AMERICA’S DEBT SLAVES: How Wall Street Turned the Middle Class Into a Human Credit Card

The Consumer Is the Economy—And the Consumer Is Drowning

We’ve heard it for decades: “Consumer spending makes up 70% of the U.S. economy.” But here’s the dirty secret the bankers won’t say out loud—that 70% is now funded by credit cards with 29% APRs.

What used to be a nation of homeowners and savers has become a nation of debtors and renters. We don’t own anything. We borrow it. We finance it. We lease it. And the moment the Fed sneezes, your wallet gets pneumonia.

The old system of mortgage-based debt was bad enough. But at least you could live in the house.

Now? You can’t live inside your MasterCard bill. You can’t sleep in your Affirm loan. And you sure as hell can’t feed your family with a FICO score.

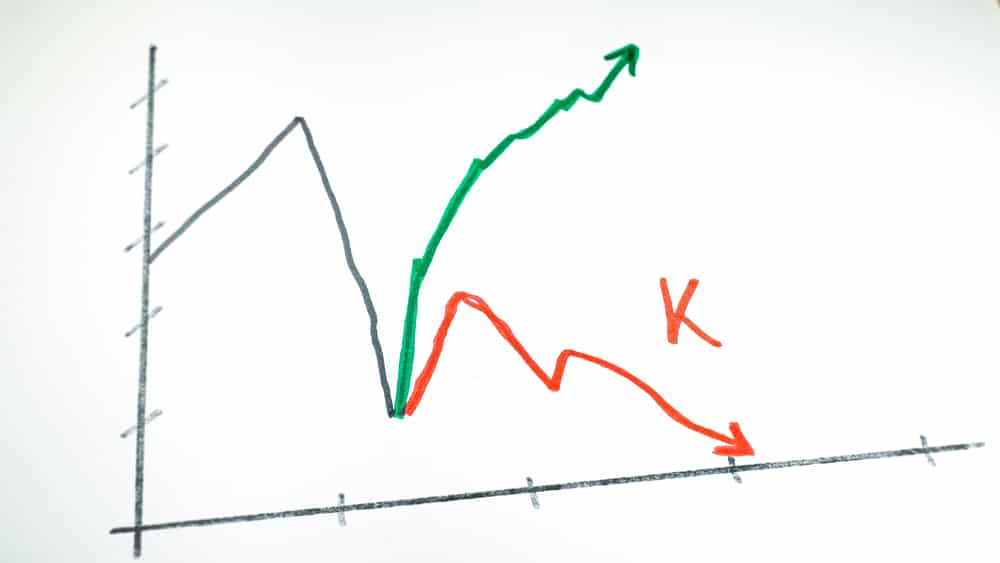

From the Housing Crisis to the Credit Card Collapse

Remember 2008? Of course you do. Wall Street made billions selling junk mortgages to grandma’s pension fund, then cried poor and got bailed out by the very taxpayers they bankrupted.

This time, the mortgages are cleaner. But the debt never left the system—it just migrated. It slithered into student loans, personal loans, auto loans, buy-now-pay-later schemes, and credit cards that would make a loan shark blush.

Let me make it plain:

- In 2008, the bomb was in housing.

- In 2025, the bomb is in your wallet.

And the fuse is already lit.

APR Is the New Tax—and You Never Voted for It

They call it “interest,” but let’s call it what it is: a stealth tax on the middle class.

And unlike income taxes, you can’t vote it away. You can’t debate it in Congress. You can’t itemize it. It just shows up in the fine print and drains your account every single month.

That’s not an accident. That’s the plan.

As rates went up, credit card interest shot up instantly. Millions of Americans went from treading water to drowning overnight. Not because they bought too much avocado toast. But because the system is designed to extract.

Banks, backed by the Fed, have weaponized interest rates to keep you working harder, longer, and owning less. That’s the modern plantation. It’s digital. It’s polite. But it’s slavery all the same.

Why the Crisis Will Be Slower—But Just As Deadly

This won’t look like 2008. There won’t be a Lehman Brothers collapse or a sudden foreclosure tsunami. Instead, we’ll get a death by a thousand credit cuts.

- First, the poor miss their credit card payments.

- Then auto delinquencies creep up.

- Then the middle class starts defaulting on personal loans.

- Then the spending stops.

Restaurants, hotels, retail stores—they’ll feel it first. Then the job losses begin. Then the defaults accelerate. And by the time the mainstream media notices? It’s already six months too late.

This is a rolling credit collapse, not a single explosion.

And the elites love it that way—because they think you won’t notice if it happens slow enough.

The Fed Is Trapped—And You’re the One Paying the Price

Jay Powell and his ilk still think they’re operating the old machine. Raise rates to cool things down. Lower rates to juice things back up. But that machine is dead.

Today, rate hikes hit the consumer directly—instantly—savagely.

Mortgages barely move. But your credit card bill? Your car loan? Your personal loan? They go ballistic.

And when the Fed cuts? It doesn’t solve the problem. It just slows the bleeding. You go from 29% APR to 25% APR. Big deal. The knife is still in your back. They just twisted it slower.

The Real Reason Congress Won’t Help

Let me be real clear: Washington will not save you.

They like this system. It props up GDP. It keeps the stock market happy. It keeps campaign donors smiling.

They’ll say the right words on CNN. They’ll talk about “middle-class relief” and “credit access.” But they’ll never unplug the machine. Because the machine makes them rich—and keeps you broke.

Consumer credit isn’t just tolerated. It’s encouraged. It’s subsidized. It’s weaponized.

And every time you swipe your card, they cheer.

What Comes Next: Rolling Crises, Media Lies, and Financial Fragility

You won’t see this crisis covered honestly on cable news. You’ll get distractions: Taylor Swift concerts, TikTok trends, border outrage, celebrity scandals. Bread and circuses.

But while you’re watching the show, the American middle class is quietly being hollowed out by compound interest and predatory lending.

Watch for these signs:

- Spiking credit card delinquencies

- Rising auto loan defaults

- Slowing sales in discretionary goods

- More layoffs in consumer-facing industries

- Quiet tightening from lenders

These are the real storm clouds. Ignore them at your own peril.

Gold, Silver, and Real Assets—Not Digital Chains

As this slow-motion collapse unfolds, one thing is clear: real assets matter more than ever.

Gold. Silver. Commodities. Land.

Not CBDCs. Not FedNow. Not some phony digital “freedom” wallet monitored by the IRS and approved by BlackRock.

The Fed’s pivot isn’t mercy. It’s desperation. They’re already trapped. But if you’re still clinging to fiat currency and trusting the banking system, you’re walking into the slaughterhouse with your eyes wide shut.

Conclusion: This Isn’t a Financial System. It’s a Control Grid.

The U.S. economy is no longer built on production. It’s built on consumption funded by debt, managed by unelected central bankers, and backed by a corrupt alliance of Wall Street, Washington, and globalist media.

We’re not facing a temporary downturn. We’re facing a permanent decline—unless we act.

If you don’t understand how interest, inflation, and digital control are being used to enslave you—then you are the product. You are the asset. And your future has already been sold.

Take Action Before It’s Too Late

The system is fragile. The middle class is exhausted. And the debt trap is closing fast.

Protect yourself now:

➡️ Download the free guide: “Seven Steps to Protect Yourself from Bank Failure”

➡️ Join the Inner Circle at a discounted rate—only $19.95/month

➡️ Get a hard copy of “The End of Banking As You Know It”

Don’t wait for the media to tell you it’s a crisis.

By then, it’ll already be too late.

Wake up. Opt out. Fight back.