Foreclosures Are Surging Again—And This Time the Fed Can’t Save You

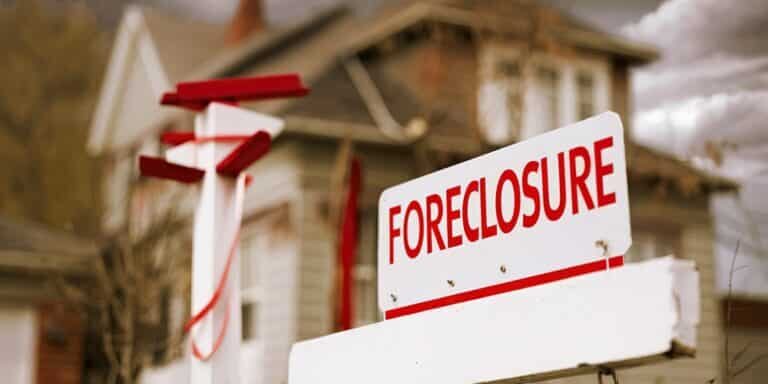

Foreclosures Are Surging—And It’s Not Random

It’s starting to smell like 2008, only this time the stench is worse. In a country where the average American can’t scrape together $1,000 for an emergency, we’re now watching foreclosure data chart the same path we saw during the Great Recession—except the pressure this time is coming from more directions. A nearly 20% spike in foreclosure filings over last year isn’t a blip—it’s a trend, and one that’s been climbing for eight straight months. That’s not a cycle—that’s structural decay.

When homeowners who bought during the low-rate mania of 2020–2022 now face ballooning payments, layoffs, and a weakening labor market, the result is predictable: mass default. Combine that with record household debt, and what you get is a credit bomb waiting to go off.

This Is a System Failure, Not a Normal Downturn

The financial media will downplay this as a manageable correction. That’s delusional. This is a system in failure mode. Foreclosures are rising, but so are evictions—both official and “informal,” the kind where landlords hike rent $600–$900 a month to force tenants out. The Fed spent years inflating asset bubbles and pushing the middle class out of housing entirely. The result? An entire generation of Americans who’ve been permanently locked out of homeownership—and many who made it in are now getting flushed out.

Wall Street’s engineered this collapse before. Back then it was subprime mortgages. Today, it’s everything: housing, autos, student loans, even credit cards. The game is simple: extend credit, juice consumption, transfer real assets to the top, and let inflation wipe out what’s left of your savings.

Corporate Layoffs Signal the Next Phase of Collapse

Here’s your leading indicator: job cuts. Verizon is planning to axe 15,000 jobs—that’s 15% of its entire workforce. And they’re not alone. Tech, telecom, retail, finance—across the board, companies are slashing payroll to protect their margins. That’s how late-cycle dynamics always play out. But unlike past downturns, this one’s colliding with record high household expenses, falling real wages, and a population that’s already financially exhausted.

This isn’t about tightening belts—it’s about survival. And when tens of thousands more Americans find themselves without income, those foreclosure and repossession numbers are going to surge even higher.

The Fed’s Hands Are Tied—And Their Playbook is Spent

Let’s get something straight: the Fed can’t fix this. They’ve painted themselves into a corner. Raise rates further, and the Treasury market cracks. Lower them, and inflation roars back. The Fed’s balance sheet is bloated beyond recognition, and confidence in the dollar is eroding globally. BRICS+ nations are dumping U.S. debt, stockpiling gold, and building systems outside the SWIFT cartel.

There’s no painless exit from this. The next policy steps will not be about recovery—they’ll be about control: Central Bank Digital Currencies, increased surveillance, tighter regulation of peer-to-peer finance, and ultimately, restrictions on your ability to move capital freely.

The Subprime Auto Market Is Flashing Bright Red

We’re now witnessing a “subprime auto loan meltdown” that mirrors the early signs of the housing crash in 2007. Over 6.6% of subprime borrowers are more than 60 days delinquent on their auto loans—the highest level ever recorded. Over 7.5 million repossession assignments have been issued this year alone, and projections show we could hit 10.5 million by year-end.

Major auto lenders targeting low-income borrowers have already filed for bankruptcy. This is a contagion event. As credit continues to tighten and defaults rise, we’re going to see massive secondary effects: used car values collapsing, lenders pulling back, and consumers getting locked out of basic transportation.

We Are Entering the Age of Digital Serfdom

This is not just an economic contraction. This is a wholesale transformation of the financial landscape. The middle class is being eradicated, replaced by a population of renters, digital dependents, and paycheck-to-paycheck strugglers who will have no choice but to comply with whatever terms are set by banks, tech companies, or the government.

When you can't own your home, can't own your car, can't keep your money safe in a bank without risking bail-ins or digital control, you are not free. The illusion of security is being replaced by a digital cage—and most Americans still think it’s temporary. It isn’t.

Take Action Before the Trap Shuts Completely

If you're still trusting the institutions that led us into this mess to guide us out, you’re going to get wiped out—plain and simple. The prudent are already moving to hard assets: gold, silver, Bitcoin. Not because it’s fashionable, but because it’s necessary. You need to be liquid, off-grid where possible, and protected against systemic failure. Get out of the system before it locks you in.

The blueprint for protecting yourself is already written. Download Bill Brocius’ free guide, 7 Steps to Protect Your Account from Bank Failure. Then, if you’re serious about insulating your wealth, join the Inner Circle newsletter for $19.95/month to get Bill’s boots-on-the-ground analysis before the next shoe drops. And don’t miss his landmark book, The End of Banking As You Know It—a survival manual for what’s coming next.

We are not in a correction. We are in the unraveling. Get ready—or get left behind.

👉 Download your free guide now:

7 Steps to Protect Your Account from Bank Failure

📘 Read the truth they don’t want you to know:

The End of Banking As You Know It by Bill Brocius

🔐 Get insider access:

Subscribe to Bill’s Inner Circle for $19.95/month and stay ahead of the collapse.