Wall Street's Dirty Little Secret: Why the Real Scam Is Blind Trust

A Slick Name and a Slicker Scam

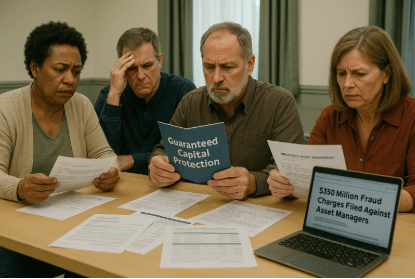

Ah, another day, another suit-and-tie snake oil salesman selling the American Dream, shrink-wrapped in financial jargon and "guaranteed capital protection." And once again, the so-called watchdogs are late to the bloodbath.

Prophecy Asset Management, a name that sounds more like a televangelist than a hedge fund, allegedly took over half a billion dollars from investors who were promised safety, transparency, and professional stewardship. Instead, they got backroom deals, forged documents, and what looks like a deliberate scheme to hide colossal losses under a mountain of lies. The number? $350 million vanished. Gone. Like smoke.

The SEC’s Kabuki Theater

And yet, the truly disturbing part isn’t that these predators exist—it’s that they’re still thriving because we’ve been conditioned to trust them.

The SEC is wagging its finger again, charging Jeffrey Spotts and his merry band of deceivers under every fraud statute they can dig up. But let’s be honest: this is just financial theater. For every one of these operations they expose, ten more are quietly rerouting cash to Cayman shells and off-the-book ledgers.

You Don’t Need These People

But here’s the thing no one wants to say out loud: you don’t need these people. You don’t need some $2,000 suit in Manhattan to "manage" your money. What you need is discipline, research, and the willingness to learn.

If It Sounds Too Good to Be True…

Ask yourself this: if it sounds too good to be true—guaranteed returns, capital protection, recession-proof portfolios—why would they need your money to begin with? Shouldn't they be sipping aged scotch on their private island funded by their own winning trades?

The Game Is Rigged—Unless You Learn the Rules

You don't need a CFA to smell the stench of a rigged game. You need common sense, a decent grasp of the basics, and enough paranoia to read past the brochure. And for God’s sake, if someone won’t let you see exactly where your money is going, you better assume it’s going into their pocket.

Not a One-Off—A Systemic Rot

This story isn’t about a one-off fraud. It’s about a system built on secrecy, manipulation, and regulatory sleight-of-hand. A system that thrives when the average investor stays ignorant, lazy, or too polite to ask hard questions.

Bottom Line: Trust No One—Learn the System

Stop trusting Wall Street like it's a church. It's not. It’s a casino where the house always wins—unless you wise up, get educated, and start asking uncomfortable questions. Don’t let your retirement turn into someone else’s Ferrari.

👉 Download Seven Steps to Protect Yourself from Bank Failure by Bill Brocius now. Because the next Prophecy-style disaster is already brewing.