The East Is Hoarding Gold & Silver While the Dollar Burns

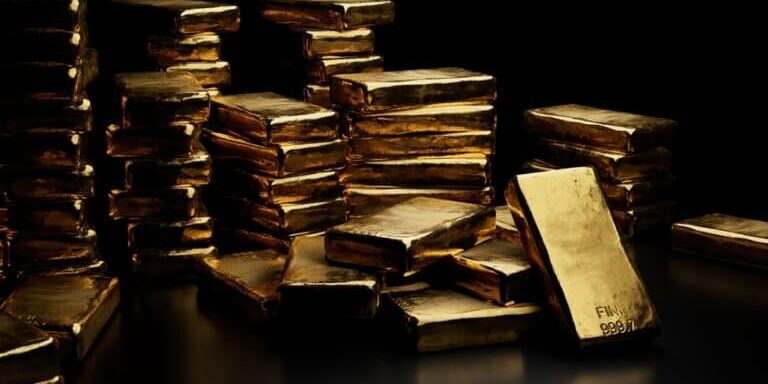

Let me be clear: while Americans are getting squeezed at the grocery store and watching their savings rot away in low-interest accounts, Russia and China are stacking gold and silver like there’s no tomorrow. And frankly, they might be right—at least when it comes to the dollar’s future.

According to Bloomberg and Chinese customs data, Russia’s precious metals exports to China jumped 80% in just the first six months of 2025. We’re talking $1 billion in sales—up from just over half that a year ago. The metals involved? Gold, silver, palladium, and platinum. Real money. Not the digital IOUs our central banks peddle.

Why the Sudden Jump?

There are two reasons:

- Price Surge – Gold is up nearly 43% year-over-year. Silver’s up more than 30%. When you’ve got central banks, ETFs, and now entire governments hoarding bullion, that’s what happens.

- Strategic Realignment – Russia and China aren’t just buying metals because they like shiny things. They’re doing it because they’re done with the dollar. And who can blame them? After the West weaponized the SWIFT system and froze Russian reserves post-Ukraine invasion, Moscow got the message loud and clear: the dollar isn’t neutral anymore.

So now? They’re cashing out of fiat and going heavy into hard assets.

Russia: From Sanctioned Outcast to Precious Metals Powerhouse

Even with sanctions choking parts of its economy, Russia still ranks as the world’s #2 gold producer—just behind China. Over 300 tonnes of gold annually. And their miners? They’re making a killing both at home and abroad. Russian citizens alone bought 75.6 tonnes of gold in 2024. That’s nearly a quarter of Russia’s total production.

It’s a similar story with palladium and platinum, especially from mining giant Norilsk Nickel, which has been ramping up exports to—you guessed it—China. Prices for those metals are up 38% and 59% this year, respectively.

But here’s what really caught my eye: Russia is now buying silver for its State Reserve Fund for the first time ever.

Let that sink in.

Silver: The “Poor Man’s Gold” Becomes a Central Bank Weapon

There’s something brewing in the silver market. Prices have outpaced gold so far this year, and part of that might be thanks to undisclosed central bank buying—especially from Russia. Since September 2024, Moscow has been quietly adding silver to its reserves, and if you think they’re the only BRICS nation doing this, I’ve got a bridge to sell you.

Silver isn’t just a metal—it’s becoming a monetary lifeboat. And it's a heck of a lot cheaper than gold, which is why countries like Brazil and India might be looking at it as their ticket out of the dollar-dominated system.

It’s also indispensable to the green energy movement—used in solar panels, EVs, electronics, and more. So not only is it money, it’s industrial gold. That’s a double whammy for long-term value.

A New Precious Metals Exchange? BRICS is Done Playing the Dollar’s Game

In a direct challenge to the COMEX and London Metals Exchange, Russia has proposed a BRICS-run precious metals exchange. If that doesn’t wake up the West, nothing will. This thing wouldn’t just trade gold and silver—it’d rewrite the rules of international pricing.

They’re talking about:

- Shared standards for bullion

- Accredited market participants within BRICS

- Independent clearing and price discovery

That’s not a marketplace—it’s a monetary declaration of independence. If it works, it could dethrone the dollar in international trade faster than most people think. The Ministry of Finance in Moscow even said they expect it to become the key global price regulator for precious metals.

Meanwhile, What’s the U.S. Doing?

Our government is printing money like it’s going out of style (because it is), pushing for a Central Bank Digital Currency under the creepy-sounding "FedNow" system, and continuing to rack up debt like a gambler on their last Vegas run.

Every signal tells me that precious metals are no longer just a hedge—they're a lifeline. A lifeline that our rivals are grabbing with both hands while most Americans are still being told to “diversify” with stocks, bonds, and index funds.

Folks, the game has changed.

Final Thoughts: Don’t Wait to Be Locked Out

Russia and China are preparing for a world without the dollar—and they’re doing it with metals. You need to ask yourself: What are you doing to prepare?

When the BRICS metals exchange launches, when the dollar gets dumped in trade deals, and when silver starts acting like gold on steroids—will you be sitting there with a pile of devalued cash, or will you have something real?

Start by downloading Bill Brocius’ free eBook: Seven Steps to Protect Yourself from Bank Failure.

And don’t just read—act. Subscribe to Dedollarize’s gold and silver alerts, and stay one step ahead of the tidal wave that’s already begun.

Stay sharp,

Frank Balm

Dedollarize News – Because freedom comes in ounces, not IOUs