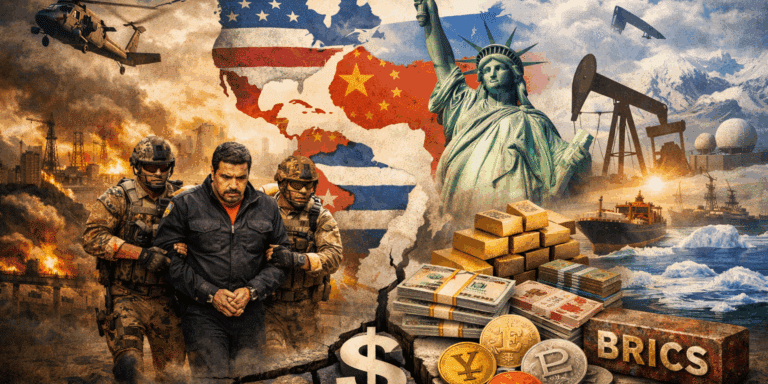

Trump’s Monroe Doctrine Revival: Will It Delay — or Accelerate — De‑Dollarization?

A Shock to the System: Maduro’s Capture and the Message It Sends

The removal of Nicolás Maduro was not just a regime-change operation. It was a statement of intent.

Operation Absolute Resolve demonstrated that the United States is once again willing to act unilaterally, decisively, and with overwhelming force inside the Western Hemisphere. Whether one supports or opposes the operation is almost beside the point. What matters is the signal it sent to allies and adversaries alike.

This was not Iraq. It was not Afghanistan. It was not a long, drawn-out nation‑building exercise. It was fast, targeted, and surgical. And it has clearly rattled governments from Havana to Brasília.

For years, Washington projected hesitation and exhaustion. That era appears to be over.

Cuba “Ready to Fall”: Symbolism Matters More Than Timelines

When President Trump says Cuba is “ready to fall,” he is not announcing an invasion or even threatening one. He is pointing to something far more important: structural dependency collapse.

For decades, Cuba survived not because of economic vitality, but because of external lifelines — particularly subsidized Venezuelan oil and deep security cooperation with Caracas. That arrangement is now broken.

What’s especially revealing is the admission that Cuban security forces were embedded at the highest levels of Venezuela’s regime, even guarding Maduro personally. The reported deaths of Cuban personnel during the operation expose how deeply intertwined these systems had become.

Cuba’s vulnerability is no longer ideological or hypothetical. It is financial, energy-based, and immediate.

The Monroe Doctrine Is Back — But This Time It’s Financial

President Trump has framed these actions as a revival of the Monroe Doctrine. Historically, that doctrine was about keeping European empires out of the Western Hemisphere.

Today, the doctrine has evolved. It is no longer just about flags and borders. It is about energy flows, trade settlement, currency dominance, and security corridors.

Venezuela holds the largest proven oil reserves on Earth. Control or influence over that production has enormous downstream consequences — not just for oil markets, but for how oil is priced and, critically, what currency is used to settle those trades.

This is where de‑dollarization readers should lean in.

Does This Strengthen the Dollar — or Put It at Risk?

At first glance, these developments appear dollar‑positive. Venezuela had increasingly sold oil to China using non‑dollar arrangements. U.S. involvement could re‑dollarize those flows. American energy firms may regain access to reserves once thought lost. Regional governments may think twice before openly challenging Washington.

But history rarely rewards raw power with long‑term monetary stability.

The paradox is this: the more aggressively dollar dominance is enforced, the more urgently others work to escape it.

Every use of sanctions, military pressure, or coercive leverage strengthens the case for parallel systems. It encourages bilateral trade, alternative settlement mechanisms, gold accumulation, and regional financial blocs. What looks like a restoration of order in the short term often becomes fragmentation over time.

Neocons vs. Libertarians: A Quiet Civil War on the Right

These developments also expose a deep and growing rift within the American right.

Neoconservatives see these actions as a long‑overdue return to strength. In their view, American dominance must be enforced, energy security requires intervention, and retreat guarantees decline.

Libertarian‑leaning Republicans and constitutional conservatives see something else entirely. They see foreign intervention as the seed of domestic expansion — larger government, deeper surveillance, higher debt, and eventually tighter controls on capital and commerce.

This is not an abstract philosophical dispute. It directly shapes how the financial system evolves at home.

Why Colombia and Greenland Matter More Than the Headlines Suggest

Trump’s comments about Colombia and Greenland may have sounded off‑the‑cuff, but they were not random.

Colombia sits at the crossroads of narcotics trafficking, regional stability, and U.S. enforcement policy. Any escalation there ties security policy directly to trade, banking, and sanctions enforcement.

Greenland, meanwhile, represents the future of Arctic shipping lanes, rare earth access, and military positioning against Russia and China. Control of geography increasingly means control of resources — and resources underpin currency power.

These are pressure points in a world shifting from globalization toward bloc‑based power systems.

And bloc‑based systems rarely coexist peacefully with a single, uncontested reserve currency.

The De‑Dollarization Reality: This Is Not a Straight Line

For readers focused on de‑dollarization, the key insight is this: the process is not linear.

Dollar dominance will not vanish overnight. In fact, moments like this can temporarily reinforce it. But reinforcement through force is fundamentally different from reinforcement through trust.

Military dominance may delay de‑dollarization. It may even strengthen the dollar in the near term. But over time, it increases the incentive for alternatives — not just abroad, but eventually at home.

What Smart Readers Should Be Asking Right Now

The real questions are not political. They are systemic.

What happens if multiple regions push back at once?

How does the U.S. fund expanded enforcement amid rising debt?

Does energy dominance translate into monetary stability — or into overconfidence?

And at what point do capital controls become “necessary” to preserve the system?

These are not questions for pundits. They are questions for anyone who understands how financial systems actually fail.

Final Thought: Power Is Not the Same as Stability

The capture of Maduro and the shockwaves rippling through Cuba and beyond prove that the United States still wields enormous power.

But power is not trust.

And trust — not force — is what sustains reserve currencies.

History is unambiguous on this point. Financial systems rarely collapse in dramatic fashion. They erode quietly, then break suddenly.

For readers who understand that reality, this moment should not inspire complacency.

It should inspire preparation.

That is precisely why I continue to urge readers to Download the Digital Dollar Reset Guide and start thinking beyond headlines, beyond politics, and beyond the assumption that the current system will hold.

Because eventually — it never does.