The Penny Is Dead — and So Is the Illusion of a Stable Dollar

The Death of the Penny Isn’t Just Sentimental—It’s Strategic

The U.S. Mint has officially stopped minting pennies after 232 years. On the surface, this looks like a practical decision: we have more than 300 billion pennies floating around, and producing each one costs more than it’s worth. But if you stop there, you’re missing the deeper threat. This isn’t just a cost issue. It’s a signpost—one more warning flare in the night sky—of where the global financial system is headed: full-spectrum digitization, centralization, and surveillance.

As Roger Stone rightly points out, a penny used to buy something. In fact, it once bought a mile of train travel. It helped fund social movements. It was part of everyday commerce in a way that reflected a time when the U.S. dollar actually held its value. Today, that same penny is economically meaningless—less than a rounding error in an inflationary economy. This is not a fluke. This is a feature of the system built by the Federal Reserve.

The Fed’s Fingerprints Are All Over This

Stone is correct to trace the destruction of the dollar back to 1913, when the Federal Reserve was created in secrecy at Jekyll Island. Since then, the U.S. dollar has lost over 95% of its purchasing power. And with every crisis—from the Great Depression to the Great Financial Crisis of 2008—the Fed’s role hasn’t been questioned. It’s been expanded.

In fact, the penny’s demise is just the latest consequence of the Fed’s mission creep. Their so-called “stabilization” policies—money printing, interest rate manipulation, and monetizing debt—have made small denominations obsolete. But the real danger isn’t just inflation. It’s the opportunity this decay creates for the system’s next phase: a Central Bank Digital Currency (CBDC).

CBDC: The Endgame

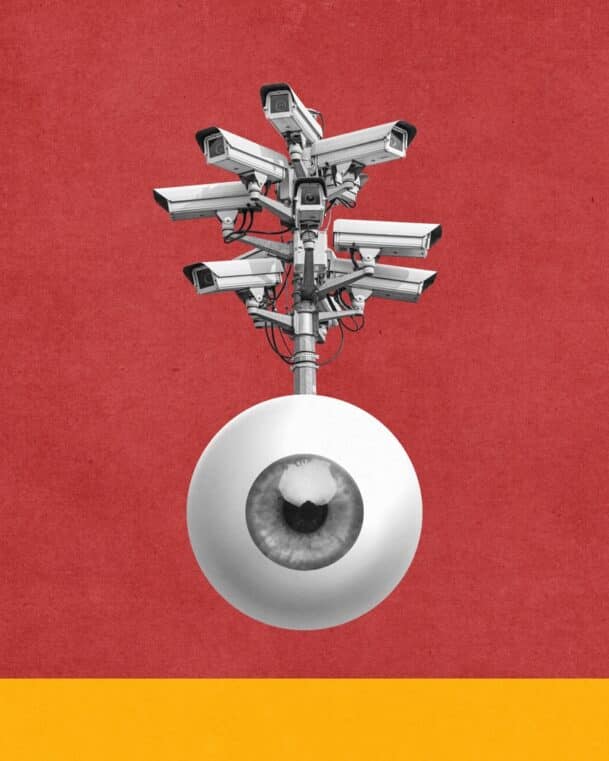

Stone’s core warning is one I’ve issued repeatedly: CBDCs are not about innovation. They’re about control.

The disappearance of coins like the penny is not a random event—it’s a strategic conditioning tool. Remove small denominations. Remove cash. Make digital payments “easier.” And then, once most of the population is onboard, flip the switch to a programmable, traceable digital dollar where every transaction is logged, analyzed, and potentially restricted.

This is not paranoia. The FedNow system is already being rolled out. CBDC pilot programs are underway. The IMF and Bank for International Settlements are openly discussing frameworks for global digital currencies. The infrastructure is being built while the public is distracted by "convenience."

Where I diverge from Stone is in the framing: invoking the “Mark of the Beast” may resonate with some readers, but it turns off others who see the looming CBDC threat through the lens of civil liberties, not theology. We need to keep the analysis sharp, fact-based, and urgent.

Be Wary of Misleading Stats

One error in Stone’s piece is worth noting: he claims a penny costs $3.69 to make. That’s off by a wide margin. The real number is closer to 2.7 cents. Still bad economics—but let’s not hand ammunition to skeptics by getting the math wrong. The truth is damning enough.

What Comes Next

The elimination of the penny isn’t just a budgetary decision. It’s a symbol of the vanishing power of the people to participate in commerce anonymously, affordably, and freely. As physical money disappears, so does financial sovereignty.

The move toward a cashless society, aided by technocratic tools like smartphones and biometric ID systems, sets the stage for an irreversible shift. If and when a CBDC is implemented, expect the following:

- Every transaction monitored.

- Accounts frozen based on “wrongthink” or social credit scores.

- Spending restricted based on government policy (climate, nutrition, etc.).

- Savings eroded by programmable expiration dates on your money.

This is not speculation. These features are already being tested abroad—in China, in Nigeria, and even in pilot programs in Europe.

Bottom Line

Stone is right on the big picture: the penny’s end is not something to celebrate. It is a red flag. It marks the latest step in a long journey away from sound money and toward digital authoritarianism.

But this doesn’t have to be the end of the story.

✅ Download my free eBook, “7 Steps to Protect Your Account from Bank Failure”

🛡️ Get my full blueprint in “The End of Banking As You Know It”—a must-read for anyone serious about protecting their wealth.

🔒 Join my Inner Circle for $19.95/month and get exclusive access to actionable insights, early warnings, and battle-tested strategies.

Don’t wait for the next coin to fall.

The death of the penny is a signal. The system is shifting.

Make sure you shift first—on your terms.