The Fed's Fantasyland: How Jerome Powell's Delusions Are Steering America Into Economic Oblivion

The Rate Pause That Solves Nothing

So here we are—again. The Fed held rates between 4.25% and 4.5% and tried to sell it as strategic patience. In reality, it’s cowardice. Powell doesn’t have the guts to admit the Fed is trapped. Raise rates and you crash the debt-leveraged economy. Lower them and you light the inflation fuse. So he does what bureaucrats always do when they’re out of options—he talks.

Markets reacted with all the excitement of a dog hearing a busted whistle. Stocks barely moved. Bonds did their little dance. And Powell droned on like it mattered. But no one with a functioning brain believes the Fed has a plan. They’re stalling, praying that another war, another pandemic, or another distraction can buy them time.

Anchored Inflation? Try Untethered Reality

Let’s dissect the most insulting lie of Powell’s performance: that inflation expectations are “well anchored.” According to who? The same government that redefined CPI to hide real price spikes? The same Fed that told us inflation was “transitory” while gas doubled and eggs became a luxury?

University of Michigan data shows short-term inflation expectations well above 6%. Five-year projections are still cruising above 4%. That’s a bonfire, not an anchor. But Powell’s job isn’t to report the truth—it’s to manage perception. Keep the sheep calm while the wolves circle.

This isn't incompetence—it’s coordinated narrative control. When the people running the money printer start lying about the fire they started, you can bet your last dollar they’re hiding something bigger behind the curtain.

A “Great Place”? Only for the Elite

Powell described the economy as being in a “great place.” For who, exactly? Hedge fund managers? Government contractors? Defense lobbyists? Because it sure as hell isn’t for families living paycheck to paycheck, or small businesses being crushed by credit costs.

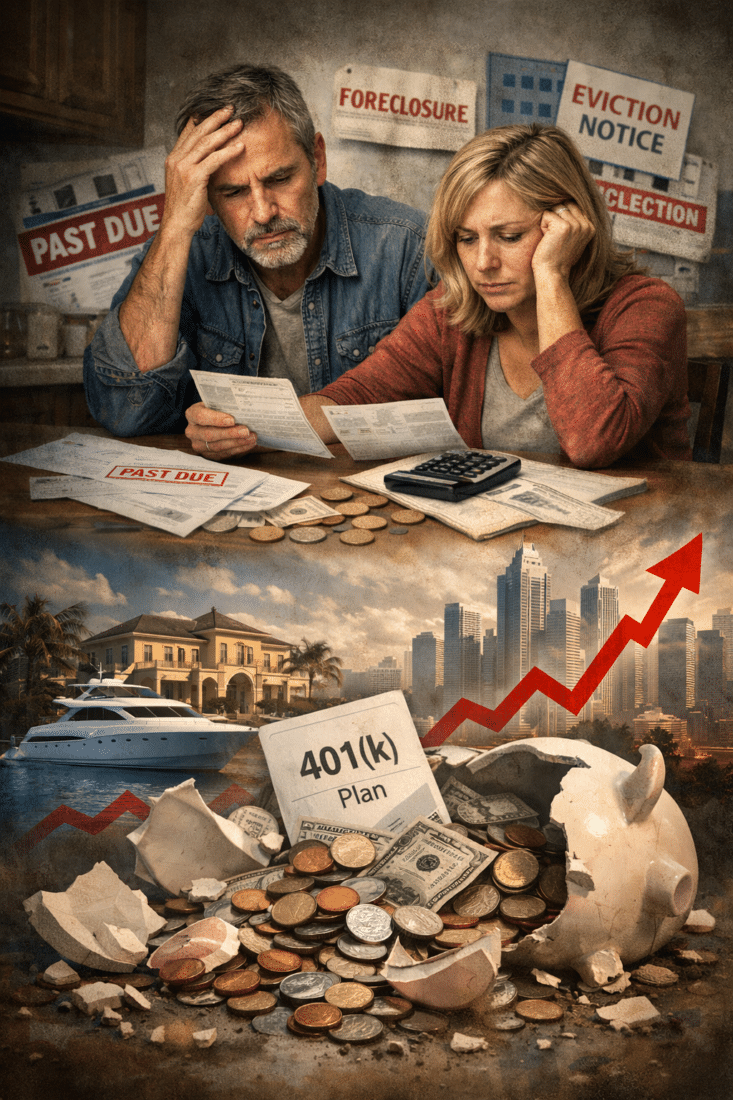

The labor market is a smoke-and-mirrors trick. Job numbers look decent only because people are working multiple gigs just to survive. Wage growth is devoured by inflation. Savings are gone. Consumer debt is breaking records. But yeah—“great place.”

The reality is we’re dangling over the edge of a structural collapse, and Powell’s calling it a picnic.

China’s Exit Strategy: Decoupling from a Dying Empire

Now let’s pivot to trade. The U.S. spent decades sucking in cheap goods from China like an addict mainlining heroin, funded by a Federal Reserve that kept the debt train rolling. But China sees the writing on the wall: America is no longer a good customer. The average American can’t afford the stuff we used to import. The Chinese are planning their escape.

Decoupling from U.S. consumer demand won’t be painless, but it’s necessary. China will shift focus toward internal development and emerging markets. Meanwhile, we’ll be stuck with empty shelves and a realization that our “consumer economy” was just a shell game, kept alive by credit and foreign goodwill.

Protectionist Clown Show: Tariffs on Movies?

And then there’s the political circus. This week’s star act? A proposal to slap a 100% tariff on foreign-made films. Let that sink in. Hollywood—one of the last U.S. industries with a trade surplus—gets punished because it doesn’t fit into someone’s isolationist fantasy.

It’s a reminder that economic nationalism, when done without strategy or sanity, is just economic suicide dressed in red, white, and blue. When your leaders are tweeting policy like it’s a reality show, you better start preparing for the crash.

Final Thoughts: The Coming Economic Purge

This isn’t about interest rates. It’s about the end of a rigged system. The Fed, the Treasury, the White House—they’re all working to keep you distracted while the lifeboats are loaded. When the dam breaks, they’ll blame “unexpected events.” But you won’t be fooled. Not anymore.

This is the calm before the purge. Fiat currency is gasping. The digital dollar is coming, and with it, programmable control over your money. Expect more surveillance, more restrictions, and less freedom. The tools of economic collapse will become the weapons of political domination.

Your Action Plan

Don’t wait for the alarm bells—they’ve been ringing for years. If you want to protect what’s yours, you need to get ahead of the collapse.

👉 Download “Seven Steps to Protect Yourself from Bank Failure” by Bill Brocius right now. Learn how to secure your assets before they vanish in a flash of defaults, freezes, and bail-ins. Click here to download

Stay sharp. Stay skeptical. Stay free.