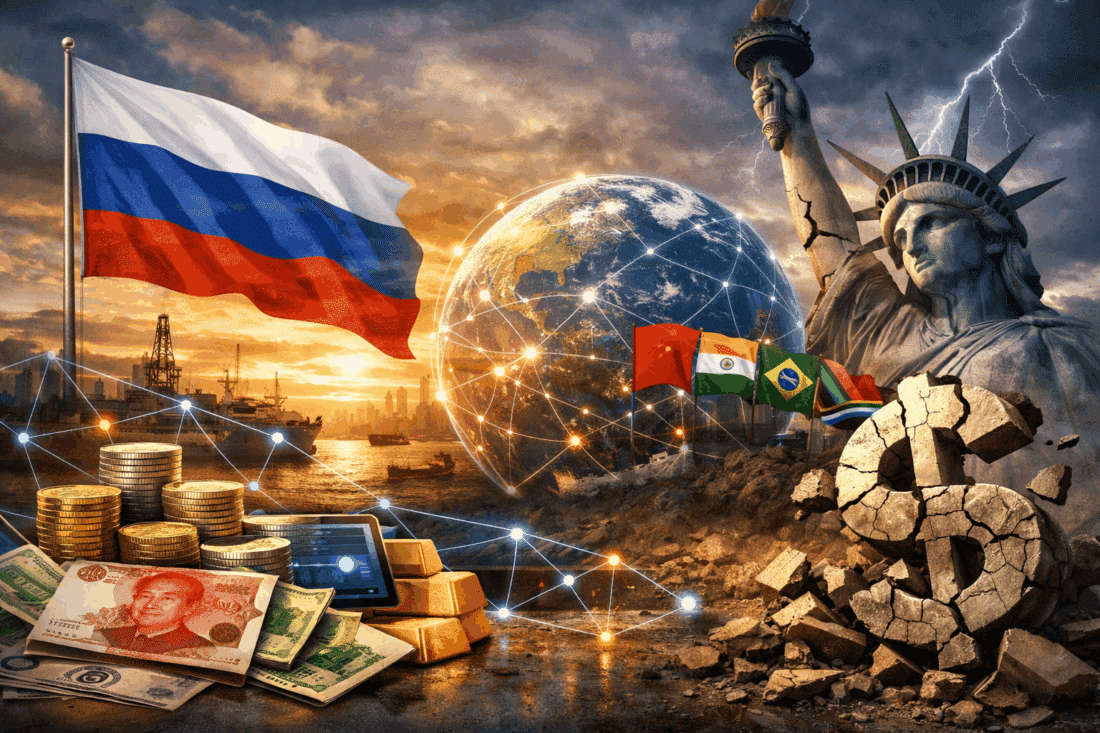

This revelation — that the economy didn’t collapse under “Trumponomics” — exposes a deeper truth: the globalist economic model is based on centralized assumptions and top-down controls that don’t reflect reality. For decades, we were told that global interdependence and open trade without friction were the keys to prosperity. But the minute that order was disrupted — by tariffs, by a populist president, by economic nationalism — the machine kept humming.

The Real Threat Was Never Tariffs — It Was Uncertainty

That’s not an accident. It’s a signal that maybe, just maybe, the free market works better without constant management by central planners and global committees with three-letter acronyms.

But here’s the kicker: even though tariffs didn’t break the economy, they did trigger something the elites really hate — uncertainty. Not uncertainty for you, the average worker. But for them — the hedge fund parasites, the think tank parasites, the policy wonks whose careers depend on the illusion of control. Trump’s approach to trade, erratic as it was, pulled the rug from under these people. It reminded them that real power lies in unpredictability — not rigid, technocratic forecasting.

And now, in classic fashion, they’re backpedaling. The IMF director herself is quoted saying the “trade war didn’t really happen.” That’s the elite way of saying: “We didn’t get the response we were hoping for, so we’ll pretend it didn’t exist.”

The Cost Is Real — But Not Where They’re Looking

Meanwhile, the labor market is softening. Firms are defending their margins. And the real costs of economic adjustment — not visible on CNN or in IMF charts — are showing up in layoffs, wage stagnation, and offshoring. But don’t worry, they’ll blame “AI disruption” next quarter and pretend tariffs had nothing to do with it. That’s the game.

What This Really Proves

So what can we learn from this mess?

That top-down economic planning is a confidence scam. That the economy — when left even partially to its own devices — tends to sort itself out far better than when it’s micromanaged by PhDs with tenure and an allergy to market volatility. And that the globalist class isn't scared of economic downturns — they're scared of losing control over the narrative and the system they built to keep you compliant.

Wake up. The next disruption might not be as soft as this one.

Take Action

Don’t wait for the next collapse to find you unprepared. Download Seven Steps to Protect Yourself from Bank Failure by Bill Brocius. This free guide lays out how to secure your assets before the next wave hits.

You’ve seen what happens when the experts lose control. Don’t let them take you down with them.