US National Debt Spirals Out Of Control - What It Means for Retirees

You’re probably sick of hearing all the doom and gloom about the US national debt.

You hear about it everywhere: politicians, financial news, and even from us.

Perhaps you think about it constantly. Or maybe you just tune it out to and dismiss it.

But however you deal with it, the last thing you'll want to do--especially if you are a retiree--is to normalize it (treat it as a regular thing). It's not.

Don’t just take it from us, pay attention to the Treasury Department’s official reports.

Last March, our national debt grew to over $21 Trillion. In fact, it even rose by almost $73 Billion in just one day!

To put things into perspective, the US national debt dwarfs all of the world’s national debts combined.

Our gross national debt now claims 106.4% of our GDP.

And you know what? It’s only getting larger.

As you might also know, our government is under increasing pressure to narrow-down this gap.

So what does it do? Well, it has to borrow more; most recently, $1 Trillion.

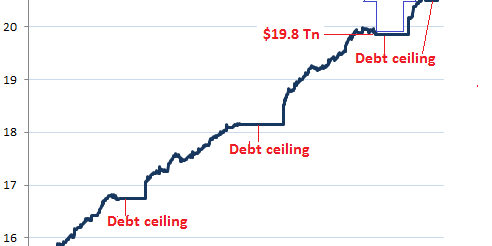

Check out this chart from Wolfstreet which provides a clear picture of what we’re facing:

You probably noticed how the Treasury has been continually raising the debt ceiling to meet government’s needs.

Another thing to think about: there hasn’t been an increase of this magnitude since the last financial crisis.

Yes, our economy may be booming, and unemployment low. But despite these positive factors, our debt is still growing.

In fact, it is expected to exceed $25 Trillion by 2020...

Since the 2008 financial crisis, China and Japan have stepped in to loan us trillions of dollars.

We can no longer rely on them to keep the US from drowning.

The Fed ended their Quantitative Easing program; closing the cheap money spigot.

And if you remember, China expressed hesitation last month in buying more US debt.

In fact, both China and Japan are beginning to unload its US debt holdings.

Ultimately, nobody is coming to our rescue.

So what does this mean? It means that falling demand for US debt will force the government to raise interest rates.

How else will the US attract new lenders?

And of course, this will put significant downside pressure on the US equities markets.

Stock prices will eventually collapse. People may not be able to get mortgages to buy properties, and that may cause real estate prices to fall.

On top of this, the government will have to pay more for its loans...which means it will have to borrow even more to pay its lenders back.

With the national debt spiraling out of control, with interest rates having no other way to go but up, the volatility that may ensue puts every retiree at risk: your wealth can literally be wiped out overnight.

There is only one surefire way to protect your wealth against the volatility that threatens it: buy precious metals.

Gold and silver are the only stable assets that can protect you during times of economic uncertainty and crisis.