BRICS Goes Back to Gold: The Final Blow to U.S. Dollar Sovereignty?

Let’s Cut Through the Hype: What’s Really Happening Here?

Look, I’ve been in this game for over four decades, and I’ve seen a lot of noise. But this BRICS gold-backed movement isn’t just noise—it’s a seismic rumble under the foundation of the U.S. dollar.

BRICS Is Building a Parallel System

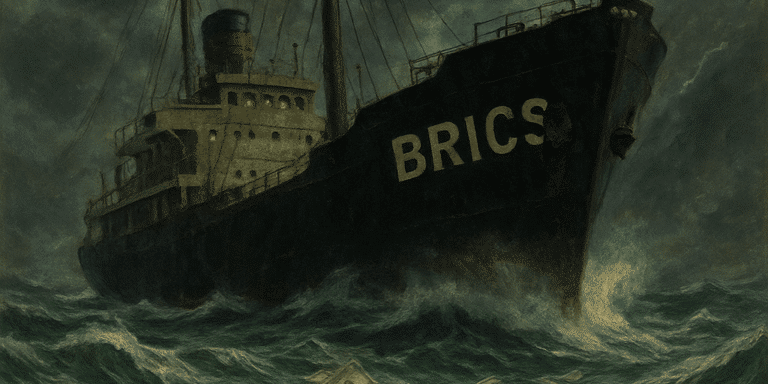

Let’s make this simple: BRICS (Brazil, Russia, India, China, South Africa – now joined by Egypt and others) is building a financial ark while the U.S. dollar is taking on water. These nations are pooling gold not because they’re gold bugs—but because they’re realists. They’ve seen what happens when the U.S. weaponizes the dollar.

From sanctions to freezing reserves (remember when Russia's dollar reserves were locked out of SWIFT in 2022?), these countries are saying “enough.” They want money backed by something real—and that something is gold.

Over 6,000 Metric Tons of Gold—That’s Not a Bluff

You know what 6,000 metric tons of gold is? It's 20-21% of all central bank reserves in the world. That’s the equivalent of a third of the gold the U.S. claims to hold (if you believe those vaults are still full, which I personally question).

This is more than just buying insurance. This is building a gold-based lifeboat while the rest of the world drowns in fiat.

The Dollar Is Losing Its Grip—Fast

Let me put it like this: if the U.S. dollar is a 20-year-old used car, it’s already lost most of its value—and it’s leaking oil. Every time the Fed prints more money, they’re draining the dollar’s worth like letting air out of a tire.

Meanwhile, BRICS is putting together a brand-new engine—powered by gold, not debt.

And James Rickards said it best: if the BRICS unit equals one ounce of gold, and gold hits $3,000, then that currency becomes $3,000 strong—while the dollar continues to slide. The dollar isn’t measured in strength anymore; it’s measured in faith. And that faith is running thin.

This Isn’t Your Granddad’s Gold Standard

Now, let’s not get confused—this isn’t a classic gold standard where you walk into a bank and trade paper for gold. As Rickards also points out, BRICS doesn’t need to operate like that. They don’t even need to prop up gold prices artificially.

They’re simply saying: “Here’s our trade currency. It’s backed by gold. Take it or leave it.”

And guess what? Countries burned by U.S. monetary bullying are lining up to take it.

The War Is Already On—And the Dollar’s Losing Ground

From the outside, this might look like another international financial experiment. But from where I’m sitting, this is a full-blown sovereignty war—financial World War III, and gold is the ultimate weapon.

Here’s the catch: this isn’t just a threat to America’s global dominance—it’s a threat to your savings account.

If BRICS keeps moving this way—and I believe they will—you’re going to see a sharp divide between nations that hold real assets and those that rely on printing paper.

Guess which side wins in the long run?

What You Should Be Doing Right Now

Let me be straight with you: if you’re still sitting on 100% dollar-based assets, you’re exposed. The BRICS nations are buying gold like their sovereignty depends on it—because it does. And yours does too.

It’s Time to Move:

- Own physical gold and silver. Not ETFs. Not paper promises. The real thing.

- Diversify out of the system. Get your money out of Wall Street casinos and government-controlled banks.

- Educate yourself. Most Americans are sleepwalking into financial disaster.

And you don’t need to be rich to start. Heck, I started buying silver rounds when I was a broke college kid with a part-time job at a gas station.

Take the First Step Before the Next Shock Hits

The writing is on the wall, and if you're reading this, you're lucky—you still have time to prepare.

👉 Download Bill Brocius' eBook, “Seven Steps to Protect Yourself from Bank Failure” – it’s packed with steps to help you survive and thrive when the system breaks:

Download the eBook here

👉 Subscribe to Dedollarize’s premium alerts and tools so you don’t miss the next move in gold, silver, and the dollar’s downfall:

Join the movement here

Final Thought:

The BRICS nations aren’t just playing chess. They’re flipping the board. And if you're still trusting the dollar like it's 1995, you're going to be left behind.

Protect yourself with gold and silver—before they lock the exits.

— Frank Balm