Gold Mining AISC Unchanged After Five Quarters of Upward Trends

EDITOR'S NOTE: In 2021, production costs for gold miners increased significantly. This was due to input cost inflation among other economic factors. Yet margins, despite dipping slightly, remained high and are expected to run even higher this year. What happened? How did the quality of the products help ease the cost of production? Understanding gold from a mining industry perspective is a critical piece of the fundamental puzzle. The author below analyzes a particular angle of mining and production. What to look out for: the factors that miners are watching which can spell the difference between windfall profits and economic headwinds in the quarters to come.

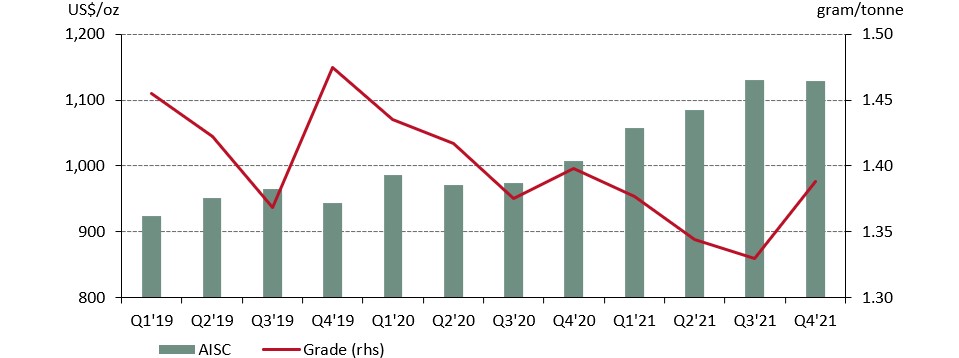

Global All-in Sustaining Costs (AISC) in the gold mining industry were US$1,129/oz in Q4’21, almost unchanged from the previous quarter (Chart 1). This relative stability is perhaps surprising, given inflation across a multitude of costs for mining operations, and breaks the upward trend seen over the last five quarters.

The rising price of inputs such as fuel, energy and labour played a significant role in pushing AISC from US$972/oz in Q2’20 to US$1,131/oz in Q3’21 (+14%). In Q4’21, however, this cost pressure was mitigated by a 4% rise in average grades, which reached 1.39g/t. This was driven by processing of higher grade ore at several major gold mines, particularly at Barrick and Newmont’s JV mines in Nevada – Carlin, Cortez and Turquoise Ridge. The rise in average grades increases the amount of gold produced per tonne of rock mined and processed, thus effectively lowering costs on a unit basis.

Chart 1: Rising grade offset inflationary cost pressure in Q4.21

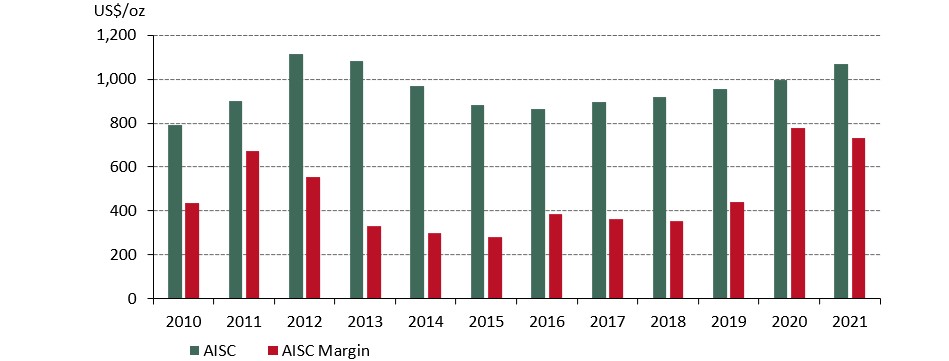

On an annual basis, average AISC for 2021 increased by 7% y-o-y to US$1,068/oz. This was the highest level since 2013 and the highest rate of annual growth over the same period (Chart 2). The y-o-y rise in costs was driven by several factors including the previously mentioned input cost inflation, strengthening of local producer currencies against the US dollar, additional costs related to COVID-19 and a fall in annual average head grades.

Average margins were squeezed by these rising costs, but remain high on a historical basis. Despite a 6% y-o-y reduction, at US731/oz they remained comfortably above the peak of US$552/oz reached in 2012, during the last bull run in gold.

Should the gold price remain strong in 2022 then gold miners should continue to generate high margins, notwithstanding further pressure from continued cost inflation.

Chart 2: AISC margins dropped by 6% in 2021 but remain high

Source: Metals Focus Gold Mine Cost Service

Originally published by Gold Hub.