The Vanishing Jobs Report: How a Broken Government Just Blinded the Economy

The BLS Screws Up — Again

The Bureau of Labor Statistics just scrapped the October jobs report — a vital data snapshot for gauging the health of America’s labor market — because of a government shutdown. You read that right. After trillions spent propping up the surveillance state, policing the world, and bailing out Wall Street, the regime can’t scrape together enough change to fund a damn survey.

The shutdown didn’t just stall paychecks for bureaucrats — it severed one of the key pipelines of economic information. The household survey — the one that actually tells us if people are working, underemployed, or scraping by — wasn’t collected at all for October. That data is gone. Not delayed. Not postponed. Just... gone. And it can’t be recovered.

Central Planners Are Flying Blind

Let’s pause here. This isn't just some clerical hiccup. This is a tactical failure of a centralized data apparatus that’s been propping up monetary policy for decades. No data means no guidance. No guidance means the Fed’s next move is a shot in the dark. And if you think they won’t misfire, I’ve got some Zimbabwean dollars to sell you.

Now the BLS is trying to play catch-up, promising to include some patchwork of October data into the delayed November report, now bumped to December 16 — conveniently after the Fed’s big December 9–10 meeting. That means when Powell & Co. sit down to decide whether to tighten the noose on interest rates, they’ll be guessing — and probably guessing wrong.

Wall Street Shrugs, But It Shouldn’t

Meanwhile, Wall Street gamblers are already pricing in a pause in rate hikes. Why? Because even bad news needs data. And without it, the casino grinds to a halt. The real kicker? The central bank is now relying on private-sector “alternatives” like ADP to fill the void — glorified crystal balls that were never meant to set national policy.

Where There's a Data Void, Narrative Fills It

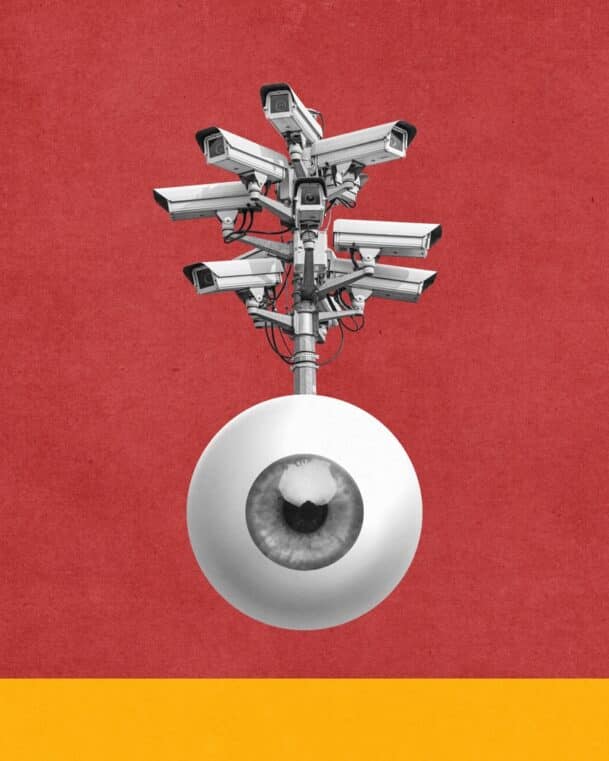

And here’s where it gets dark. This kind of data blackout isn’t just a technical inconvenience — it’s an opening. A vacuum. When official stats vanish, narrative takes over. The regime, the media, and the central banks can spin whatever story they want: soft landing, mild slowdown, nothing to see here. And the public? They nod, pay their taxes, and sleepwalk right into stagflation.

Remember, the Fed isn’t just watching the labor market — it’s shaping it. The employment data isn’t passive; it’s the fuel for policy. If you can’t measure the labor force, how do you justify rate hikes, currency devaluation, or quantitative easing? You don’t. You manipulate the void. You control perception.

The Real Issue: Systemic Fragility

The BLS failure is a symptom of something deeper. We’re seeing the limits of a system built on central control, infinite spending, and fragile data pipelines. When that system cracks — even for a month — the downstream effects ripple through the whole economy.

The Domino Effect You’re Not Being Told About

- The Fed delays action or makes a bad call.

- The markets seize up, unsure what’s real.

- Businesses hold back hiring, expansion, and wages.

- And the media keeps everyone calm with pablum about “revised data coming soon.”

This is what collapse looks like in the digital age. It’s not explosions or riots. It’s information silence. It’s decision-makers guessing. It’s confidence quietly draining out of the system while the façade still stands.

Here’s What You Can Do

If you’re still waiting on the government to tell you how bad things are, you’ve already lost. It’s time to unplug from the illusion of stability and take control.

Start with the basics:

- Ditch your dependence on official data. Follow real-time indicators. Job postings. Layoffs. Local info. Decentralized signals.

- Prepare for volatility — the system is glitching, and the next error could be financial.

- Convert assets to things with real utility — not just numbers on a screen.

Final Word — Before the Next Shutdown Hits

And above all, get the guide: “Seven Steps to Protect Yourself from Bank Failure” by Bill Brocius. It's free, it’s critical, and it’s been downloaded by thousands of people who understand what’s coming.

👉 Download it now 👈

You’re not going to hear this from CNBC or NPR. They’re too busy waiting for the next spreadsheet from the BLS.

But you heard it here.

Stay alert. Stay independent. And remember: when the data disappears, the lies begin.