Labor Market Softening Hits New Low: Is the Economy Slipping Into a Hiring Freeze?

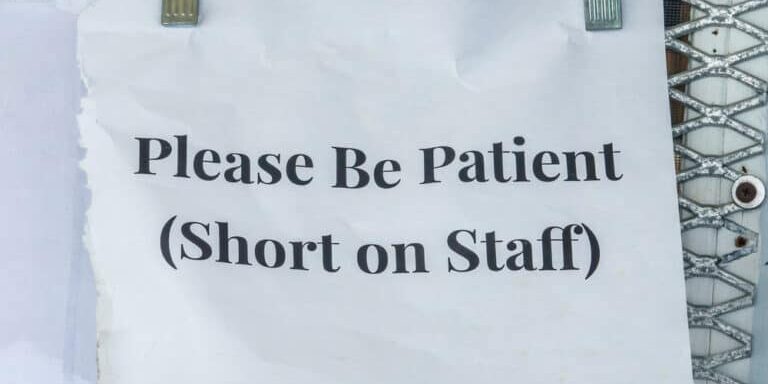

Job openings slumped to their lowest level in 3½ years in July, the Labor Department reported Wednesday in another sign of slack in the labor market.

The department’s closely watched Job Openings and Labor Turnover Survey showed that available positions fell to 7.67 million on the month, off 237,000 from June’s downwardly revised number and the lowest level since January 2021.

With the decline, it brought the ratio of job openings per available worker down to less than 1.1, about half where it was from its peak of more than 2 to 1 in early 2022.

The data likely provides further ammunition to Federal Reserve officials who are widely expected to begin lowering interest rates when they meet for their next policy meeting on Sept. 17-18. Fed officials watch the JOLTS report closely as an indicator of labor market strength.

“The labor market is no longer cooling down to its pre-pandemic temperature, it’s dropped past it,” said Nick Bunker, head of economic research at the Indeed Hiring Lab. “Nobody, and certainly not policymakers at the Federal Reserve, should want the labor market to get any cooler at this point.”

While the job openings level declined, layoffs increased to 1.76 million, up 202,000 from June. Total separations jumped by 336,000, pushing the separations rate as a share of the labor force up to 3.4%. However, hires rose as well, up 273,000 on the month, putting the rate at 3.5% or 0.2 percentage point better than June.

The professional and business services sector showed the biggest increase in openings with 178,000. On the down side, private education and health services fell by 196,000, trade, transportation and utilities declined 157,000 and government, a leading source of job gains over the past few years, was off by 92,000.

Though the report adds to concerns that the economy is slowing, it “does not suggest any rapid deterioration in the labor market,” Krishna Guha, head of the Global Policy and Central Bank Strategy Team at Evercore ISI, said in a client note.

“The still low level of layoffs and tick up in hires suggests the labor market is not cracking. But demand for workers continues to soften relative to the supply of workers, and a forward perspective suggests this is likely to continue under restrictive policy,” he added.

The report comes two days ahead of the pivotal August nonfarm payrolls count that the Labor Department will release Friday. The report is expected to show an increase of 161,000 and a tick down in the unemployment rate to 4.2%.

This article originally appeared on CNBC.