Why Your 401K Plan is a Scam

The 401K plan has been around since 1980, yet most retirees don’t have enough money stashed away to “survive,” let alone enjoy their retirement!

The 401k sounds like a common-sense solution to help any working person achieve the American Dream. Work for a solid company for most of your life; set aside money for retirement before it is taxed; your employer will match the money you set aside; and when you are at retirement age, you get to pull your money out. You will have to pay taxes on your deferred income, but that money, wisely invested in mutual funds, will have appreciated. A happy and wealthy retirement!

It sounds like a great story. And it is. But the operative word here is…story. Perhaps a better word choice would be “myth.”

Here’s the reality of the 401K experiment from 1989 - 2013

This graph shows the median retirement account savings by age. What happened to that golden nest egg?

The 401k program benefits your money manager and your employer, leaving you with a mere portion of your hard-earned money.

How did this happen? Here are a few answers:

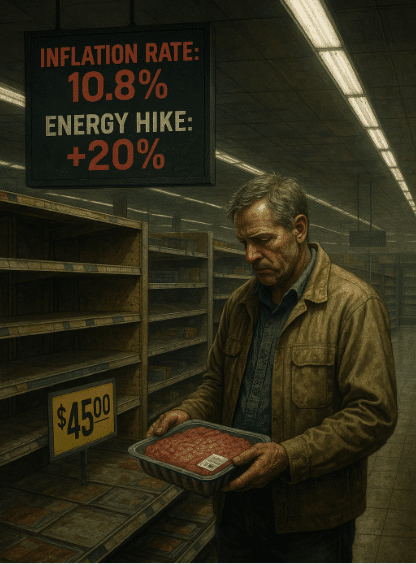

INFLATION IS EATING AWAY AT YOUR STANDARD OF LIVING

Take a look at the graph below and note the critical measures of college tuition, medical care, housing, and stagnant wages.

The cost of living is such that most Americans simply don’t have enough to stash away for retirement. Many Americans burdened with student debt cannot find high-paying jobs to pay down that debt, as wages have remained stagnant for over a decade. Add rising housing costs and medical costs to the mix, and you’ll see why many families are living paycheck to paycheck. Some households are only an illness away from having to declare bankruptcy.

But what about the people who are able to stash enough money away into their 401K plan?

YOU DON’T KNOW WHAT YOUR TAX RATE WILL BE WHEN YOU RETIRE--IT WILL MOST LIKELY BE HIGHER

Chances are that you will be making more money close to retirement than when you started saving, say, in your 20’s. If this is the case, which we all hope it is, it also means that your tax rate will be much higher when you retire. And when you finally take money out, you’ll be taking out more than you put in, which necessarily means a higher tax rate. Also, you are under the assumption that taxes won’t be raised by the time your retire.

Overall, these factors make pre-tax income somewhat pointless, don’t you think?

YOUR EMPLOYER BENEFITS FROM MATCHING YOUR 401K...BUT AT YOUR EXPENSE

We all know that there’s no such thing as a free lunch. In the case of a 401K match, the person who pays for this “free money” in the long term is you.

Companies that don’t match 401K programs often pay higher salaries. According to the Center for Retirement Research, for every dollar a company contributes to an employee’s 401k match, it saves 99 cents from what could have been higher pay. That’s a huge savings!

But is it a win/win situation for both the company and the employee?

Most companies typically spread out their contribution over four to six years (they don’t give it to you all at once). So if you leave before that time period--and the average employee stays with a company for only 4.6 years according to the Bureau of Labor Statistics--then you won’t get your match.

Big win for your employer. Big loss for you!

EXTRANEOUS FEES THAT WORK AGAINST YOU

As with any service, a 401k retirement plan comes with costs. You pay fees to the person managing your account, fees for the mutual funds allocated into your account, plus you pay for the revenue-sharing that takes place between your employer and 401k manager. Yes, this latter point is legal, and it’s one way your employer makes money off your 401k, aside from not having to pay you a higher salary. In addition to these costs, several mutual funds also charge fees to cover their marketing expenses.

How do these fees support your retirement goals? They don’t. And all of these fees are transparent, believe it or not. But most people won’t take the time to read the fine print.

Plus, the fine print often comes in volumes, written in technical or legalistic jargon. It’s almost never written in plain language. If it actually were legible, then you might end up reading it. And all the extraneous fees would not go undetected or unchallenged.

BUT THE MARKETS WILL RISE...AND SO WILL MY 401K

Are you certain about this? If so, on what grounds do you base this certainty? Let’s look at the historical facts. On average, the markets return a figure roughly between 7 to 10% per year. Despite this “decent” return, most investors still underperform the markets. And when I say “investors,” I’m referring to top mutual fund managers. In fact, 86% of all mutual funds have consistently underperformed the markets.

Why is that? Most money managers miss the big returns--those really big bull markets that exceed 100% in gains. These gains typically follow large market downturns, and most money managers who have already pulled out tend to stay out, resulting in missed opportunities. As you can see, such gun-shy behavior is natural when it comes to investing. But it also shows us that professionals aren’t any better or worse than the average non-professional investor.

Also consider the fact that these funds are US dollar denominated. With the US debt near 20 Trillion and a debt-to-GDP ratio near 104.5, how much value will your funds have even if you were lucky enough to see your investments appreciate? From a “sound money” perspective, the value of your dollar-denominated funds are dangerously vulnerable.

If you are looking for a sound investment, one that rises when markets plunge, one that doesn’t charge extraneous fees, and one that isn’t subject to the depreciating dollar, go with the time-tested solution: buy gold and silver.

Otherwise, invest in yourself. Most millionaires have multiple sources of income. Build a side business, learn some new skills, and get those multiple income streams going.

Don’t allow your 401k...and the false dream that it promises...to define an impoverished future for you and your family.

GSI Exchange is pleased to bring our 75 years of market expertise to work for you in our exclusive brochures; The Silver Action Plan, The Power of Gold, Precious Metals IRA Guide and the US Bank Expose, all of which are free of charge and available to download immediately when you click here.