Crypto’s House of Cards: Why Your Digital Fortune Could Vanish Overnight

Crypto’s House of Cards: Why Your Digital Fortune Could Vanish Overnight

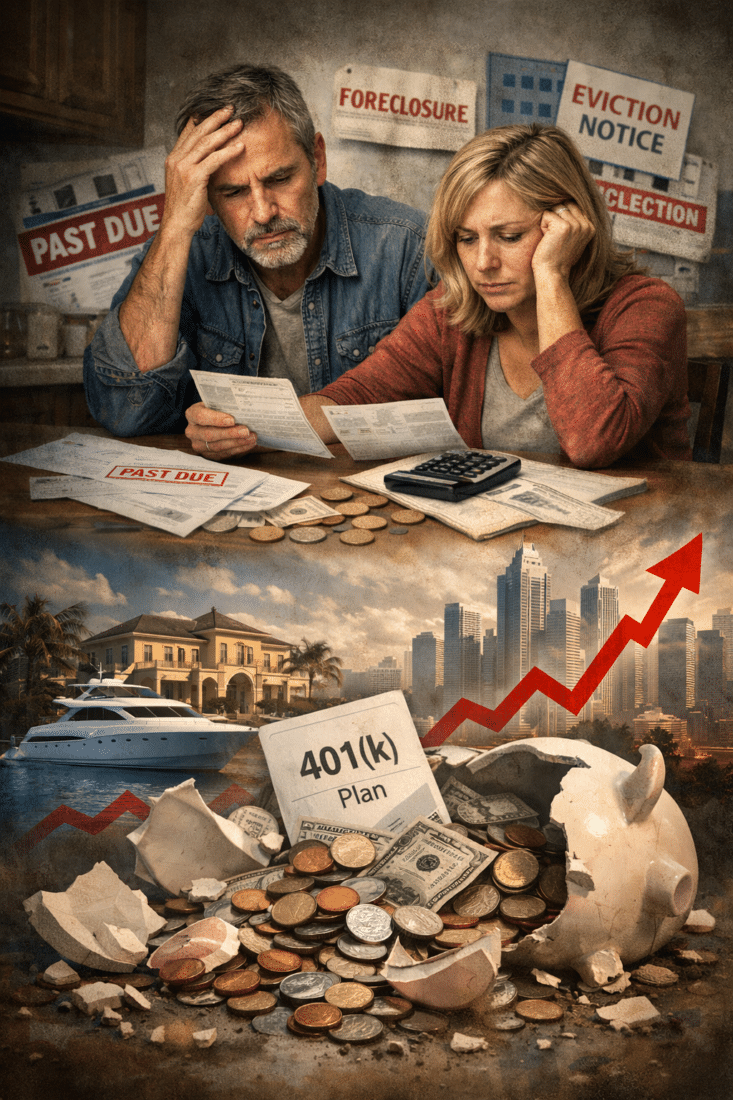

The modern financial world is fracturing. Currency devaluation, global debt spirals, and manipulated markets have turned the average saver into a target. In this chaos, two camps have emerged: those who hold real, tangible assets, and those chasing a digital pipe dream—crypto.

Crypto was sold as liberation. “Digital gold,” they called it. A hedge against fiat tyranny. But strip away the buzzwords and what you’ve got is a fragile, centralized ecosystem built on hope, Wi-Fi, and government-permitted infrastructure. That’s not sovereignty. That’s dependency.

Digital Delusion: Crypto’s Flawed Foundation

Bitcoin, Ethereum, Solana—call it what you want. These aren’t currencies. They’re speculative digital gambling chips that only exist because the system allows them to. No power? No internet? No crypto. That’s not resilience—it’s a ticking time bomb.

And don’t kid yourself: in a crisis, the feds won’t hesitate to pull the plug. Ask anyone living under authoritarian regimes that black out the web like flicking a switch. Your digital wallet? Frozen. Your decentralized dream? Gone.

Crypto evangelists brag about “self-custody,” but how sovereign are you when a firmware update can brick your cold wallet? Or when your seed phrase gets phished, hacked, or lost? You don’t own that code. You’re just borrowing it from the grid.

Gold & Silver: The Enemies of Central Banks

Meanwhile, gold and silver just are. No third-party validation, no app updates, no captcha codes. Just pure, unadulterated value recognized across borders, centuries, and civilizations. Try buying bread with a Dogecoin after an EMP hits. Now try a silver dime.

Gold doesn’t crash because Elon Musk tweets a fart joke. Silver doesn’t disappear when Binance halts withdrawals. These metals are the original no-counterparty assets. They’ve outlasted every paper currency in history—and they’ll outlast crypto too.

Real Ownership, Not Just a Wallet Address

Digital ownership is a myth the technocrats love to sell. It’s ownership at the mercy of electricity and permissioned access. True liberty means owning assets that don’t vanish when you close your laptop.

Precious metals don’t rely on validators, consensus algorithms, or server uptime. They don’t get rekt in flash crashes. You can hold them in your hand, bury them in the dirt, trade them in a back alley, or smuggle them across borders. Try doing that with your ERC-20 tokens.

Market Mayhem: Crypto’s Rollercoaster Reality

Crypto’s volatility isn’t just risky—it’s suicidal. One minute you’re a millionaire, the next you’re begging for gas money. This isn’t investment. It’s hopium-fueled roulette for the dopamine generation. Austrian economics teaches us to seek value rooted in scarcity and utility, not digital fantasies pumped by Reddit threads.

Gold and silver don’t give you adrenaline—they give you stability. And in a world hurtling toward central bank digital control, stability is the new rebellion.

The System Is Failing. Don’t Fail With It.

Governments are bankrupt. Central banks are panicking. The IMF is licking its lips. And in this mess, they want you distracted—fixated on meme coins and NFTs while they roll out the surveillance coin: the FedNow CBDC.

Don’t be their pawn. When the digital curtain drops and the lights go out, those holding real, physical assets will still eat. They’ll still trade. They’ll still own something.

Final Thought: Stack What Survives

You don’t need a blockchain to barter silver. You don’t need an API to own gold. When the digital dust settles, the only wealth that matters will be what you can hold, hide, and defend.

Choose real. Choose resilient. Choose liberty.

Download “Seven Steps to Protect Yourself from Bank Failure” by Bill Brocius now

Click here to download

Don’t wait for the crash to figure out what’s real. The system won’t warn you twice.