The Digital Dollar Storm Just Rocked the Markets — And You Weren’t Supposed to Notice

The Crash They Didn't Warn You About

On Friday and Saturday, the markets took a beating most media outlets downplayed — or ignored completely.

- Silver fell 30% — the worst single-day drop since 1980.

- Gold plunged 15%, after a quick 10% dip the day before.

- Bitcoin dropped below $80,000, erasing 13% over five days.

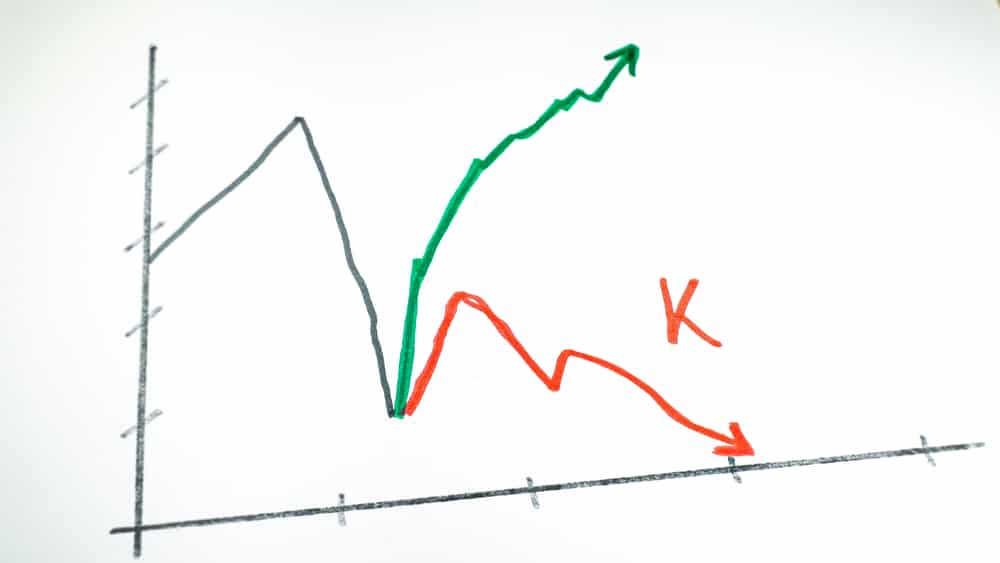

These weren’t just isolated corrections. This was market turbulence on a historical scale, hitting the supposed hedges against inflation and fiat collapse. And it happened fast — almost as if someone flipped a switch.

Wall Street Called It "Volatility" — I Call It Conditioning

Citi analysts called it the “biggest turbulence since November.” Market strategists chalked it up to parabolic rallies that had to end “painfully.”

But here’s what they’re not saying:

This kind of synchronized crash — across precious metals and digital stores of value — is exactly what you'd expect before rolling out a controlled financial system. It’s the shock therapy phase. They spike asset prices, draw in retail investors, then pull the rug. Boom — a perfect recipe for mass disillusionment, herding, and eventually, compliance.

"Digital Gold" Takes a Hit Right When CBDCs Need It To

Bitcoin didn’t just stumble — it crashed right through psychological support levels, dropping under $80k for the first time in months. This isn’t just about crypto volatility.

This is about timing.

With CBDC pilots accelerating, and FedNow pushing deeper into the American financial bloodstream, it’s no coincidence that alternatives to fiat control mechanisms are suddenly under fire. These digital currencies challenge central bank supremacy — and when that challenge gets too strong, the system bites back.

Gold and Silver: From Safe Havens to Scapegoats?

For decades, gold and silver have been the go-to hedge against fiat erosion, inflation, and geopolitical instability. But this week, they were portrayed as speculative traps. The narrative is shifting. Precious metals are being reframed as unreliable just as governments push the idea that central bank digital currencies are safer, faster, and more stable.

You see where this goes?

First, destroy trust in real stores of value. Then offer a controlled alternative — a CBDC linked to your social behavior, carbon footprint, or vaccination status. It’s the oldest trick in the authoritarian playbook: create the problem, control the solution.

Why the Market Turned "Risk-Off" — And What It Signals

Citi analysts noted a broad “risk-off” movement, with investors pulling out of volatile sectors. But that’s surface-level. Beneath it, we’re seeing the first major behavioral pivot of 2026: people losing faith in decentralized systems just as the state ramps up its digital grip.

What’s next?

- More market whiplash to kill momentum in decentralized assets.

- Public narratives pushing "stable" digital payment rails like FedNow.

- “Emergencies” justifying programmable controls over your money: where you can spend, how much, on what, and when.

They Want You Panicked — But Not Awake

Let’s be clear: this isn’t about protecting investors. It’s about nudging the public toward a system where compliance equals access. With CBDCs, you don’t just hold money — you lease it from the state. And if you dissent? If you buy the wrong book, donate to the wrong cause, or say the wrong thing online?

Your account gets flagged, frozen, or drained — and there’s no recourse.

This crash? It’s a warning. A stress test for your psychological resilience. A dry run for a cashless cage they’ve already built.

What You Must Do Right Now

If you’re waiting for the mainstream to tell you when it’s too late, you’re already behind. The signs are flashing red. The FedNow payment system is already live. CBDCs are entering beta. Financial surveillance is tightening. The goal? Total monetary obedience.

You need to prepare like your freedom depends on it — because it does.

Download the Digital Dollar Reset Guide by Bill Brocius — the only no-BS survival manual I trust in this digital lockdown age. This isn’t fluff. It’s critical intelligence for anyone who wants to sidestep the trap, preserve financial autonomy, and fight back with knowledge, not fear.

Download it here before the next wave hits:

Digital Dollar Reset Guide

You’ve seen what happens when the system gets spooked. Now imagine what happens when it takes control. Get ready, or get steamrolled.