Cracks in the Shadow Bank: The Private Credit Collapse Has Begun

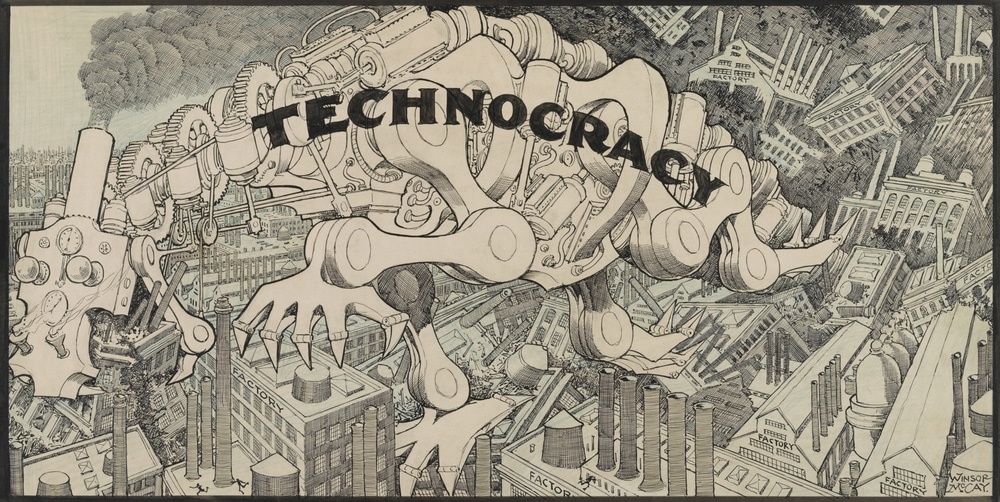

The Rise of a New Shadow System

Private credit—once the niche playground of the ultra-wealthy—has metastasized into a trillion-dollar beast. These aren’t your local credit unions or community banks. This is capital flowing through opaque channels: no public market pricing, no SEC oversight, and zero liquidity.

It’s the Wild West of Wall Street, where backroom deals replace risk assessment and fund managers sell the illusion of stability to pension boards and insurance giants. They pool your retirement money and throw it into exotic, liquid loans that nobody understands and nobody can sell when the music stops.

From “Safe” to Zero in 30 Days

Gundlach dropped a bombshell: a credit fund marked a bond at 100 cents on the dollar, then slashed it to zero one month later. That's not volatility—that's financial fraud with a spreadsheet.

What else is sitting in your portfolio, priced at fantasy levels while the underlying companies rot from the inside out?

This isn’t some one-off glitch. It’s systemic. These firms mark their portfolios based on models, not markets. The whole house of cards stays upright until someone actually tries to cash out—then it collapses.

Illiquidity: The Hidden Cancer in Your Portfolio

Private credit funds promise high yields in exchange for locking up your money. That’s fine when times are good. But when things get shaky, fund managers start calling in capital from investors who are already tapped out, triggering a domino effect of panic, forced liquidations, and fund implosions.

Remember 2008? Liquidity froze. Credit lines vanished. That same blood-freezing scenario is already playing out behind the scenes—except now it’s bigger and less visible.

And unlike 2008, there’s no appetite—or ability—for a taxpayer bailout this time.

Canaries in the Coal Mine Are Dying

Blue Owl Capital scrapped its planned fund merger citing “market conditions.” That’s the sanitized version. The truth? The engine is seizing up. The liquidity is gone. And like a poker game with no chips left, the players are eyeballing the exits while pretending the game isn’t over.

Gundlach didn’t say “this might happen.” He said it’s already happening. The losses are real, the valuations are fake, and the exit doors are starting to jam.

Why This Is a Warning to all Americans

If you think this is just a rich guy problem, you’re missing the point.

The collapse of private credit isn't a side story—it’s a core pillar of U.S. financial dominance. The dollar is backed by faith in American markets. That faith evaporates when pensions implode, insurance funds go insolvent, and retirees find out their “diversified portfolio” was just an illiquid tomb wrapped in a quarterly statement.

This is the iceberg hitting the hull:

- Private credit defaults ripple into public markets.

- Domestic investors panic and rush into cash, gold, or crypto.

- Foreign investors accelerate their de-dollarization strategies.

- The Fed either prints (sparking inflation) or sits still (triggering deflation).

Either way, your dollar loses—value, trust, and global relevance.

Call to Action

If you still think “the system will work itself out,” you’re not paying attention. The system is the crisis.

Get educated. Get independent. And download “Seven Steps to Protect Yourself from Bank Failure” by Bill Brocius before your financial advisor tries to explain why your 401(k) is suddenly illiquid.

👉 Download it here 👈

Don’t trust the canaries. Trust the cage—and the silence that follows.