Sleepwalking into Theft: Why Digital Finance is a Dangerous Illusion Without Hard Assets

The Digital Trap We Call "Convenience"

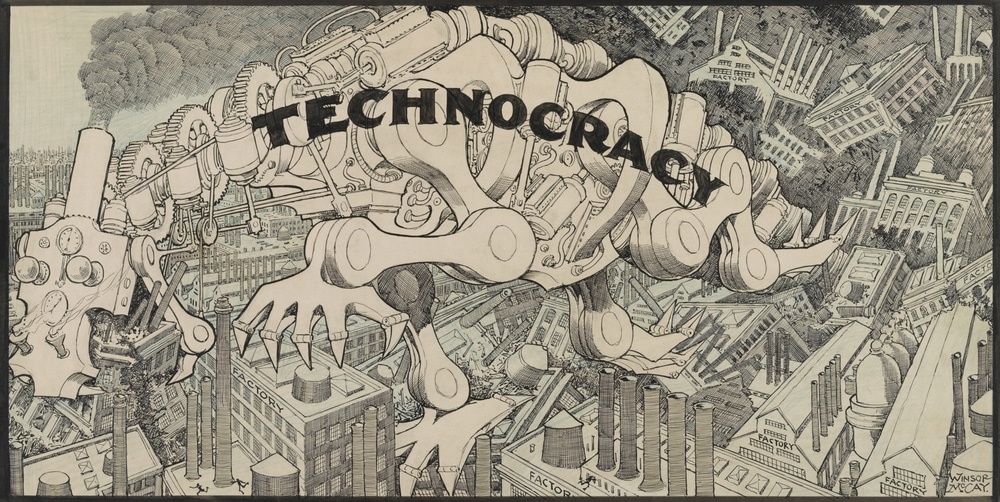

You don’t need to be a cybersecurity expert to understand the writing on the wall: digital finance—slick, seamless, and sold to us as “progress”—is rapidly becoming a trap. A recent warning out of Europe confirms what many of us have feared for years: the system built for convenience is now tailor-made for exploitation.

Enter Klopatra, the newest malware terror. It’s not some clunky piece of code cooked up in a basement—it’s a professional, sophisticated tool that allows criminals to drain your bank account while you sleep. It can see your screen, simulate your taps, and approve fraudulent transfers as though it were you. If that doesn’t terrify you, it should.

ISO 20022: The Infrastructure for Control

While Trump officially banned Central Bank Digital Currencies (CBDCs) during his second term, the plumbing that could make them possible in the future is already being installed. It’s called ISO 20022.

This messaging standard is being adopted globally under the guise of "efficiency" and "interoperability" across financial institutions. But what it really represents is the creation of a unified global financial language—one that allows governments and central banks to plug directly into transaction-level data at a scale we've never seen before.

If CBDCs are the surveillance tool, ISO 20022 is the highway that delivers it straight to your wallet. And once it’s in place, flipping the switch won’t require legislation—just a “crisis.”

Your Phone Is Now a Trojan Horse

Let’s not sugarcoat this: mobile banking has become the weakest link in your financial security.

The Klopatra malware doesn’t just steal passwords—it takes over the entire device. It navigates your apps, presses buttons, simulates gestures, and confirms transfers like a ghost in the machine. And most terrifying of all? It strikes when you're most vulnerable—asleep, unaware, and disconnected.

And why does this keep happening? Because the entire digital finance system is dependent on trust—trust in devices, in servers, in apps, in institutions. That trust is being shredded by the month.

Banks Can't Protect You Anymore

If you still think your bank is your financial backstop, you're already a decade behind. Today’s banks are software stacks bolted onto legacy systems, managed by bureaucrats, and constantly under siege from both cybercriminals and their own regulators.

And in case you’ve forgotten: they don’t even need to be hacked to freeze your funds or limit your withdrawals. They just need a directive from above.

Hard Assets Don’t Need Passwords

Here’s the truth they don’t want you to hear: you don’t have to keep your wealth in a system built to fail.

There’s still a way to opt out—hard assets.

Physical gold. Physical silver. These are the anti-fragile tools of real wealth preservation. You don’t need an internet connection to access them. They don’t rely on some third-party authentication server in Silicon Valley. They can’t be hacked, drained, or wiped out because you fell asleep without locking your screen.

When fiat currencies falter—and they always do—tangible assets hold the line. When the grid goes down, when bank holidays freeze your accounts, when a foreign IP address walks off with your digital dollars at 3:00 AM, it won’t be your mobile app that saves you. It will be the ounces in your safe.

Don’t Sleep on This Warning

To be fair, we’re not going back to a world without digital finance. The trap is too far set. But that doesn’t mean we have to play this game unprotected. It’s not too late to shift a portion—hell, even a meaningful portion—of your wealth into something the system can’t touch.

Bill Brocius saw this coming years ago. His landmark book, End of Banking As You Know It, isn’t just a warning—it’s a blueprint. If you haven’t read it yet, you’re already behind. And if you think your bank is safe, I urge you to download the free guide he and I put together: “7 Steps to Protect Your Account from Bank Failure.”

And for those who want the deeper insights—the forecasts the media won’t print—join Bill’s Inner Circle newsletter for just $19.95. It’s a small price to pay to stay ten steps ahead of the next financial crisis.

Action Steps to Take Today:

- 📘 Grab a copy of End of Banking As You Know It by Bill Brocius

- 🛡️ Download the free ebook: 7 Steps to Protect Your Account from Bank Failure

- 🔐 Subscribe to Bill’s Inner Circle newsletter and take control of your financial future

Time’s running out. Don’t wait until a Turkish malware gang teaches you what your bank won’t.

— Eric Blair