Deficit Explosion: Washington Burns Through $1.6 Trillion in 10 Months — Even with Tariff Windfall

$1.6 Trillion in 10 Months — and Climbing

The Congressional Budget Office just dropped its July update, and the numbers are a gut punch. In the first 10 months of fiscal year 2025, the U.S. federal government has racked up a $1.6 trillion deficit — that’s $109 billion more than last year, despite a tidal wave of new tariff revenue flooding into Washington.

Revenue Is Up — Spending Is Out of Control

Let’s be clear: this isn’t a revenue problem. Federal tax receipts are up $263 billion year-over-year. Customs duties — largely driven by the Trump administration’s ramped-up tariffs — have skyrocketed 112%, bringing in an extra $70 billion. That’s on top of a $214 billion jump in individual income and payroll taxes.

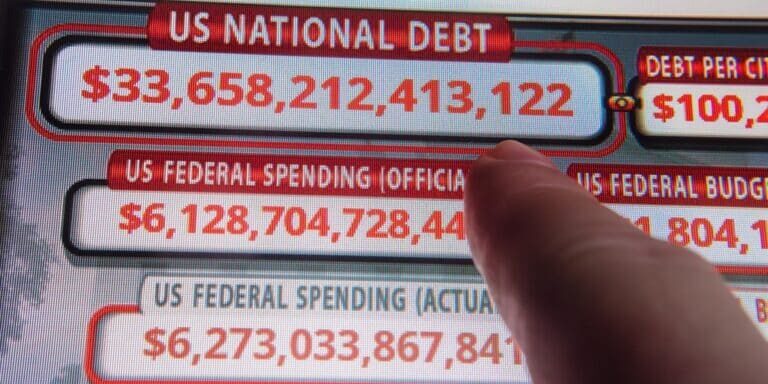

The problem is spending — and it’s out of control. In just ten months, Washington has burned through $372 billion more than last year. Social Security outlays alone are up $102 billion thanks to cost-of-living adjustments (a direct consequence of inflation) and an expanding pool of retirees. Medicare spending? Up $58 billion. Medicaid? Another $47 billion. And here’s the kicker — interest payments on our nearly $37 trillion national debt are up $60 billion. That’s money flushed down the drain to service past overspending, not to build a single road, school, or hospital.

July Deficit Shows No Signs of Slowing

In July alone, the monthly deficit hit $289 billion — $45 billion worse than July 2024. Every month, the debt hole gets deeper, and every dollar printed to fill it chips away at the purchasing power in your wallet.

The Historical Warning Signs Are Flashing Red

History is unambiguous: when governments choose to inflate, spend, and borrow without restraint, currencies collapse. The same destructive forces that obliterated the value of the German mark in the 1920s or the Argentine peso in the 2000s are now at work here. The math doesn’t care about party politics — and when the reckoning hits, it will hit everyone, from the retiree living on fixed income to the small business owner trying to make payroll.

The Solution: Don’t Wait for Washington to Save You

This is exactly why Bill Brocius has been warning readers for years: stop trusting the system to protect you, because it won’t. Protect your savings with tangible assets that can’t be debased by a keystroke in D.C.

If you haven’t yet read Bill’s free guide, “7 Steps to Protect Your Account from Bank Failure,” you’re gambling with your financial future. Download it here before the next shockwave hits.

And for those serious about staying ahead of the crisis, Bill’s Inner Circle newsletter delivers the real intel for just $19.95 a month. Because when the lights go out in the financial system, you’ll want to be holding more than promises from politicians.