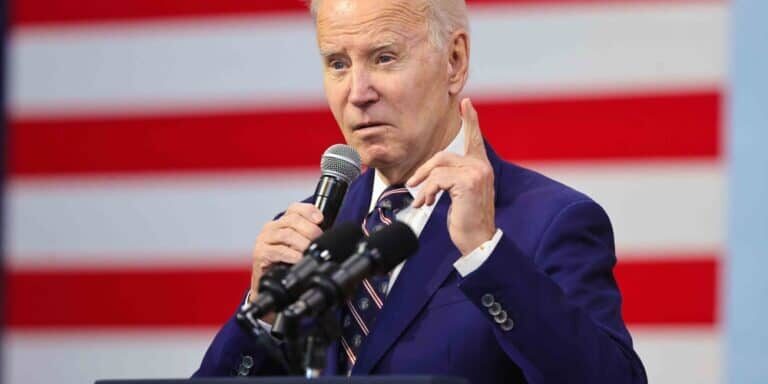

A Dark Cloud of Pessimism Hangs Over Biden's Electoral Prospects

Americans are extremely pessimistic about the state of the U.S. economy, and that is really bad news for Joe Biden. Despite the glowing economic numbers that the Biden administration has been relentlessly feeding us, there is an overwhelming consensus among the American people that the economy is rapidly heading in the wrong direction. Prices continue to rise, mass layoffs are happening all over the country, loans are going bad at a staggering rate, homelessness and poverty are spiking, and economic activity is slowing down all around us. According to a poll about the economy that was recently conducted for Newsweek, the percentage of Americans that believe that the economy is going in the wrong direction is twice as high as the percentage of Americans that believe that the economy is going in the right direction…

Their widespread pessimism is reflected in the results of a Redfield & Wilton Strategies poll conducted on behalf of Newsweek on April 11. According to the survey, some 50 percent of Americans believe that the U.S. economy is heading in the wrong direction, while only 25 percent said it is going in the right direction.

Americans are also negative about their own financial situation. Some 42 percent of respondents said their financial situation has worsened in the last year. Only 26 percent said it has improved, while 32 percent said it has stayed the same.

Some 47 percent of Americans said they were now financially worse off than they were three years before, against 26 percent who said they were better off and 27 percent who said they were about the same. Some 45 percent said they were now worse off than before the pandemic, while 28 percent said they were better off and 27 percent were about the same.

When U.S. voters don’t feel good about the economy, they tend to want change in Washington.

And the main thing that Americans don’t like about the economy right now is the high cost of living…

Forty-one percent of Americans responding to an April Gallup poll said inflation or the high cost of living is their main economic concern. The number has risen for three years running, from 32 percent in 2022 to 35 percent in 2023.

Prior to 2022, the highest rating inflation received in the survey was 18 percent in 2008 during the Great Recession. Otherwise, the figure has been below 10 percent since Gallup began asking the question in 2005.

Joe Biden and his minions keep telling us that inflation is “low”.

But hardly anyone believes them, because that is obviously not true.

Anyone that goes shopping for groceries on a regular basis understands what has been happening to food prices, and another recent survey discovered that young adults are really feeling the pain…

Younger Americans are feeling the pinch from inflation, with 54% saying that rising food costs have hit them the hardest.

The findings are part of a recent CNBC/Generation Lab survey that polled 1,033 people between the ages of 18 and 34.

When I was a young adult, I could get everything that I needed for one week, including an entire cake, for just 25 dollars.

But today a full cart of food will cost you hundreds of dollars.

At this point, beef is actually considered to be a “luxury meat”, and Americans have cut back as prices have soared.

In fact, Tyson is going to lose a ton of money this year because people are buying a lot less beef now…

“Tyson Shares Fall as Beef Business Struggles” is a headline story in today’s Wall Street Journal. They go on to note that Tyson, America’s largest U.S. meat supplier, said its beef business was softening and that “The company, a bellwether for the U.S. meat industry, forecast a bigger operating loss for its beef business this fiscal year—between $100 million and $400 million.”

Why? Mostly because people can’t afford beef and are eating chicken. And droughts and shrinking herds have made the situation worse.

At one time, you could economize by eating some of your meals at fast food chains, but those days are long gone…

Prices at America’s biggest fast-food chains have soared above the rate of inflation in the last five years as firms come under fire for ‘greedflation.’

Customers are now voting with their wallets causing traffic to chains to drop 3.5 percent in the first three months of the year compared to 2023, according to data from Revenue Management Solutions.

It means big chains like McDonald’s, Wendy’s, Popeyes, Pizza Hut and Chipotle have likely sold millions fewer burgers, pizzas and burritos.

The financial market is crumbling and EVERYONE will be affected. Only those who know what's going on and PREPARE will survive... dare we say thrive. Our 7 Simple Action Items to Protect Your Bank Account will give you the tools you need to make informed decisions to protect yourself and the ones you love.