Will Bitcoin Anchor BRICS’ Quest for Economic Dominance?

Introduction: A Turning Point in Global Finance?

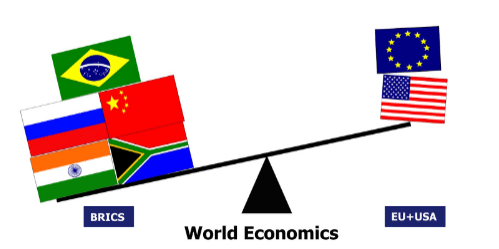

The financial world is abuzz after Russia’s Vladimir Putin made a bold declaration: Bitcoin and digital assets are inevitable. This isn’t just another leader talking up crypto—it’s a tectonic shift in the global monetary landscape. BRICS (Brazil, Russia, India, China, South Africa) has long been a thorn in the side of Western financial dominance, and now, with Bitcoin in their sights, the implications could be nothing short of revolutionary. But what does this mean for you and the dollar in your wallet?

Analysis: Bitcoin, BRICS, and the End of Dollar Dominance

For years, BRICS has sought ways to reduce reliance on the U.S. dollar. Sanctions on Russia during the Ukraine conflict only accelerated this urgency. Enter Bitcoin: a decentralized, borderless asset immune to sanctions and political manipulation. Putin’s recent comments—“Who can ban Bitcoin? Nobody.”—speak volumes about the bloc’s direction.

Russia has already taken steps to formalize digital currencies, recently recognizing them as property for international trade settlements. Meanwhile, Brazil is considering a Bitcoin treasury reserve, and China is no stranger to exploring blockchain-based financial instruments. The momentum is undeniable.

Let’s not forget the geopolitical angle. For nations like Russia and China, Bitcoin offers a tool to bypass Western financial systems like SWIFT, paving the way for a more multipolar economic order. For years, critics have laughed off Bitcoin as speculative or volatile, but BRICS sees it as a strategic weapon—a way to accelerate de-dollarization while hedging against instability in traditional markets.

Predictions: A New Era of Trade Settlements

If BRICS officially adopts Bitcoin for trade settlements, it would be a watershed moment. Imagine a world where oil deals between China and Russia bypass the dollar entirely, conducted instead in Bitcoin or other digital currencies. The implications for U.S. influence—and the value of the dollar—are staggering.

But this isn’t just about geopolitics. For individuals, this shift underscores the fragility of fiat currencies. Bitcoin’s adoption by BRICS could drive global demand, pushing its price to new heights. However, it also highlights the importance of owning decentralized assets to protect your wealth in an increasingly unstable financial system.

Solutions: Securing Your Financial Sovereignty

As BRICS aligns itself with Bitcoin and other decentralized technologies, the writing on the wall is clear. The dollar’s days of uncontested dominance are numbered. Here’s what you can do to prepare:

- Diversify Your Assets: Don’t keep all your wealth in dollars. Explore decentralized assets like Bitcoin and gold.

- Stay Informed: Knowledge is your best asset. Follow developments in global finance and understand how they impact your portfolio.

- Take Action Now: Waiting for the “perfect moment” is a recipe for financial disaster. The time to secure your financial sovereignty is today.

Conclusion: Are You Ready for the New Financial World Order?

The era of dollar hegemony is unraveling before our eyes. BRICS and Bitcoin represent the forefront of this change, and their actions signal a new financial paradigm—one where decentralization, not centralized power, takes center stage.

The question is, will you adapt, or will you be left behind?

Call to Action:

The financial landscape is shifting faster than most realize. Take control of your financial future today with two powerful resources:

- Download My Free Guide: “Seven Steps to Protect Your Bank Accounts”

Get it Here - Grab Your Copy of "The End of Banking as You Know It" (Now $19.95, usually $49.95)

Order Now

In a world where controlling money equals controlling freedom, securing your sovereignty isn’t just wise—it’s essential.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.